19 Nov ASC 606 – Credit and Rebill

Credit and Rebill

Credit and Rebill is a reduction to the Outstanding Balance of a Receivable which is re-documented by a new invoice for the same product.

It is in connection with a correction of an error and not as part of a restructuring, extension or partial payment thereof.

It may be valued at the amount by which the original invoice exceeds the new invoice; otherwise, it shall be valued at the entire amount of the original invoice

Common scenarios for credit and rebill include:

- Incorrect invoicing for the price of a product or service. Invoice is credited and rebilled for the correct amount.

- Change in contract value with mutual consent

- Change to any information other than that affecting the amount e.g: bill-to information on a posted transaction, this will not impact revenue recognition.

In this article, we will focus on two scenarios of Credit and Rebill for Maintenance renewal and Mid Term upgrade and how Zuora RevPro can help recognise the impact of same on the Revenue.

Use Case I

Credit and Rebill – Maintenance renewal

Business Challenge:

XYZ Inc has entered into a contract with ABC Inc for Maintenance of Equipment and perpetual License in June 2019 with an effective date of May 2019. However, a month later, it realized that Invoicing for the contract was done incorrectly with 4 different POBs instead of 2 POBs and needed to be revised.

XYZ Inc now needs to credit the existing invoice raised in June 2019 and rebill the contract.

Revenue and Deferred Revenue for the Month of May and June has been Posted which needs to be revised for the new opportunity in July 2019

Key Facts:

XYZ Inc. uses Salesforce for Opportunity, Oracle OM and AR management (Upstream) and Zuora RevPro for Revenue management

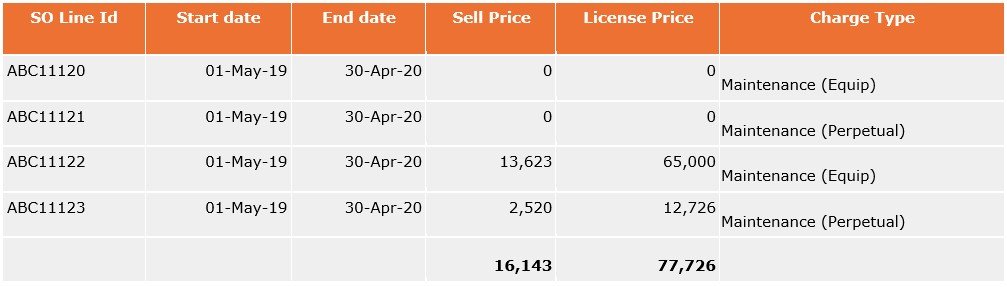

Details of the order transaction in month of June 2019: Opportunity ID- OppID1423, SO Number- ABCD1234

As per existing flow of the credit and rebill in upstream system XYZ Inc. had to cancel the opportunity OppID1423, SO Num- ABCD1234 and create a new rebill opportunity OppID1424 for this change required in July 2019

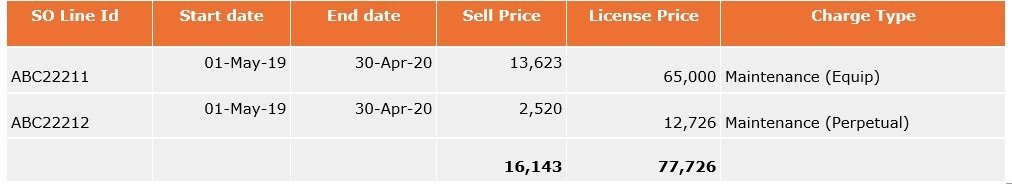

Below are the details of Rebill Order transaction for July 2019

Full Billing is done for the above transaction

Other Important details:

SSP is based on License price for Maintenance lines

The contract is grouped using Opportunity ID

How would Zuora RevPro deal with this Credit and Rebill scenario where new opportunity is created

Solution:

