23 Oct Revenue Recognition – ASC 606 & IFRS 15

1. OBJECTIVES & EXCEPTIONS OF ASC 606 & IFRS 15

Objectives

- It is an industry-neutral revenue recognition model designed to increase financial statement comparability among companies and industries.

- The objective is to decrease the complexity involved with the current models for revenue recognition.

- The objective was to establish the principles that an entity shall apply to report useful information to users of financial statements about the nature, amount, timing, and uncertainty of revenue and cash flows arising from a contract with a customer

Exception

- Lease Contract

- Insurance Contract

- Financial Instruments

- Guarantees (Other than product or service Warranties (406))

- Non-monetary exchanges between the entities within the same business.

2. EFFECTIVE DATES & APPLICABILITY OF ASC 606 & IFRS 15

Transition approach

- Full Retrospective

- Modified Retrospective

Full Retrospective

Retrospectively to each prior reporting period presented and the entity may elect from practical expedients

a) For Completed contracts: No need to restate if transaction in same FY

b) For completed contract with VC use transaction price of contract date

c) No disclosure of prior reporting period obligation & revenue

Modified Retrospective

Retrospectively with the cumulative effect of initially applying this update recognized at the date of initial application

a) Additional disclosures in reporting periods that include the date of initial application of and cumulative effect of implementation

b) An explanation of the reasons for significant changes

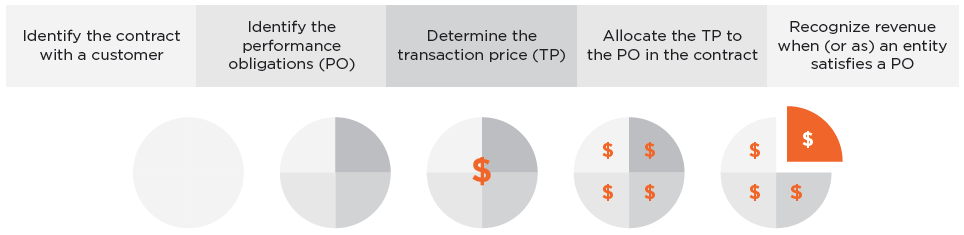

3. IFRS 15 & ASC 606 (5 Steps Approach)

Objectives

The main aim of IFRS 15/ASC 606 is to recognize revenue for transfer of goods/services promised to customers in an amount reflecting the expected consideration in return for those goods or services.

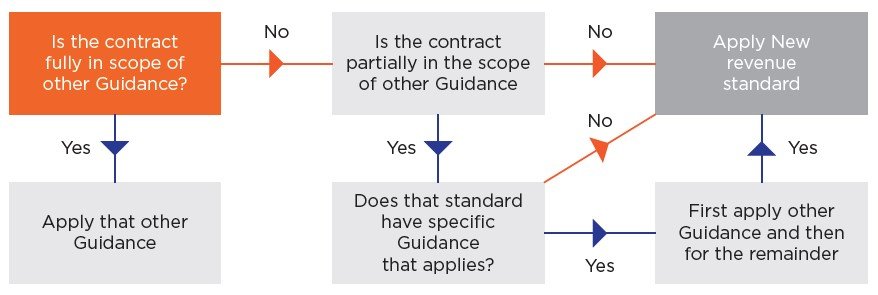

4. APPLICABILITY OF ASC 606/IFRS 15

4.1 STEP 1: IDENTIFYING CONTRACTS WITH CUSTOMERS

(IFRS 15 & ASC 606: 606-10-25-1 THROUGH 25-13)

a) A contract is an agreement between 2 parties that creates enforceable rights and obligations.

