10 Jul ASC 606 – Managed Services

Table of Contents

-

-

-

- Background Information.

- Transition Approach.

- Policy Details.

- Step 1 – Identify the contract with a customer.

- Step 2 – Identify the performance obligations in the contract.

- Step 3 – Determine the transaction price.

- Step 4 – Allocate the transaction price.

- Step 5 – Recognize revenue as performance obligations are satisfied.

- Presentation of statement of financial position.

- Case Study.

-

-

Revenue is an important point of concern to the users of Financial Statements in assessing an entity’s Financial Performance and Position.

Accounting Standard Codification (ASC) 606 – Revenue from Contract with Customers is an Industry-wide revenue recognition guidance which has been formulated by the Financial Accounting Standard Board (FASB). This was a joint task by Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop common revenue standard for U.S. GAAP and IFRS.

ASC 606 is applicable across all the industries and aid in recognizing revenue from all the types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

ASC 606 was introduced to improve the way revenue recognition was been carried out as per ASC 605. This document is to introduce the readers the impact of ASC 606 on staffing solution companies.

This document covers:

The timing, amount and pattern of Revenue Recognition for Staffing Solution companies.

BACKGROUND INFORMATION

Company Background

RDST is a global leader in the Staffing Solutions Services industry. With a combination of passion of people with the power of today’s intelligent machines, the Company supports people and organizations to realize their true potentials. To underpin a commitment to maximizing future employment and contributing to economic growth for society, Company has defined its ultimate goal by 2030; Company will touch the work lives of 500 million people worldwide. The company provides specialized services in recruitment and HR & Staffing solutions. Services range from regular temporary staffing and permanent placements to In-house services, Professionals and HR solutions. The overall revenue of the company is more than $23 billion with more than 38000 employees and having a presence in more than 35 countries.

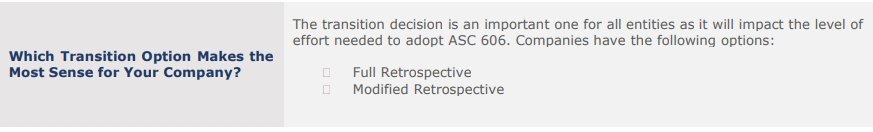

TRANSITION APPROACH

The Company elected to apply the modified retrospective method with the following practical expedient as provided by the new standard and as applicable:

For contracts that were modified before the beginning of the earliest reporting period presented, the Company will not restate the contract for those contract modifications. Instead, the Company will reflect the aggregate effect of all modifications that occur before the beginning of the earliest period presented.

POLICY DETAILS

Revenue Recognition Framework

The Company recognizes revenue to depict the transfer of promised goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods and services.

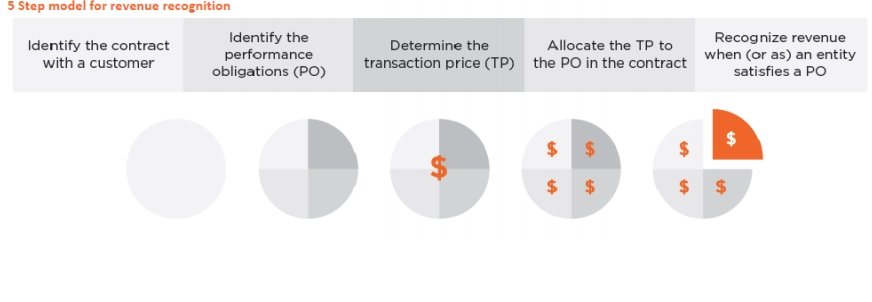

As outlined in ASC 606, the Company applies the following five steps to adhere to the above core principle:

Depending on the circumstances, the guidance may be applied on a contract-by-contract basis, or the practical expedient described in ASC 606-10-10-4 of using the portfolio approach may be followed. The portfolio approach allows an entity to apply the guidance to a portfolio of contracts with similar characteristics so long as the result would not differ materially from the result of applying the guidance to individual contracts. The Company will decide whether to apply the portfolio approach on a case-by-case basis as appropriate.

The Company’s approach to applying each of these steps is discussed in detail throughout the remainder of this section.

IDENTIFY THE CONTRACT(S) WITH A CUSTOMER

Step 1 of the revenue recognition model requires the Company to identify the contract(s) with a customer. This section discusses the steps to determine whether a contract exists and specific considerations that may impact that determination. Each contract will need to go through this evaluation.