Original Opportunity

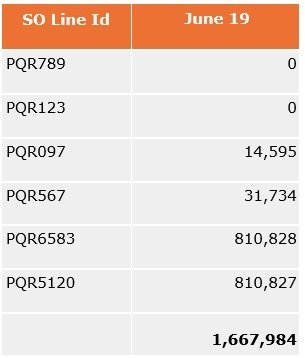

June 2019

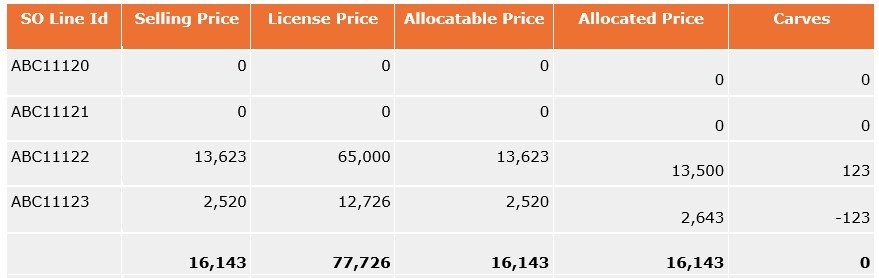

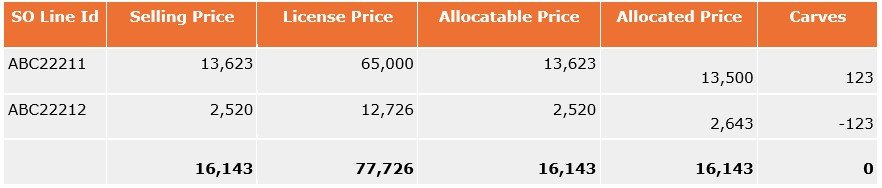

Allocations: Total Allocatable/ Total License Price* License Price for the line

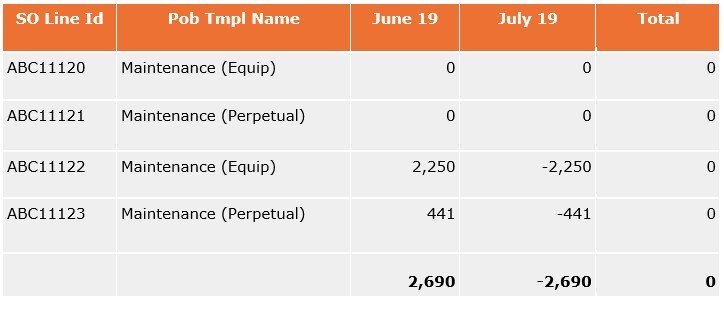

July 2019 Original Opportunity credited

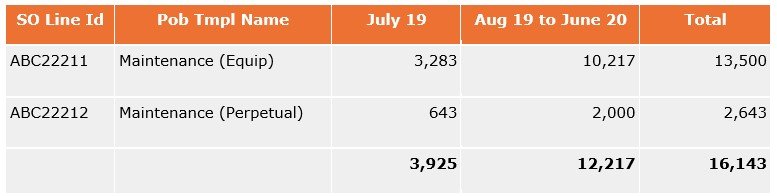

Net Revenue Waterfall after Crediting opportunity

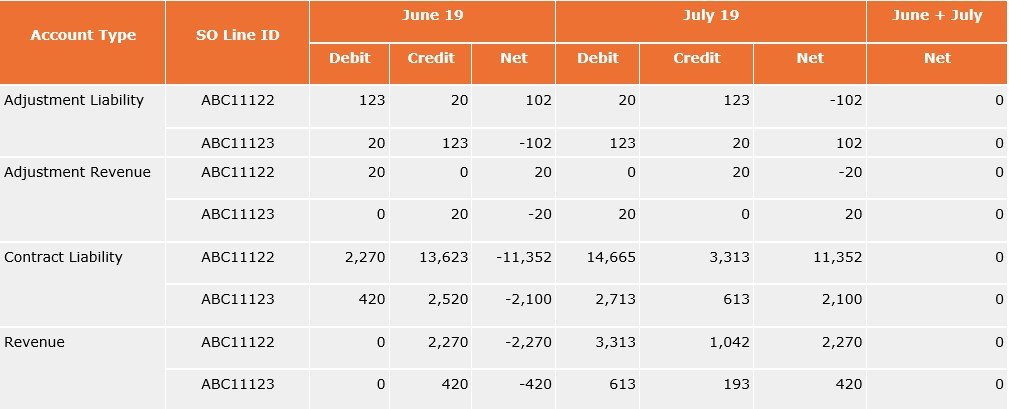

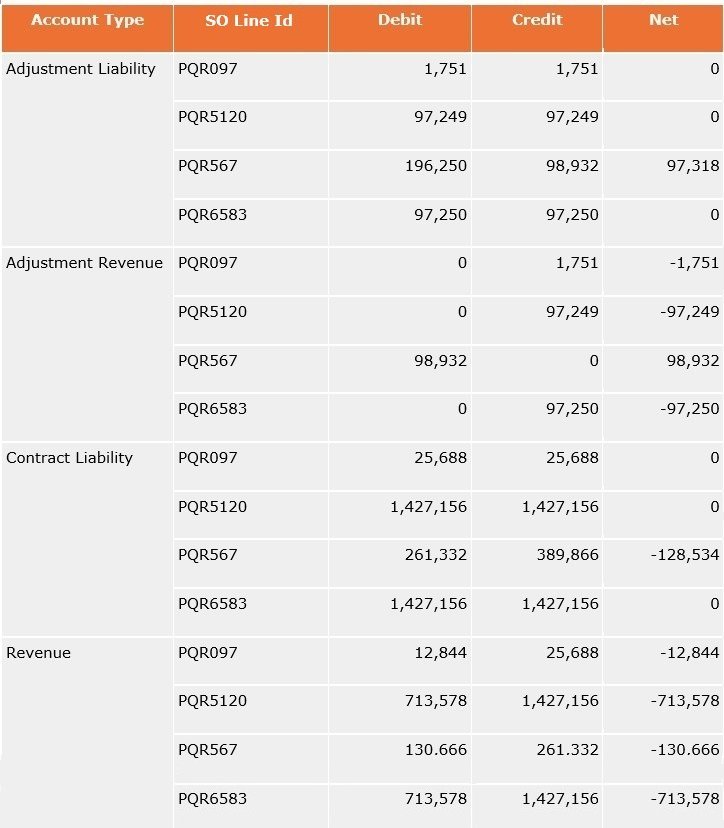

Accounting:

New Rebill opportunity

July 2019

New Rebill opportunity created through opportunity ID OppID1424

Allocations: Total Allocatable/ Total License Price* License Price for the line

POB has been satisfied and hence revenue is released

Net Revenue Waterfall

Accounting for July 19

Conclusion

Original opportunity (Contract 1) created in June 2019 is completely credited in July 2019 hence all amounts posted to GL (Contract and adjustment Liability and Revenue) in June 2019 are reversed in July 2019

New opportunity treated as a new contract. Allocations, Waterfall and GL are computed according to new billing.

Use Case II