Components of a Contract (IFRS-15/ASC (606-10-25-2)

b) Parties to the contract have approved & committed to perform

c) Each party’s rights to the G/S transferred are identified

d) Payment terms are identified

e) Contract has a commercial substance

f) Probability of collecting consideration & Evaluate customer’s ability & intention

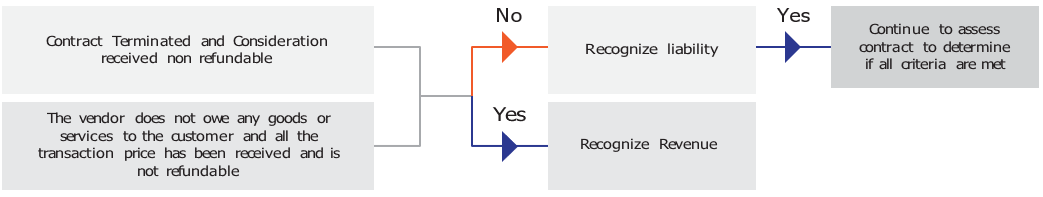

Scenario: Payment for Agreement with no contract (Consideration Received)

Contract Combination and Modification

Contract combination happens when multiple contracts were entered into at or near the same time with same customer or related parties of customer and one or more of the following conditions satisfied

- Contracts were negotiated as a single commercial package (bundle)

- Consideration in one contract depends on the other contract

- All or some of the Goods or services are a single performance obligation

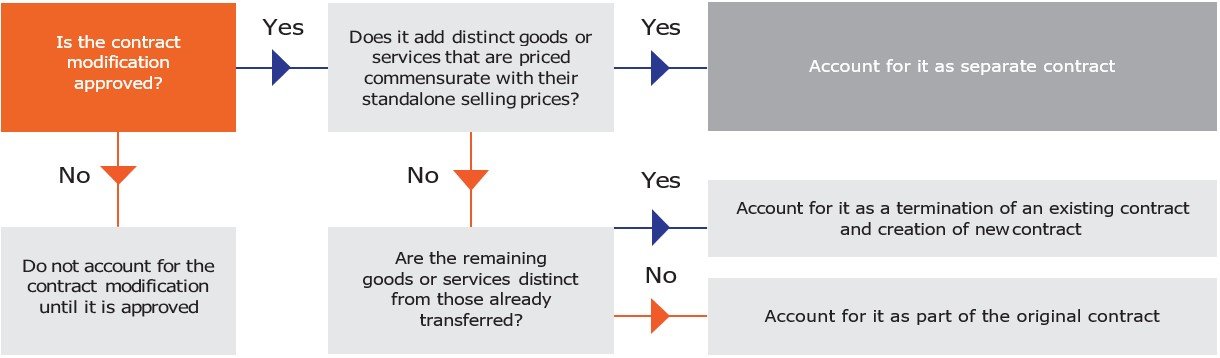

Contract modification is the change in the contract’s scope, price or both. In other words, when you add certain goods or services, or you provide some additional discount, you are effectively dealing with the contract modification.

Contract Combination and Modification

Contract combination happens when multiple contracts were entered into at or near the same time with same customer or related parties of customer and one or more of the following conditions satisfied

- Contracts were negotiated as a single commercial package (bundle)

- Consideration in one contract depends on the other contract

- All or some of the Goods or services are a single performance obligation

Contract modification is the change in the contract’s scope, price or both. In other words, when you add certain goods or services, or you provide some additional discount, you are effectively dealing with the contract modification.

4.2 STEP 2: IDENTIFY PERFORMANCE OBLIGATIONS

(IFRS 15 & ASC 606: 606-10-25-14 THROUGH 25-22)

Performance obligation can be any explicit (e.g. written in the contract) or implicit (e.g. implied by some customary practices) promise for transfer of any goods or services that contract promises to transfer to the customer.

It can be either

- A single good or service, or their bundle that is distinct; or

- A series of distinct goods or services that are substantially the same and have the same pattern of transfer.