Per ASC 606-10-25-1, the five criteria for identifying a contract are as follows:

a. The parties have approved the contract and are committed to perform.

- Services directly to end customers

- A signed service agreement. Or

- A standard purchase order of the form normally issued by the customer, supporting the customer’s commitment to receive and pay for products and/or services specified in the quotation and/or contract, which is approved by the Company’s legal and finance department.

- The Company does not consider the contract approved until both parties have executed the documents. Such execution is deemed to have occurred as of the last signature date.

- The approved contracts described above must be executed before the end of the accounting period in which revenue is to be recognized and be provided to the order entry location by midnight Pacific time. Faxed documents will not be considered received unless they are legible and complete.

- Contracts, in general, are reviewed and executed by the Legal Team. All non-standard contracts should be reviewed by the Revenue Team and approved prior to being executed.

b. Each party’s rights are identifiable: rights should all be documented in writing within the terms and conditions of the approved contracts described above.

c. Payment terms are identifiable: which are discussed in detail in the previous criteria “the parties have approved the contract and are committed to perform.”

d. The contract has commercial substance: when the risk, timing, or amount of the Company’s future cash flow is expected to change as a result of the contract. Generally, an executed contract is evidence of commercial substance.

e. The collection is probably based on the customer’s ability and intent to pay. The amount deemed collectible may be less than the contractual price: The collectability assessment only applies to consideration associated with goods or services to be transferred during the non-cancellable term of the contract. The Company’s contracts with its customers are usually non-cancellable. Generally, the Company will not enter into an arrangement for which the collectability criterion is not met.

Customers’ creditworthiness will be assessed at the outset of an arrangement through a background check.

Examples of other situations that may call collectability into question include the following:

a. The customer not being required to make payment within a reasonable period after the due date (i.e. 120 days or less)

Generally, the Company believes that its contracts with customers will meet Step 1 of the revenue recognition model.

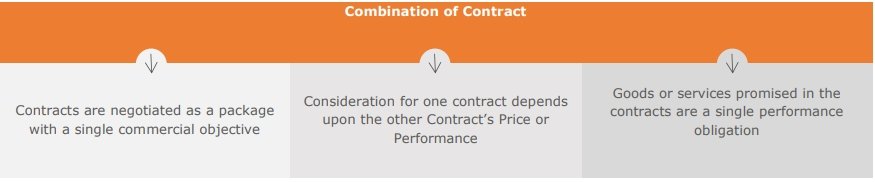

Combination of contracts

The Company combines two or more contracts entered into at or near the same time, same location and with the same customer and end user, and accounts for the combined contracts as a single arrangement if one or more of the following criteria outlined in ASC 606-10-25-9 are met:

In the event that the Company enters into multiple contracts with a customer, the Company will evaluate the considerations above to determine whether the contracts should be accounted for together or as separate contracts.

Customers may subsequently add additional products or services that were not included in the original contract. In general, such transactions are not deemed to be separate contracts that should be combined for accounting purposes but rather the Company will consider whether such contracts are a modification to the original contract (see the Contract Modifications section below for further discussion).

