25 Nov Revenue Treatment for Group Discounts

Revenue Treatment for Group Discounts

Linked SO Line ID on CMC for group discount

What is Credit memo cancellation (CM-C)?

Credit memo cancellation is used in case of cancellation of the invoice value.

CM-C does not affect contract value unless there is an invoice overage. It only impacts the billings.

CM-C can be used in two ways –

- Linking with Invoice line ID

- Linking with Sales order line ID

When Customers have multiple invoices for one Sales order and they provide group discounts to their Customers, CM-C could be useful instead of CM when Customer sends updated orders net of Credits.

In this article, we would be explaining how CM-C would be useful instead of CM for group discount and its Revenue impact.

CASE STUDY

In Jan 2020 ABC Inc entered into a 12-month contract with XYZ Inc for Software subscription services for $10,000. At the commencement of the contract, ABC Inc. provides software subscription services to XYZ Inc. XYZ Inc will pay $2,000, $5,000 and $3,000 to ABC Inc on 1st Jan 2020, 1st Feb 2020 and 1st March 2020 respectively.

ABC Inc has a policy of providing group credits to its customers. In Sept 2020, ABC realized that group credit entries need to be booked in the system, they don’t know which invoices these credits are linked to, but they know the Sales Orders to which they relate. XYZ Inc now needs to credit the existing invoice raised on the account of group discounts.

Short Background on how Company deals with such situation currently

Note – Full billing is done for above transactions

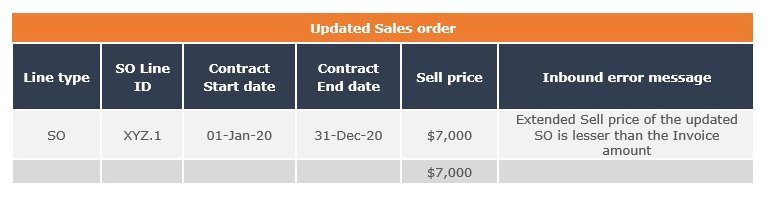

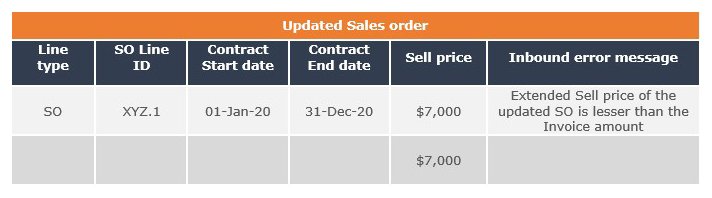

As per the existing process of the credit, ABC Inc. was passing standalone Credit memos (CM) to handle the group discount. CM reduces Contracts and billings amount on contract level so afterwards when ABC INC was passing updated Sales order for the reduced amount, it was getting stuck in LSE, with the error message “Extended Sell price of the updated SO is lesser than the Invoice amount”

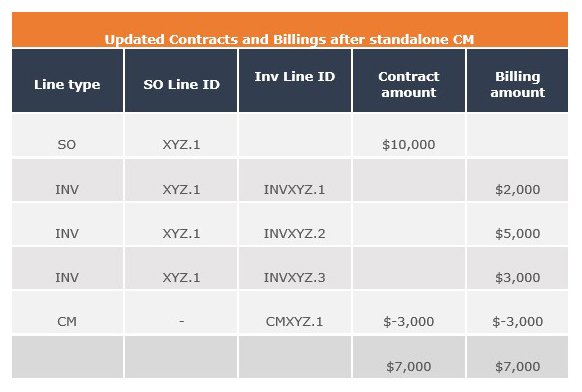

Below table shows, CM reduces contracts and billings amount on contract level rather than on line level.

ABC INC brought the updated Sales order amount to 7,000 to reduce the Contract amount.

Updated SO got stuck in an inbound table. This is because on line level contracts and billings are still 10,000.

Other important details

ABC Inc uses FinancialForce (upstream) and Zuora Revenue for Revenue management.