Entity shall assess the goods or services promised in a contract with a customer and shall identify as a performance obligation

Material rights of Customer option are additional performance obligations Practical Expedients ASC 606: – No need to identify Promised Goods/ Services that are immaterial in the context of contract; Account for shipping and handling costs as fulfillment costs rather than promised service

Distinct Performance Obligation Criteria

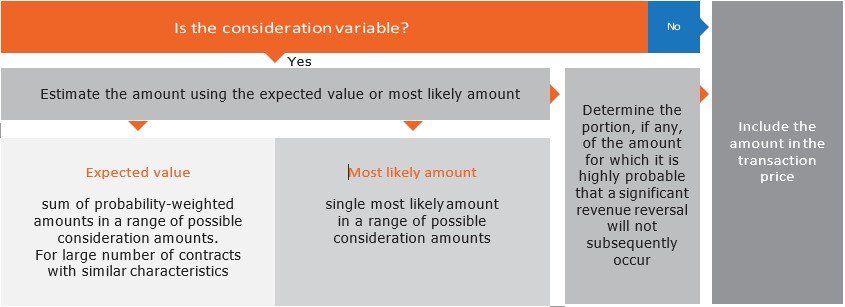

4.3 STEP 3: DETERMINATION OF TRANSACTION PRICE

(IFRS 15 & ASC 606: 606-10-32-2 THROUGH 32-37)

The transaction price is the amount of consideration that an entity expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties (ex. Agency relationship).

If the consideration is variable, an entity estimates the amount of consideration to which it will be entitled in exchange for the promised goods or services.

It’s NOT always the price set in the contract. It is your expectation of what you will receive.

Adjustment factor for determining transaction Price

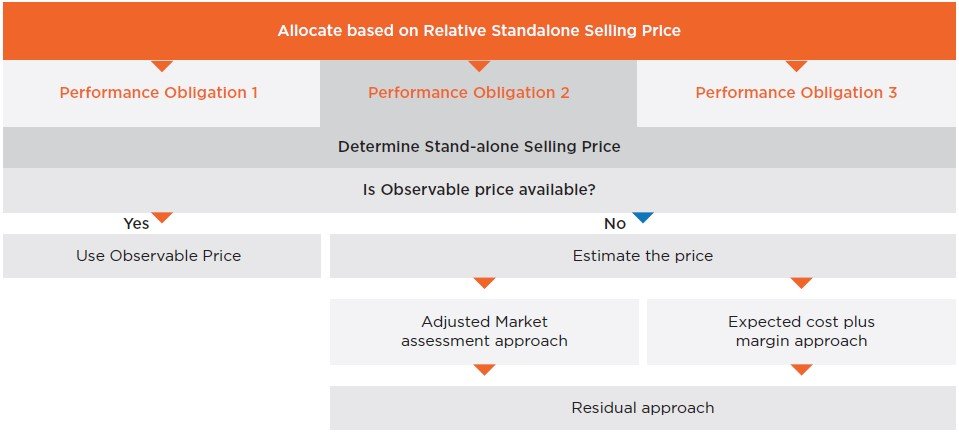

4.4 STEP 4: ALLOCATE THE TRANSACTION PRICE

(IFRS 15 & ASC 606: 606-10-32-28 THROUGH 32-41)

Where a contract has multiple performance obligations, an entity will allocate the transaction price to the performance obligations in the contract by reference to their relative standalone selling prices. If a standalone selling price is not directly observable, the entity will need to estimate it.

Exception to above General Rule

- Allocating discounts, Significant financial components

- Allocating considerations with variable amounts

A stand-alone selling price (SSP) is a price at which an entity would sell a promised good or a service separately to the customer (not in the bundle).

METHODS TO DETERMINE SSP

- Adjusted Market Assessment Approach:

Estimating the price that a customer in a particular market would be prepared to pay, which might include referring to prices charged by the vendor’s competitors for similar goods or services and adjusting those prices as necessary to reflect the vendor’s costs and margins.

- Expected Cost-Plus Margin Approach:

Estimating the expected costs of satisfying a performance obligation and adding an appropriate margin.

- Residual Approach:

It involves deducting observable stand-alone selling prices that are available for other goods or services to be supplied from the total contract price. However, the use of this approach is restricted to those goods or services for which there is a wide range of selling prices (meaning that these cannot be observed from past transactions or other observable evidence), or in circumstances in which the selling price is uncertain because no selling price has been set for the good or service and it has not previously been sold on a stand-alone basis.