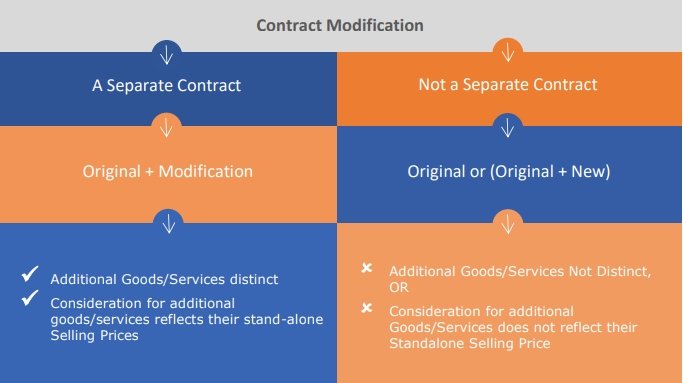

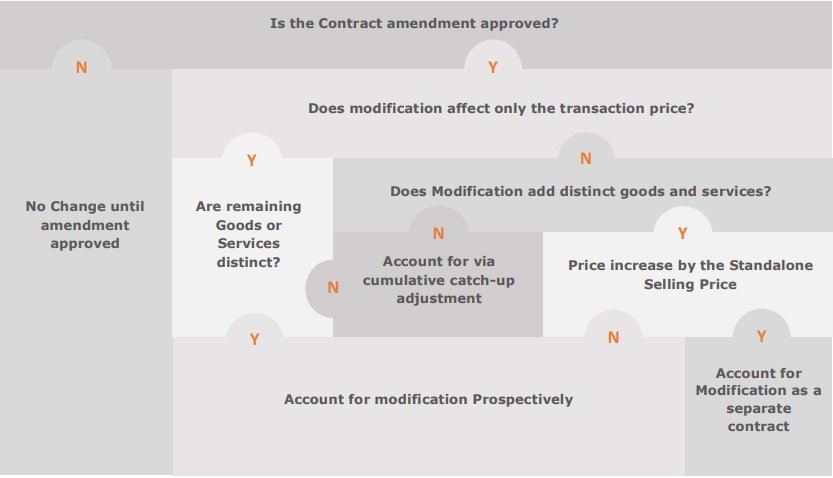

Contract modifications

A contract modification exists when there is a change in the scope and/or the price of a contract. Upon approval of a change in an existing contract, it is accounted for as a separate contract, termination of the existing contract and creation of a new contract, or as part of the existing contract.

Separate contract:

A contract modification is accounted for as a separate contract (prospective treatment) when both of the following criteria are met:

- The additional goods and services are distinct from the goods and services in the original arrangement; and,

- The amount of consideration expected for the added goods and services reflects the standalone selling price of those goods and services.

Existing contract / New Contract:

- A contract modification that does not meet the above criteria is considered a change to the original contract and is accounted for as either the termination of the original contract and the creation of a new contract, or as a continuation of the original contract, depending on whether the remaining goods or services to be provided after the contract modification are distinct from the goods or services transferred to the customer on or before the date of the modification.

- A modification is accounted for on a prospective basis, or said differently, a termination of the existing contract and creation of a new contract, if the goods and services subject to the modification are distinct from the other goods and services provided within the original contract but the consideration does not reflect the standalone selling price of those goods or services.

- A modification is accounted for as a continuation of the original contract if the goods or services added or removed are not distinct from the goods and services already provided; such modifications are accounted for on a cumulative catch-up basis. This scenario is considered to be rare.

Once a contract modification has been determined to be either a separate contract, a termination of the existing contract and creation of a new contract, or as part of an existing contract, the Company will recognize revenue for the contract consistent with the above policies.

Changes to existing SOWs will be evaluated as contract modifications, including changes to the nature of the professional service and the purchase of additional hours of professional services.

Flow Chart for a better understanding:

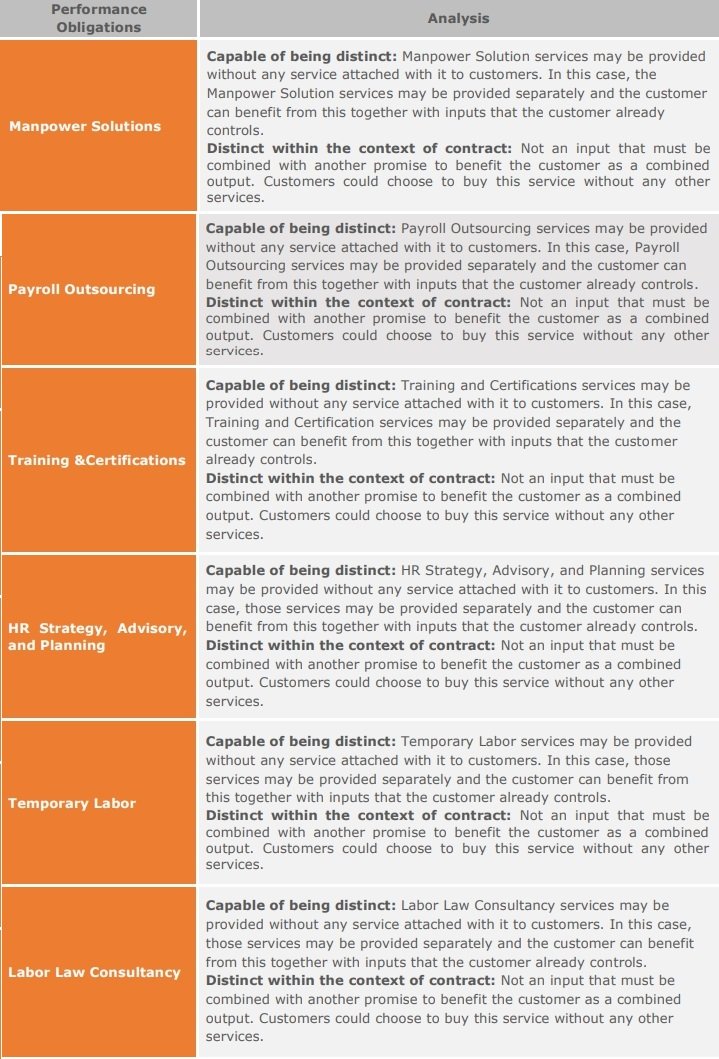

IDENTIFY THE PERFORMANCE OBLIGATIONS IN THE CONTRACT

Step 2 of the revenue recognition model requires the Company to identify performance obligations and whether the promises to transfer either goods or services are distinct performance obligations. This section discusses the requirements and provides conclusions for our general performance obligations in our contracts with customers. Each contract will need to go through this evaluation.

ASC 606-10-25-14 states that at contract inception an entity shall assess the goods or services promised in a contract with a customer and shall identify, as a performance obligation, each promise to transfer to the customer either:

a. A good or service (or a bundle of goods or services) that is distinct;

b. A series of distinct goods or services that are substantially the same and that have the same pattern of transfer to the customer.

A good or service is distinct if both of the following criteria are met:

a. Capable of being distinct – the customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer.

b. Distinct within the context of the contract – the promise to transfer the good or service is separately identifiable from other promises in the contract.

In assessing whether an entity’s promises to transfer goods or services to the customer are separately identifiable, the objective is to determine whether the nature of the promise, within the context of the contract, is to transfer each of those goods or services individually or, instead, to transfer a combined item or items to which the promised goods or services are inputs.

A series of distinct goods or services that are substantially the same are accounted for as a single performance obligation if:

- Each would be a performance obligation satisfied over time; and

- The same method would be used to measure the company’s progress toward satisfaction

The Company’s revenue transactions may include a combination of the following:

The policies below illustrate additional considerations of the Company when identifying performance obligations in the contract.

Series of distinct goods or services

The Company’s contracts contain promises to deliver a distinct series of services that are substantially the same. If the distinct series of services meet both of the criteria below, they are considered to be a single performance obligation:

a) Each distinct service in the series that the Company have promised to transfer to the Company’s customer would meet the criteria of a performance obligation satisfied over time

b)The same method would be used to measure the Company’s progress toward complete satisfaction of the performance obligation to transfer each distinct service in the series to the Company’s customer.

Stand-ready obligations

A stand-ready obligation represents a service of ‘standing ready’ to provide goods or services or of making goods or services available for a customer to use as and when the customer decides. The appropriate measure of progress to apply to a stand-ready obligation that is satisfied over time might vary from one type of stand-ready obligation to another. Although the Company is obligated to provide these services throughout the term of the contract, the pattern of benefit to the customer may or may not be consistent throughout the term of the contract.

DETERMINE THE TRANSACTION PRICE

Step 3 of the revenue recognition model requires the Company to determine the transaction price for the contract. This section discusses the potential transaction price components and how they may increase or decrease the overall transaction price. Each contract will need to go through this evaluation.

The Company considers the terms of the contract and its customary business practices to determine the transaction price. The transaction price is the amount of consideration to which the Company expects to be entitled in exchange for transferring goods or services to a customer, excluding amounts collected on behalf of third parties such as sales taxes. The following items are taken into consideration when determining transaction price and are discussed in further detail throughout this section.

+ Fixed Consideration (includes consideration related to performance obligations and activation fees)

+ Estimated Variable Consideration

– Contingent Amounts (unless no revenue reversal is probable)

– Consideration Payable to the Customer

+ Noncash Consideration

± Significant Financing Component

– Amounts Collected on Behalf of Third Parties

= Transaction Price

When determining the transaction price, the Company assumes that the goods or services will be transferred to the customer based on the terms of the existing non-cancellable contract and does not take into consideration the possibility of the contract being canceled, renewed, or modified. The Company also considers the effects of the following:

1. Variable consideration (and the constraint)

Forfeitures, refunds, rights of return, price concessions, payments contingent on future events, and similar items give rise to variable consideration which, in turn, affects the transaction price for an arrangement. The Company will determine how much variable consideration can be included in the overall transaction price at contract inception. This determination is comprised of the following two steps:

a. Estimate the amount of variable consideration;

b. Determine whether any of the estimated amounts are subject to a probable revenue reversal (this concept is referred to as “the constraint” in the literature).