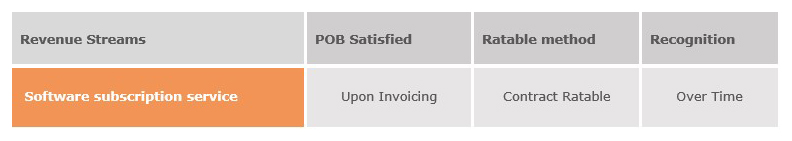

SSP allocation flag is N where the revenue stream is Software subscription

The contract is grouped using Arrangement ID

Solution:

How Zuora Revenue deals with Group discounts:

STEP 1 – Identify Contracts with Customer

The contract is mutually agreed upon between the customer and the Company. Terms of payment are defined in the contract. Also, the payment is enforceable as well as collectible from the customers.

The contracts are identified as per Arrangement ID. As per the case study, the Arrangement ID is XYZ1234. Thus, all the contracts with the same Arrangement ID will be grouped into this contract.

STEP 2 – Identifications of Performance obligations

STEP 3 – Determine the transaction price

The transaction price consists of single component i.e. Software subscription Customer XYZ Inc will pay $2,000, $5,000 and $ 3.000 on 1st Jan 2020, 1st Feb 2020 and 1st March 2020 respectively for the said service.

STEP 4 – Allocation of Transaction Price

ABC Inc is charging $10,000 for software subscription services which are equal to the standalone selling price of the service. The SSP allocation flag is N where the revenue stream is Subscription services. So, the SSP is not applicable to a given case study.

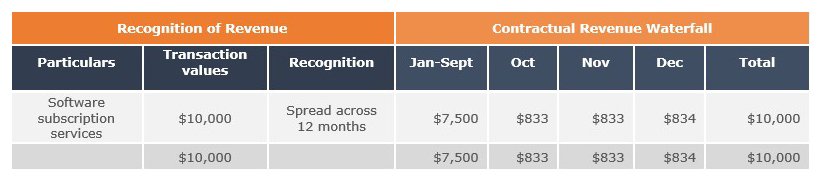

STEP 5 – Revenue Recognition

Zuora Revenue provides us with two approaches to deal with such situations.

- Sending CM with linked original SO line ID

- Sending CM-C with linked original SO line ID

Approach 1: Sending CM with linked Original SO Line ID

CM passed for $3,000 to account for group discount

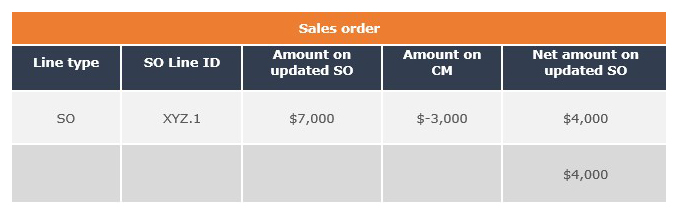

The upstream system of ABC INC sends updated Sales Orders net of credit i.e. (10,000-3,000=7,000)

The updated Sales order was again getting stuck in Inbound with the error message “Extended Sell price of the updated SO is lesser than the Invoice amount” this was happening because of transaction processing rules in Zuora revenue.

This updated Sales order of 7,000 is processed in Zuora revenue as:

So, ABC Inc must pass updated SO with an amount equal to 10,000 i.e. amount on updated Sales order + CM amount, so that it can get processed.

Since this option was not feasible, ABC Inc went with approach two.