TRANSACTION PRICE ALLOCATION FLOW

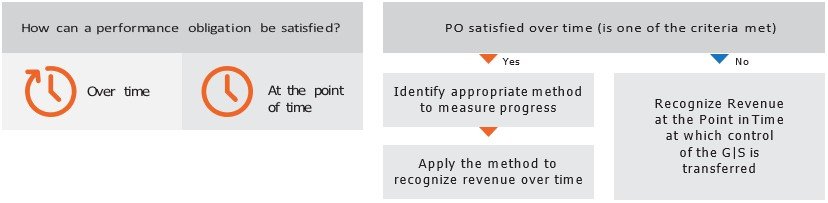

4.5 STEP 5: RECOGNISE REVENUE

(IFRS 15 & ASC 606: 606-10-25-23 THROUGH 25-30)

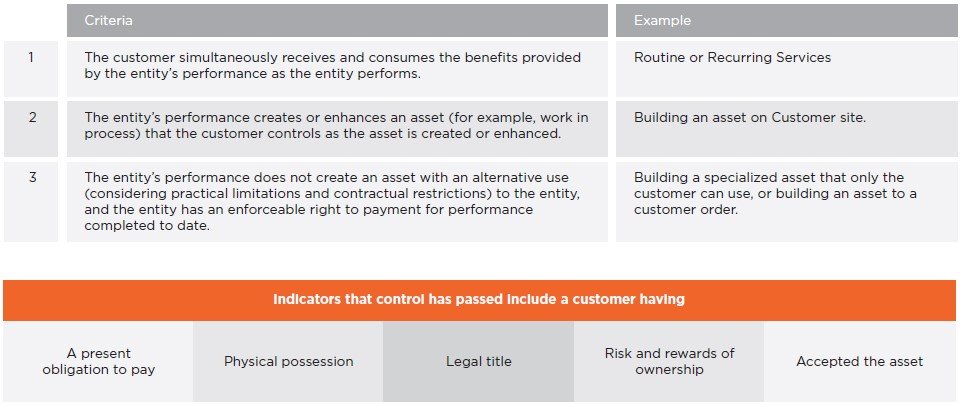

A performance obligation is satisfied (and revenue is recognized) when a promised good or service is transferred to a customer. This happens when control is passed.

Scenario: Recognition of Revenue over time

First, the entity assesses whether it transfers control over time, using the following criteria

5. ILLUSTRATIONS

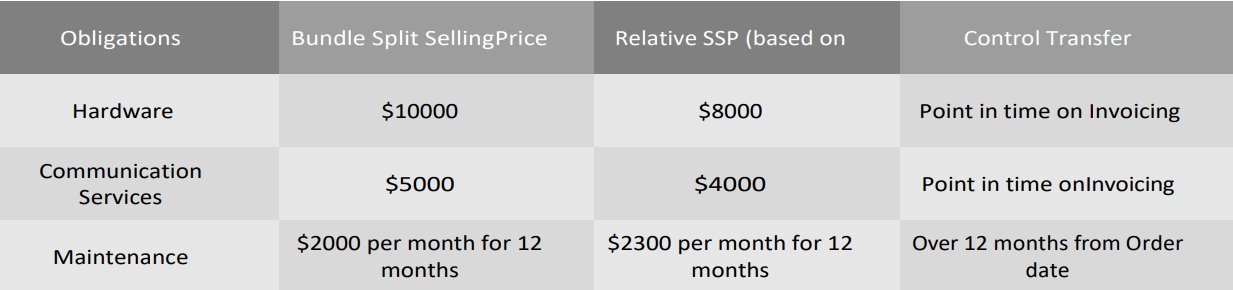

XYZ Inc. deals in telecom products. It has contract with customers identified based on locations. A typical contract will include Supply of Hardware, Communication Service and Maintenance where Hardware, Communication Service and Maintenance is Series Distinct.

