16 Mar Step 5 – Recognize the Revenue

Revenue is an important point of concern to the users of Financial Statements in assessing an entity’s Financial Performance and Position.

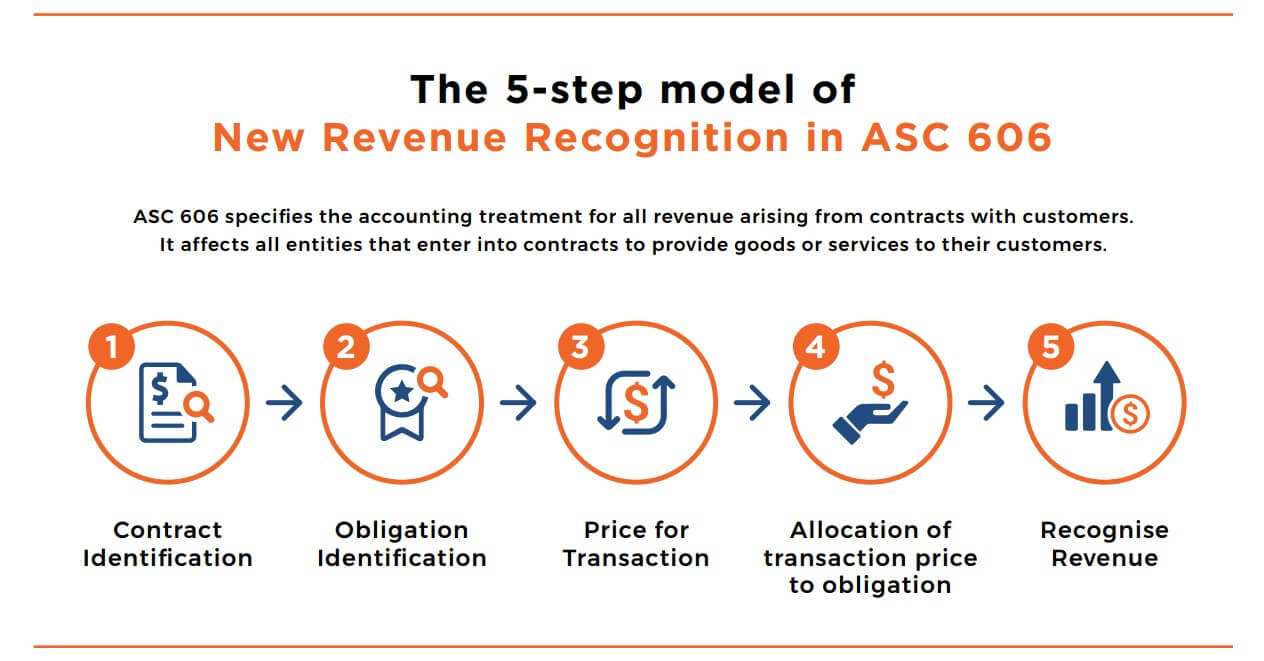

Accounting Standard Codification (ASC) 606 – Revenue from Contract with Customers is an Industry-wide revenue recognition guidance which has been formulated by the Financial Accounting Standard Board (FASB). This was a joint task by Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop common revenue standard for U.S. GAAP and IFRS.

ASC 606 will be applicable across all the industries and aid in recognizing revenue from all the types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

ASC 606 was introduced to improve the way revenue recognition was been carried out as per ASC 605. This document is to introduce the readers to Step 5 of ASC 606.

This document covers:

The timing, amount and pattern of Revenue Recognition based on the satisfaction of performance obligation.

HOW IS THE PERFORMANCE OBLIGATION SATISFIED?