ASC 606-10-32-8 suggests two alternatives to use (be consistently applied throughout the life of the contract) when estimating the amount of variable consideration:

a. The expected value method:

Sum of probability-weighted amounts in a range of possible consideration amounts

b. The most likely amount method:

The single most likely amount in a range of possible consideration amounts

Below are potential issues that may be faced by the Company that may require an estimate of variable consideration and the constraint.

Variable consideration may include amounts that could be refunded, returned, or uncollected from customers or resellers, rebates in the form of cash or credits provided to resellers for meeting certain sales targets, booking targets, etc., credits to end-users, price concessions, incentives, performance bonuses, penalties, usage-based fee, price protection, time and materials contracts, usage overages on subscription contracts, or other similar items.

2. Concessions

The Company may provide infrequent concessions to certain customers in order to preserve the Company’s relationship or to extend the term of contracts. These concessions typically result in free or reduced-price product exchange, free or reduced-price maintenance and support services, an extension of the payment term, or a credit to be applied against future purchases.

Under ASC 606, concessions are generally viewed as any post-execution change to the original agreement between the Company and the customer that increases the customer’s rights or the Company’s obligations. Concessions may impact the determination of performance obligations and/or transaction price and could be considered a contract modification. As such, concessions should be considered throughout the five-step revenue recognition framework. Discussion of concessions is placed in the transaction price section of the policy as transaction price is frequently impacted by concessions.

Concessions may take many forms and include, but are not limited, to the following:

– Accepting returns that are not required under the terms of the original arrangement;

– Reducing the arrangement fee or extending the terms of payment; or

– Increasing the deliverables or extending the customer’s rights beyond those in the original transaction, without an appropriate increase in fees

The Company will assess whether to include estimated concessions in the transaction price on a contract-by-contract basis when and if concessions are expected to be provided. As of the date of this policy, the Company does not have a history of granting concessions and, as such, estimated concessions will not be included in the transaction price.

3. Noncash consideration

Any noncash consideration received from a customer is measured at fair value and included in the transaction price. If a reasonable estimate of the fair value of the noncash item cannot be made, the Company will use the stand-alone selling price of the good or service that is provided in exchange for the noncash consideration.

4. The consideration payable to a customer

The Company evaluates consideration payable to a customer to determine whether the amount represents a reduction of the transaction price, payment for distinct goods or service, or a combination of the two. Consideration payable that does not exceed the fair value of distinct goods or services shall be accounted for as a purchase from suppliers. The consideration payable that exceeds the fair value of distinct goods or services shall be accounted for as a reduction to the transaction price with the remainder accounted for as a purchase from suppliers. If the Company cannot reasonably estimate the fair value of goods or services received from the customer, then it will account for all consideration payable to the customer as a reduction of the transaction price at the later of when the Company recognizes revenue for the transfer of the related goods or services and the Company pays or promises to pay the consideration.

5. Sales taxes

The Company excludes all taxes assessed by governmental authorities from the measurement of the transaction price as allowed by ASC 606-10-32-2A as the taxes collected by the Company are levied against its customers. The Company is considered an agent for the governmental authority and therefore the taxes collected are not included in the transaction price.

ALLOCATE THE TRANSACTION PRICE TO THE PERFORMANCE OBLIGATIONS IN THE CONTRACT

Step 4 of the revenue recognition model requires the Company to allocate the transaction price to the performance obligations in the contract. This section discusses how standalone selling prices are determined and how the transaction price will be allocated using the standalone selling prices or other appropriate methods. Each contract will need to go through this evaluation.

Allocating the transaction price to performance obligations

The Company allocates a portion of the total transaction price to each performance obligation based on the relative stand-alone selling price (SSP) of each performance obligation. The amount allocated, therefore, represents the amount of consideration to which the Company expects to be entitled in exchange for providing the goods or services included in the performance obligation. SSP is determined at the inception of the contract for each performance obligation.

Once the Company has determined the transaction price, a portion of the total transaction price is allocated to each performance obligation in a manner depicting the amount of consideration to which the Company expects to be entitled in exchange for transferring the goods or services to the customer (the “allocation objective”). The first step is to determine the SSP of each performance obligation. Once the SSPs have been determined, the second step is to allocate the transaction price based on the performance obligations’ relative SSPs. However, in some cases, a discount or variable consideration may be allocated to one or more, but not all, performance obligations in the contract. See the discussion of these cases in sections Allocating variable consideration and Error! Reference source not found., below.

SSP is determined at the inception of the contract for each performance obligation. After contract inception, no reallocation of the transaction price is made to reflect subsequent changes in SSPs.