Credit and Rebill for Mid Term Upgrade

Business Challenge:

PQR Inc has entered into a contract with ABC Inc for Perpetual License and its Maintenance and Billed to the customer fully in May 2019 with an effective date of December 2018. However, two months later, ABC Inc approached with a request for a change in Maintenance only for the remaining term and adjust the price accordingly as maintenance was not opted for, for the previous term. The arrangement hence was decided to be updated for the consumed term of Maintenance and a new opportunity needs to be created for the remaining term of maintenance.

PQR Inc now needs to credit the existing invoice raised in May 2019 and rebill the contract for Maintenance for the remaining term.

Revenue and Deferred Revenue for the Month of Dec 18 to May 19 has been Posted which needs to be revised for the new opportunity in July 2019.

Key Facts:

PQR Inc. uses Salesforce for Opportunity, Oracle OM and AR management (Upstream) and Zuora RevPro for Revenue management

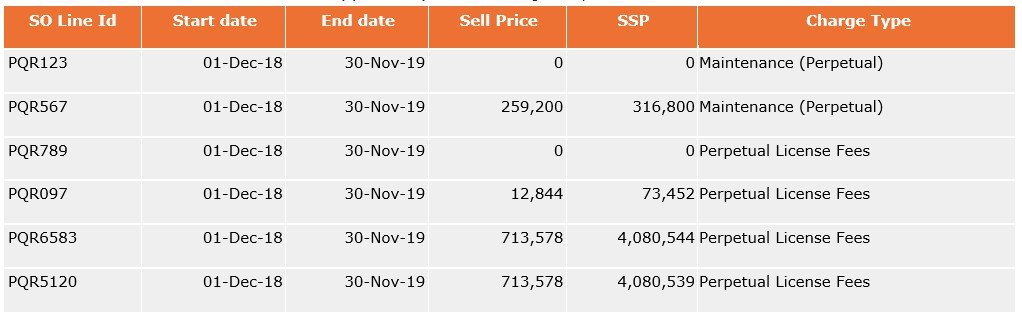

Details of the transaction entered for Opportunity ID- 1234PQRINC, SO Num-9002134 are:

The customer has been billed fully for same in the month of May 2019

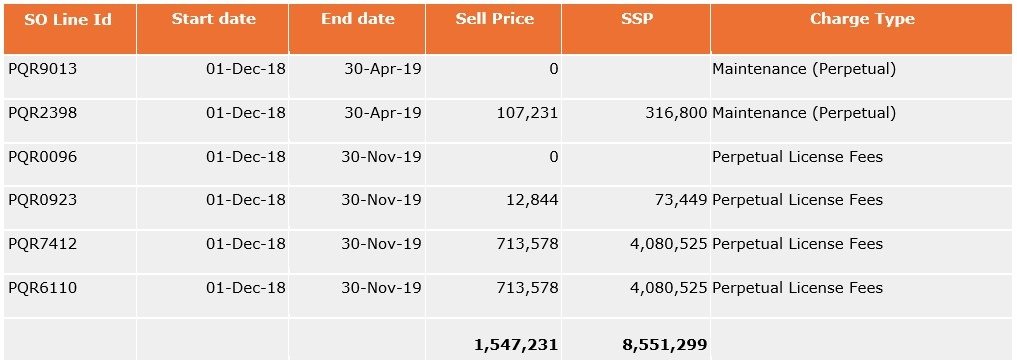

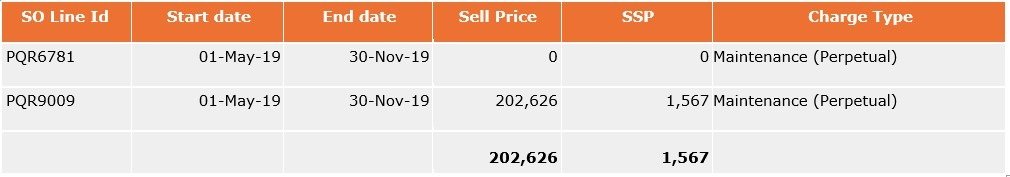

In the month of July 2019, value for maintenance was to be revised from $259,200 to $309,857 by apportioning additional price over the remaining term. For this original opportunity was credited completely in SFDC and new transactions were added to the same opportunity for all lines except for remaining maintenance. Also, a new rebill opportunity was created for the remaining maintenance term with revised amounts.

Below are the details of Rebill transaction:-

For consumed term(5 months): Same opportunity

For unconsumed term (Maintenance for 7 months) New opportunity

PQR Inc had to create a new contract for an unconsumed term of Maintenance due to price change with opportunity ID- 7835PQRINC, SO Num-9807654.

Other Important details:

SSP is based on Net licence price for Maintenance lines

The contract is grouped using Opportunity ID

How would Zuora RevPro deal with this Credit and Rebill scenario where new opportunity is created