Contracted Selling Price with ABC Inc from USA for Communication Product MN is $ 39000 which is a bundle of Hardware, Communication Service and Maintenance (for invoicing, the bundle will be split in ratio of 10:5:24). Contract Start date 1 Jan 18 Contract end date 31 Dec 18, Product has been delivered in month of Jan 2018, the rights to invoicing is established from date of delivery, Invoice for the Communication Product MN is generated in month of Feb 2018.

Illustration Modality

Step 1 – Identify Contracts with Customer

As the contract with customers identified based on locations, ABC Inc. USA contracts will be considered as a one class of contract. It could be identified as Contract no. ABC_USA.

Step 2 – Identifications of Performance obligations (PO)

- For Hardware: Point In time recognition on Invoicing

- For Communication Services: Point In time recognition on Invoicing

- For Maintenance: Over time recognition from Order date

Step 3 – Determine the transaction price

Transaction price as per contract

- For Hardware (H) $10000

- For Communication Services (S) $5000

- For Maintenance (M) $24000 ($2000*12)

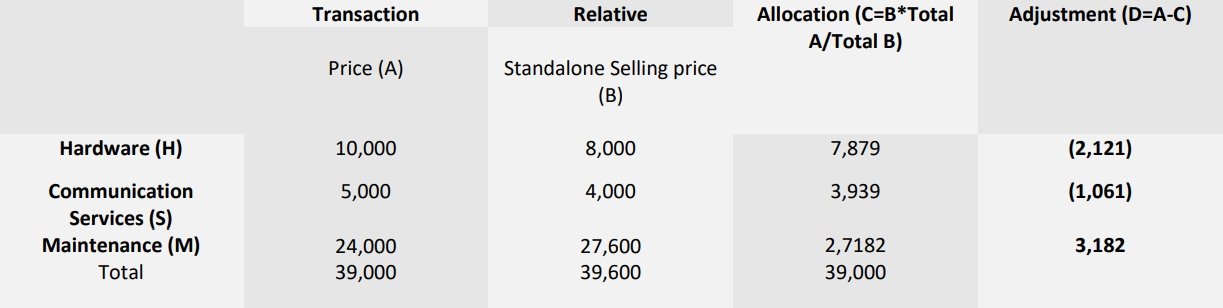

Step 4 – Allocation of transaction price

Based on Relative Standalone Selling price the allocation of Transaction price would be as below