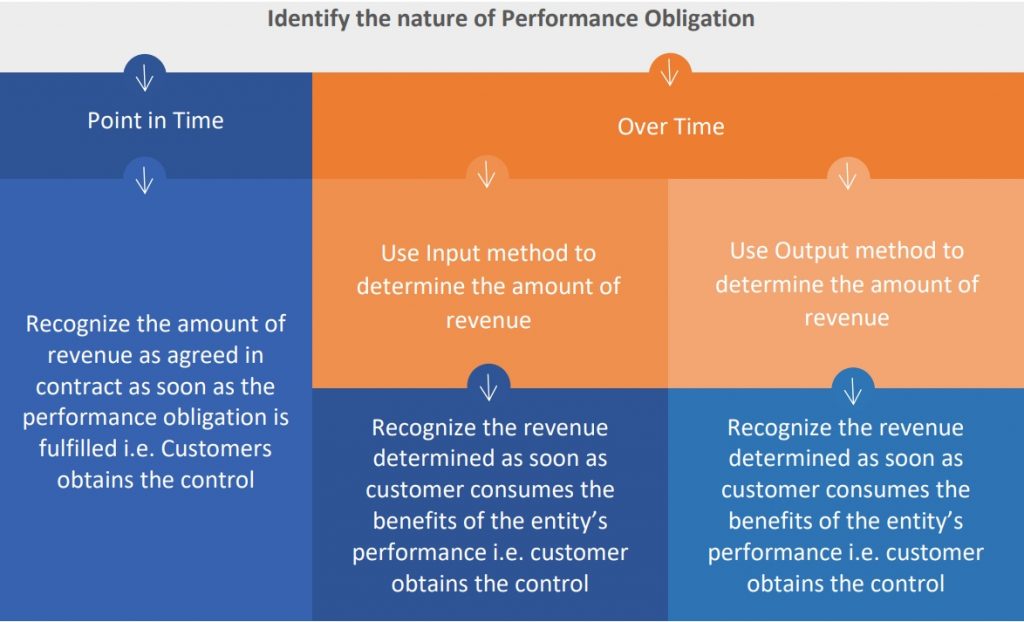

Before moving ahead with recognizing the revenue from a contract, entity must first determine whether the performance obligation is fulfilled at a point in time or overtime at the inception of the contract. The amount and the pattern of revenue recognition is dependent on the way the performance obligations are satisfied.

OVER TIME:

An entity is said to transfer control of a good or service over time and satisfy a performance obligation and recognize revenue over time if one of the following criteria is met:

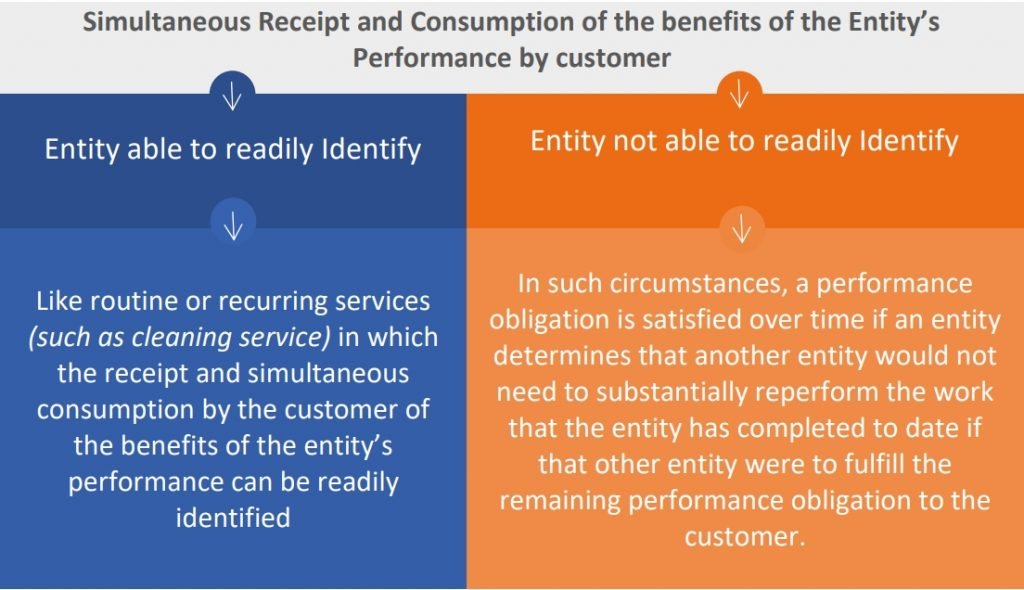

- The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs.

Determining the over time for such performance obligation can be explained as below

2. The entity’s performance creates or enhances an asset (for example, work in process) that the customer controls as the asset is created or enhanced.

The asset is created or enhanced to a certain level that the customer controls the asset as it is enhanced and created.

Below are indicators of the control

a. The entity has a present right to payment for the asset.

b. The entity has transferred physical possession of the asset.

c. The customer has legal title to the asset.

d. The customer has significant risks and rewards of ownership of the asset.

e. The customer has accepted the asset.

3. The entity’s performance does not create an asset with an alternative use to the entity, and the entity has an enforceable right to payment for performance completed to date.

The asset is in process of enhancement or limited practically from readily directing the asset in its completed state for another use, however, the entity is entitled for the payment for performance completed to date. There is restriction on the entity to put the asset to alternative use, the examples could be the asset cannot be sold to another customer because of design specifications that are unique to customer or are located in remote areas.

The assessment of whether an asset has an alternative use to the entity is made at contract inception. After contract inception, an entity shall not update the assessment of the alternative use of an asset unless the parties to the contract approve a contract modification that substantively changes the performance obligation.