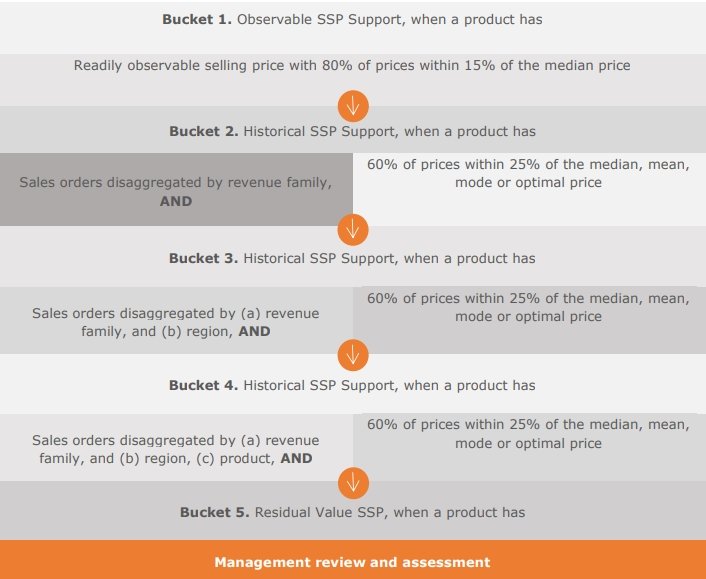

Determining standalone selling prices

The following shows the Company’s decision-making process for selecting a standalone selling price:

SSP is the price at which the Company would sell a promised good or service separately to a customer. The best evidence of SSP is an observable SSP, which is the “price of a good or service when the entity sells that good or service separately in similar circumstances to and to similar customers” per ASC 606-10-32-32.

The Company considers SSP to be a range of prices. The Company will apply judgment in determining what constitutes an appropriate SSP range. Any such range will be established based on an analysis that maximizes observable inputs and supports an assertion that any price within that range would be a valid pricing point if the performance obligation were sold on a stand-alone basis.

Determining observable SSP

The Company first concludes whether an observable SSP exists. An observable SSP is the price of a good or service when the entity sells that good or service separately in similar circumstances and to similar customers. The Company conducts a regular analysis to determine whether various services have an observable SSP. If an observable SSP exists, it is used for allocation purposes. If there is a relatively narrow range of observable prices, then a stated contract price within that range is an acceptable SSP. The Company considers observable SSP to exist when

(a) 80% of contract prices for a separately sold service to be within 15% of an estimated SSP, and

(b) there are a sufficient number of observed contracts to reasonably estimate SSP.

Determining SSP based on historical prices

If the Company does not have an observable SSP then, the Company next assesses whether products have an estimated SSP by considering its historical pricing. Historical prices include both

a) observed in transactions within the last twelve months and

b) standalone and non-standalone transactions.

The Company considers historical SSP to exist when

c. 60% of contract prices for a separately sold service to be within 25% of an estimated SSP, and

d. there are a sufficient number of observed contracts to reasonably estimate SSP.

Determining SSP for low-coverage products

If the historical standalone selling price is not available after disaggregating the product revenue family, Management reviews the specific item and makes its best estimate of SSP. This analysis may consider the following:

a. Adjusted market assessment

Prices based on SSP of similar goods or services or SSP observed in another market and adjusted for known differences in functionality, markets, etc.

b. Expected cost plus a margin

Prices based on a forecast of the expected costs plus an appropriate margin for the service.

c. Combined method

Prices established for a bundled (combined) performance obligation based on combining SSP of individual goods or services included in the bundle, and adjusting for the effect of bundling, as appropriate. The Company does not believe it will utilize this method.

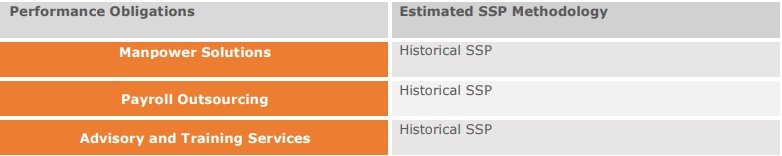

The following table outlines the Company’s distinct performance obligations and the method that is most frequently used to establish SSP:

Frequency of updating the SSP analysis

The Company estimates SSP on an annual basis, or as needed when standard discounts are updated or new products are introduced in the market. On a six-monthly basis, the Company will revise its estimate of SSP if there is a material change in the SSP.