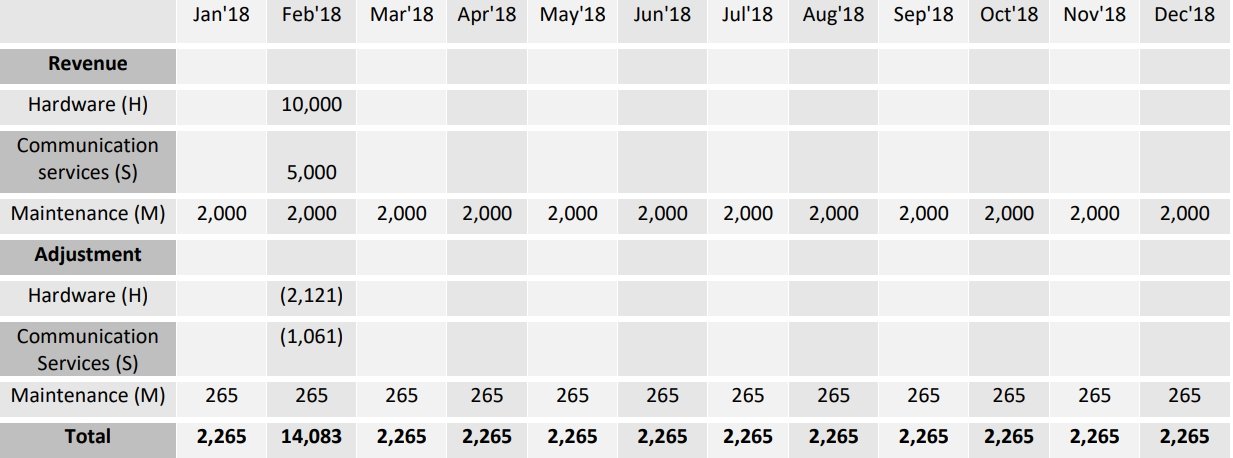

Step 5 – Recognition of Revenue

Recognition of Revenue over 12 months

Illustration Modality

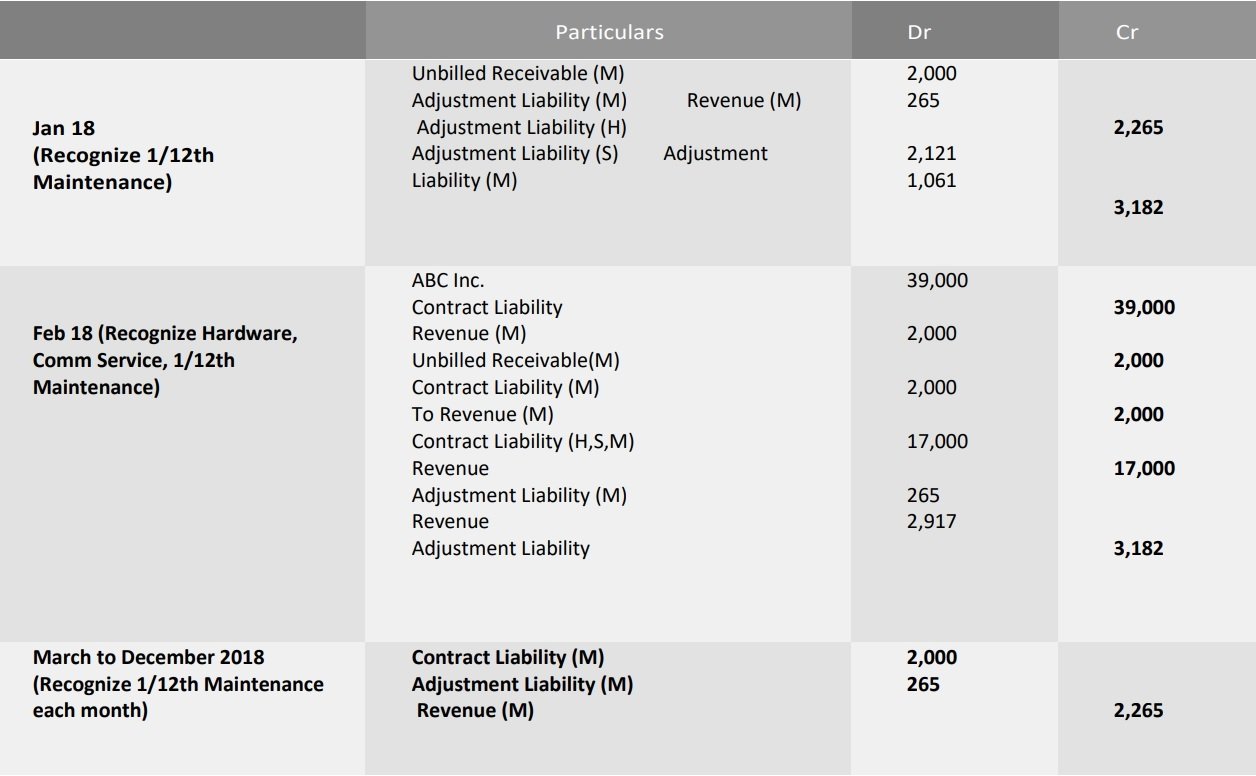

Accounting

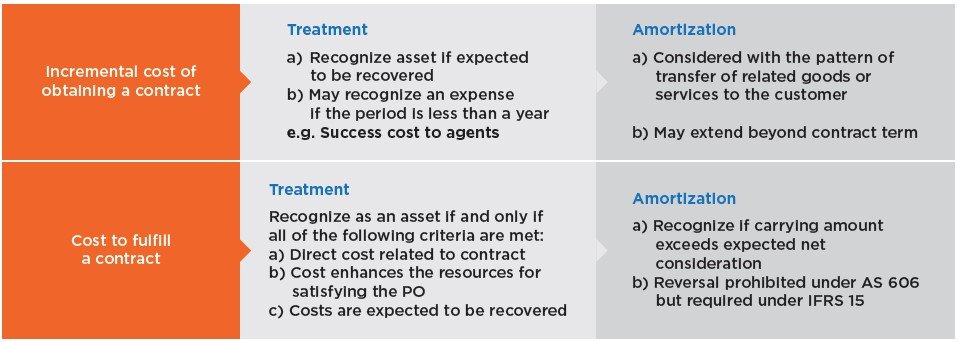

6. CONTRACT COSTS

In Codification 606-10-55-16 to 606-10-55-21 demonstrates manner of PO satisfaction based the manner of cost incurred