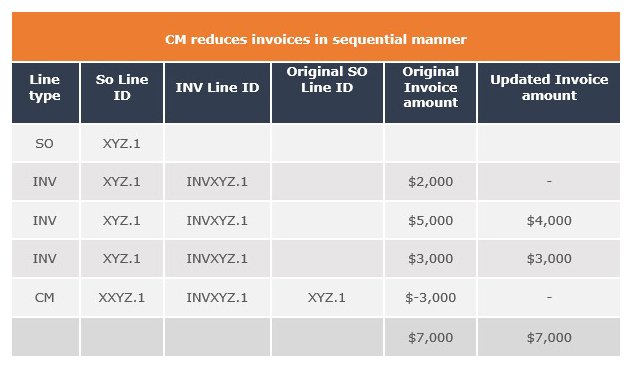

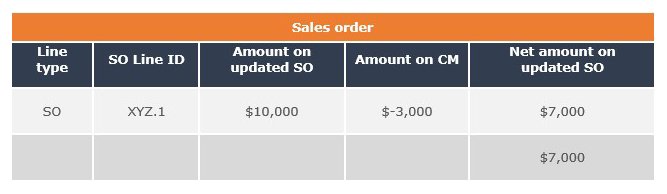

Approach 2: Sending CM-C with linked original SO Line ID

Existing Revenue Waterfall before CM-C

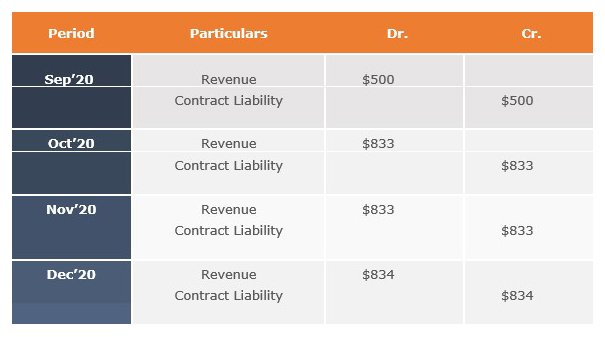

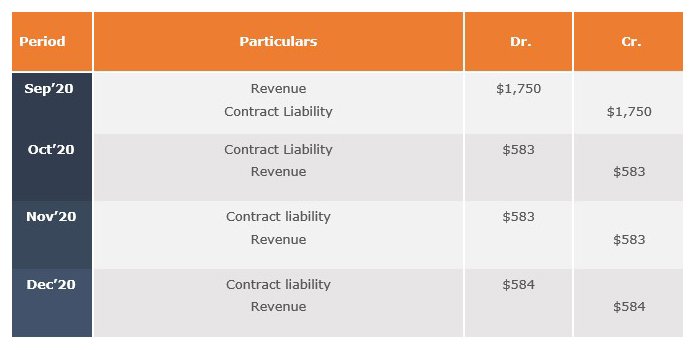

Journal Entries for revenue recognition

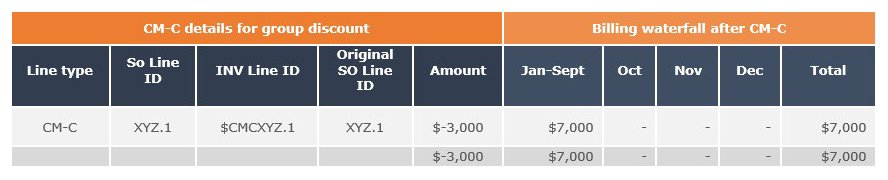

CM-C passed for $3,000 to account for group discount

Accounting impact for group discount

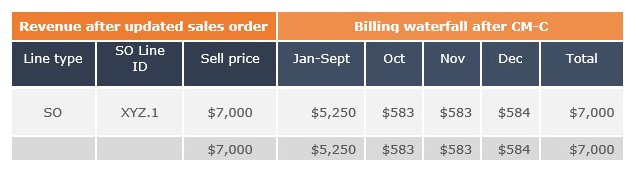

Sales order of $7,000 is passed to update the contract value to a reduced amount

Accounting impact after contract reduction

Conclusion

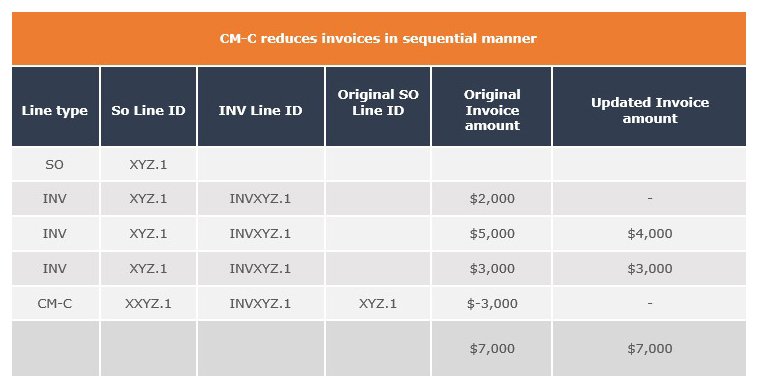

CM-C linked with Sales order line id reduces Invoice value on line level in a sequential manner and that can be used for group credits wherever multiple invoices are there and Customer doesn’t know which invoice it is linked to.

Did you find this article on ASC 606 case study helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding ASC 842, IAS 17, IFRS 16, IFRS 15, Revenue Recognition and ASC 606.