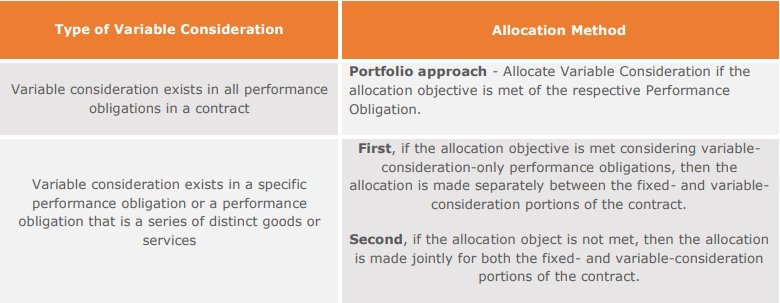

Allocating variable consideration

Variable consideration may be attributable to:

i. All of the performance obligations in a contract— including amounts that could be refunded, returned, or uncollected from customers or resellers, rebates in the form of cash or credits provided to resellers for meeting certain sales targets, booking targets, etc., credits to end-users, price concessions, incentives, performance bonuses, penalties, price protection, or other similar items;

ii. One or more, but not all, of the performance obligations in a contract— including time and materials contracts, and usage-based fees; and

iii. One or more, but not all, of the distinct goods or services, promised in a series of distinct goods or services that forms part of a single performance obligation— including usage overages on subscription contracts.

The Company will allocate variable amounts, along with subsequent changes to such amounts, entirely to one or more, but not all performance obligations when both of the following criteria are met:

I. The variable payment terms relate specifically to the entity’s efforts to satisfy the performance obligation; and

II. Allocating the variable amount of consideration entirely to the performance obligation is consistent with the allocation objective when considering all of the performance obligations and payment terms in the contract.

Portfolio approach – The new standard is applied to an individual contract with the customer. However, as a practical expedient, an entity may apply the revenue model to a host of contracts clubbing them together as a portfolio. A portfolio of contacts will consist of those contracts which exhibit similar characteristics and the entity reasonably expects that the effect of applying this approach as opposed to applying the 5-step model to the individual contract would not result in a material difference to the financial statements.

Allocation objective – At the commencement of the contract, the transaction price is generally allocated to each performance obligation on the basis of relative standalone selling prices. However, when specified criteria are met, a discount or variable consideration is allocated to one or more performance obligations in the contract. This is known as allocation objective.

RECOGNIZE REVENUE WHEN (OR AS) THE ENTITY SATISFIES A PERFORMANCE OBLIGATION

Step 5 – of the revenue recognition model requires the Company to recognize revenue when (or as) it satisfies a performance obligation, which is determined by the transfer of control to the customer. This section discusses potential impacts to the timing of the transfer of control, the types of transfer of control and the likely recognition method for the Company’s various performance obligations. Each contract will need to go through this evaluation.

The Company recognizes revenue when (or as) it satisfies a performance obligation by transferring promised goods or services to its customers. The good or service is considered transferred when the customer gains control of the good or service. Control of an asset refers to the ability to direct the use of and obtain substantially all of the remaining benefits from the asset. Control also means the ability to prevent other entities from directing the use of and receiving the benefit from, a good or service. If control transfers over time, revenue will be recognized over time in a manner depicting The Company’s performance in transferring control of the good or service. If control transfers at a point in time, revenue will be recognized at that point.