7. PRESENTATION AND DISCLOSURE REQUIREMENTS under ASC 606 & IFRS 15

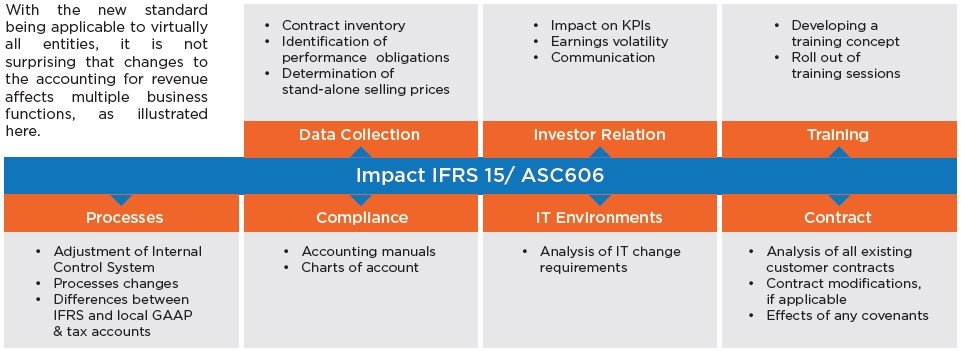

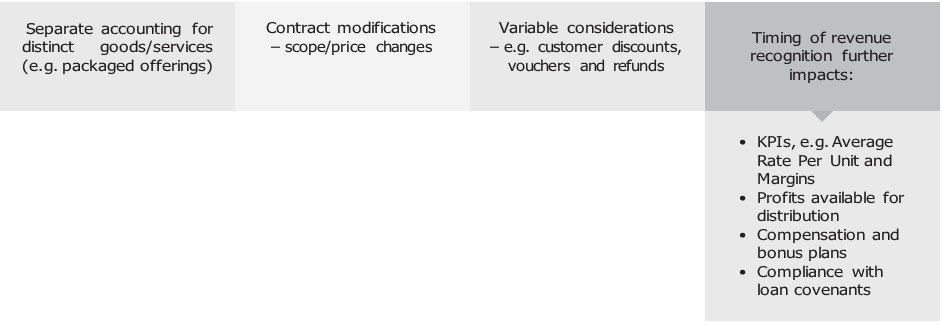

8. KEY IMPACTS OF IFRS 15 & ASC 606

General Impact of IFRS-15 & ASC606

The increased detail required and prescriptive nature of IFRS 15 & ASC 606 will result in a change in the pro- file of revenue and profit recognition. The general major industry impacts include:

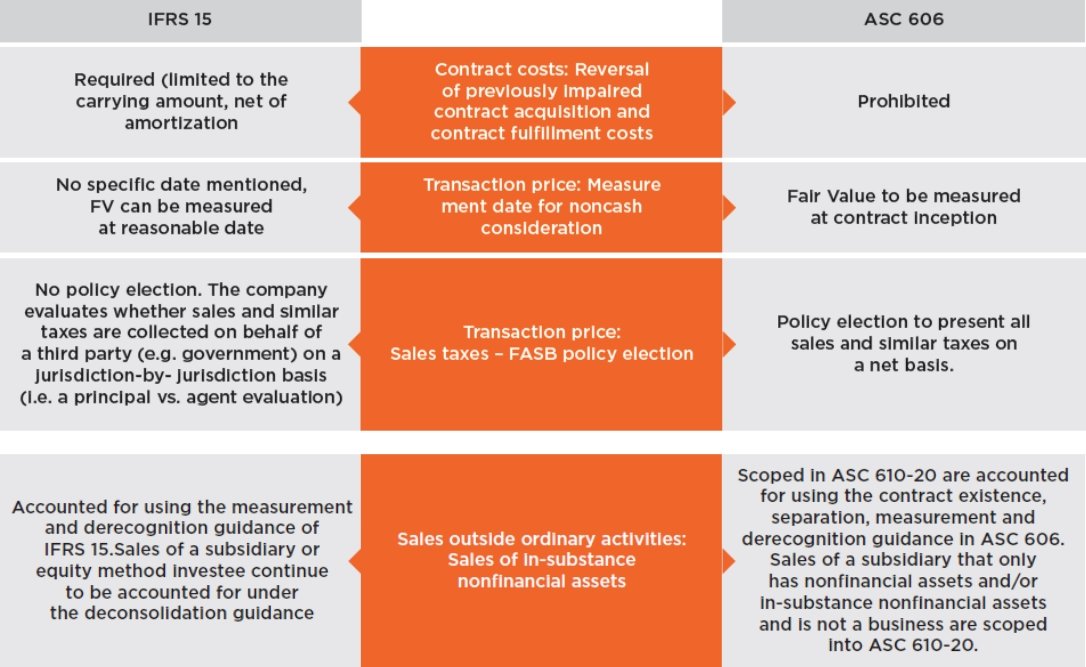

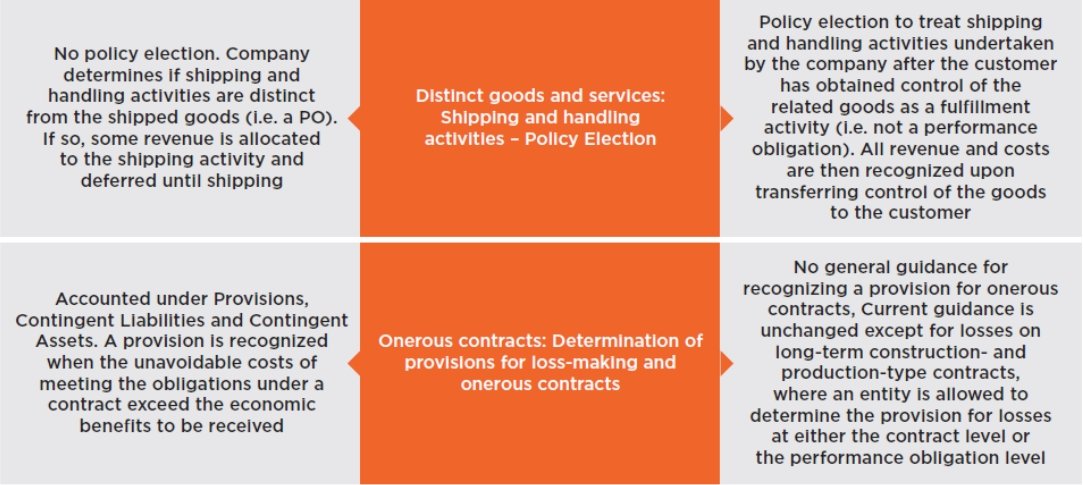

9. DIFFERENCES BETWEEN IFRS 15 & ASC 606

Did you find this article on comparison of ASC 606 and IFRS 15 helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.