Solution

Original Opportunity

02 June 19

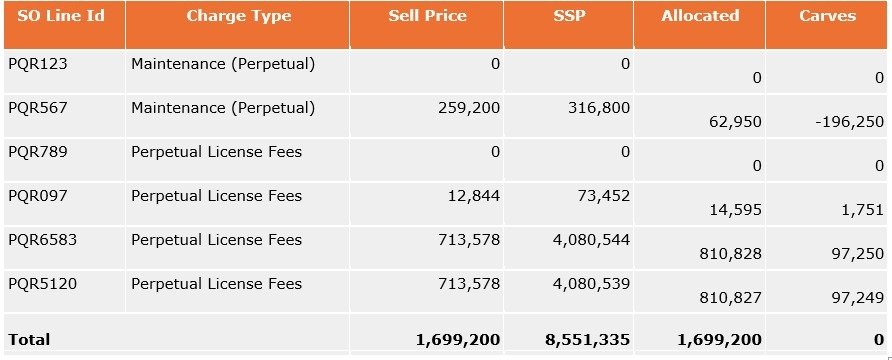

Allocations: Total Allocatable/ Total SSP * SSP for the line

Net Revenue Waterfall June 19 Catch up for Dec 18 to June 19

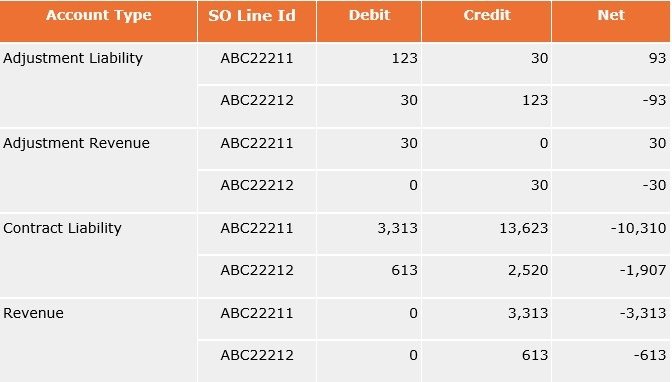

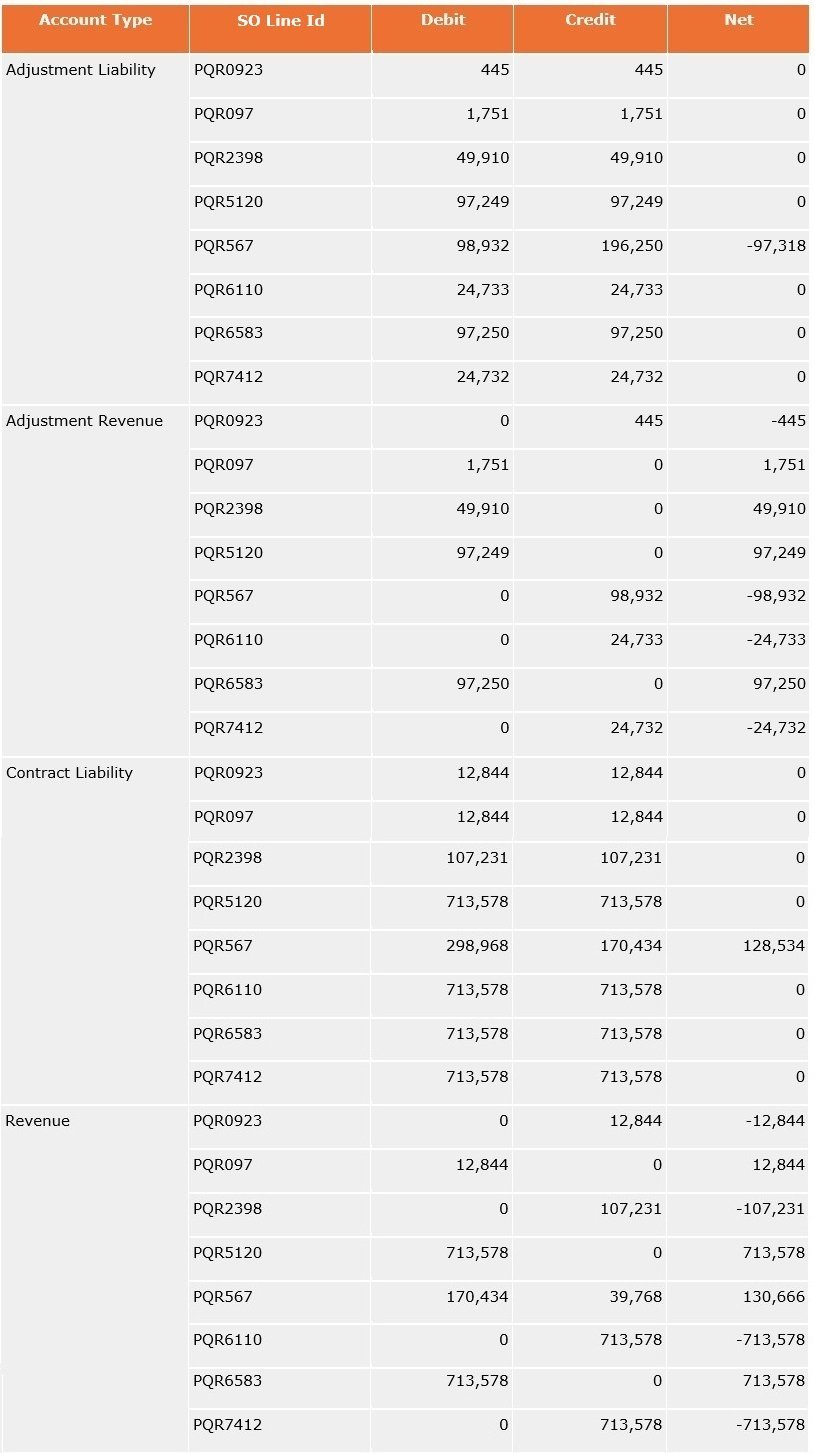

Accounting for June 19

30 June 19

Original Opportunity credited and rebilled except for remaining term of maintenance

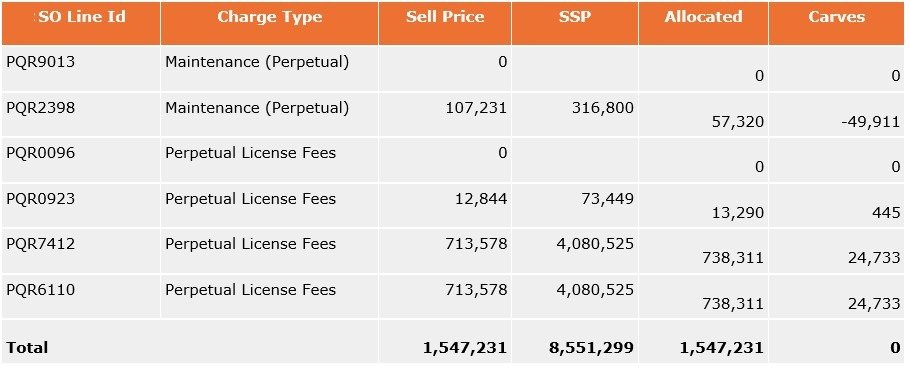

Allocations: Total Allocatable/ Total SSP * SSP for the line

Note: For SOLID PQR2398: 50% amount was posted and after CM-R prospective allocation was done for the remaining period.

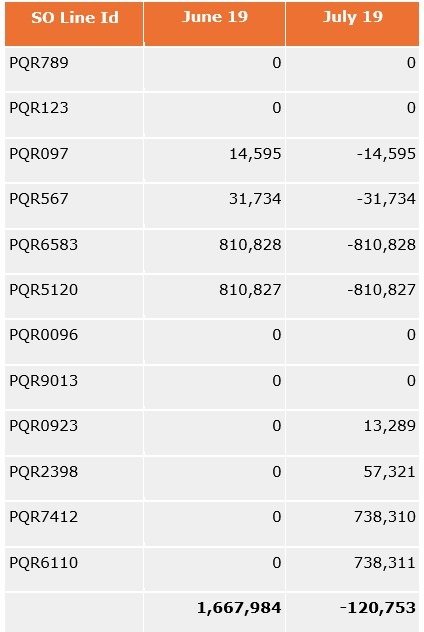

Net Revenue Waterfall

Accounting for July 19

July 19 New Opportunity credited – rebill Maintenance for unconsumed period

Allocations:

As there is a single non zero lines ineligible for allocation of the contract, allocations will not happen

Net Revenue Waterfall

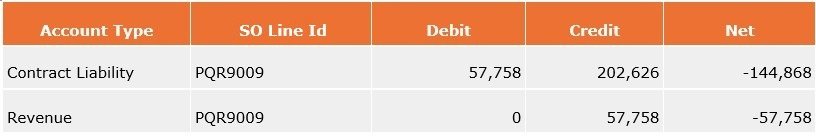

Accounting for July 19

Conclusion

Original opportunity (Contract 1) created in June 2019 is completely credited in July 2019 hence all amounts posted to GL (Contract and adjustment Liability and Revenue) in June 2019 are reversed in July 2019

Existing lines other than the remaining term of maintenance added to the existing contract with consumed maintenance and Revenue released as per the POB satisfaction on July 19

The new opportunity created for the remaining term of Maintenance treated as a new contract. Allocations, Waterfall and GL is computed according to new billing on July 19

Did you find this article on ASC 606 case study helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding ASC 842, IAS 17, IFRS 16, IFRS 15, Revenue Recognition and ASC 606.