POINT IN TIME

If a performance obligation is not satisfied over time, an entity satisfies the performance obligation at a point in time. To determine the point in time at which a customer obtains control of a promised asset and an entity satisfies a performance obligation, the entity considers indicators of the transfer of control, which include, but are not limited to the following:

- The entity has a present right to payment from the customer for the asset.

- The customer has legal title to the asset.

- The entity has transferred physical possession of the asset.

- The customer has significant risks and rewards of ownership of the asset.

- The customer has accepted the asset.

MEASURING THE PROGRESS FOR OVERTIME PERFORMANCE OBLIGATION

An entity shall for each performance obligation that it satisfies OVER TIME, recognize revenue over time by consistently applying a method of measuring the progress toward complete satisfaction of that performance obligation.

- Appropriate methods of measuring progress include output methods and input methods. In determining the appropriate method for measuring progress, an entity shall consider the nature of the good or service that the entity promised to transfer to the customer.

- When applying a method for measuring progress, an entity shall exclude from the measure of progress any goods or services for which the entity does not transfer control to a customer. Conversely, an entity shall include in the measure of progress any goods or services for which the entity does transfer control to a customer when satisfying that performance obligation.

- As circumstances change over time, an entity should update its measure of progress to depict its obligations completed to date.

- Reasonable measures of progress

- An entity shall recognize revenue for a performance obligation satisfied over time only if the entity can reasonably measure its progress toward complete satisfaction of the performance obligation.

- In some circumstances (for example, in the early stages of a contract), an entity may not be able to reasonably measure the outcome of a performance obligation, but the entity expects to recover the costs incurred in satisfying the performance obligation. In those circumstances, the entity shall recognize revenue only to the extent of the costs incurred until such time that it can reasonably measure the outcome of the performance obligation.

OUTPUT METHOD

Measurement is based on the customers value of the goods or services transferred.

“Output methods recognize revenue on the basis of direct measurements of the value of the goods or services transferred to date relative to the remaining goods or services originally promised under the contract. Output methods include calculations such as analysis of performance completed till date, appraisals of results achieved, milestones achieved, time elapsed, and units produced/delivered.”

When an entity evaluates whether to apply an output method to measure its progress, the entity should consider whether the output selected would faithfully depict the entity’s performance toward complete satisfaction of the performance obligation.

As a practical expedient, if an entity has a right to consideration from a customer of an amount that relates directly with the value to the entity’s performance completed to date (for example, a service contract in which an entity bills a fixed amount for each hour of service provided), the entity may recognize revenue in the amount to which the entity has a right to invoice.

The disadvantages of output method is that the outputs used to measure progress may not be directly observable and the information required to apply them may not be available to an entity.

INPUT METHOD

The revenue is measured based on the efforts/inputs made towards the performance obligation.

“Input methods recognize revenue on the basis of the entity’s efforts or inputs towards satisfaction of a performance obligation (for example, resources consumed, labor hours expended, costs incurred, time elapsed, or machine hours used) relative to the total expected efforts/inputs towards the performance obligation. If the entity’s efforts or inputs are expended evenly throughout the performance period, it may be appropriate for the entity to recognize revenue on a straight-line basis.”

The drawback of the input method is that there may not be direct relationship between the efforts/inputs and the transfer of goods and services to the customer. Therefore, an entity should exclude from an input method the effects of any inputs that do not depict the entity’s performance in transferring control of goods or services to the customer.

For example, when using a cost-based input method, an adjustment to the measure of progress may be required in the following circumstances:

- When the cost incurred does not reflect the POB satisfied like wastage.

- When cost is not proportionate to the POB satisfied, like recognition of cost in accordance with the revenue.

WHEN TO RECOGNIZE REVENUE

Revenue should be recognized by an entity when (or as) it satisfies a Performance Obligation by transferring the goods and services to the customer.

A Performance Obligation is a promise in a contract to transfer goods or services to a customer, for more please refer Step 2 – Identify the Performance Obligation in the Knowledge Center.

“The Performance Obligation gets satisfied when the control of goods and services is transferred to the customer”

Per ASC 606-10-20 control means “the ability to direct the use of, and obtain substantially all of the remaining benefits from, the asset.”

An entity should consider following indicators of the transfer of control, which include, but are not exhaustive:

- The entity has a present right to payment from the customer for the asset.

- The customer has legal title to the asset.

- The entity has transferred physical possession of the asset.

- The customer has significant risks and rewards of ownership of the asset.

- The customer has accepted the asset.

The amount of revenue to be recognized is the amount allocated per the Step 4 – allocation of transaction price to the satisfied Performance Obligation.

Did you find this article on Step -5 revenue recognition in ASC 606 helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.