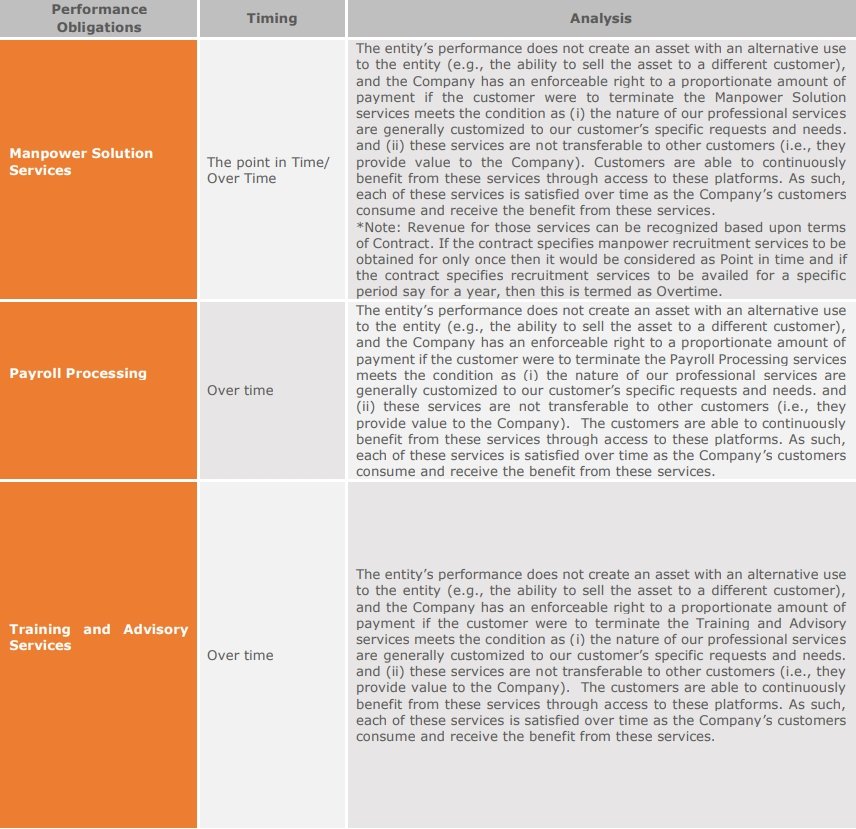

Per ASC 606-10-25-27, transfer of control occurs over time if one of the following criteria is met:

a. The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs

b. The entity’s performance creates or enhances an asset that the customer controls as the asset is created or enhanced

c. The entity’s performance does not create an asset with an alternative use to the entity (e.g., the ability to sell the asset to a different customer), and the Company has an enforceable right to a proportionate amount of payment if the customer were to terminate the contract. Generally, our professional services meet this condition as

I. the nature of our professional services are generally customized to our customer’s specific requests and needs, and

II. these services are not transferable to other customers (i.e., they provide value to the Company.

The customer receives and consumes the benefits as the entity performs if another entity would not need to substantially re-perform the work completed to date to satisfy the remaining obligations. The fact that another entity would not have to re-perform work already performed indicates that the customer receives and consumes the benefits throughout the arrangement.

If a performance obligation is not satisfied over time it is satisfied at a point-in-time. Per ASC 606-10-25-30, indicators of transfer of control that would likely result in point-in-time revenue recognition include:

a) The Company has a present right to payment for the asset

b) The customer has legal title to the asset

c) The Company has transferred physical possession of the asset

d) The customer has the significant risks and rewards of ownership of the asset

e) The customer has accepted the asset.

The following table summarizes how the Company transfers control for each performance obligation based on the above guidelines.

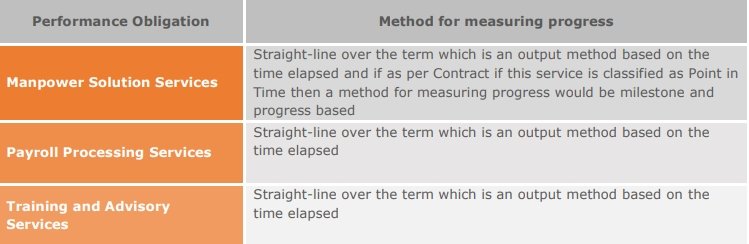

Once the determination of how control is transferred, the method for measuring the progress of satisfying a performance obligation must be selected. For performance obligations satisfied over time, a company may select either an output method or input method as provided under ASC 606. The methods selected by the Company for measuring the progress of each of its performance obligations are as follows:

PRESENTATION ON THE STATEMENT OF FINANCIAL POSITION

The Company will present a contract liability or a contract asset in its statement of financial position when either party to the contract has performed. The Company performs by transferring goods or services to its customers, and the customer performs by paying consideration to the Company. Unconditional rights to consideration will be separately presented as receivables. A right to consideration is unconditional if only the passage of time is required before payment becomes due.

Obligations to transfer goods or services to a customer for which the Company has received consideration, or for which an amount of consideration is due from the customer, will be presented as contract liabilities. It is noted that in extremely rare situations, customers contracts contain a right to terminate for convenience, where amounts paid by the customer are refundable. In these situations, the customer has paid for future goods or services, but because of the termination clause an agreement does not exist and thus the Company does not have an obligation to transfer goods or services except as the customer requests (i.e. doesn’t terminate). The amount of consideration received for which the Company is not currently obligated is not considered a contract liability, but rather will be classified as a customer deposit and included in Other Liabilities.

Rights to consideration in exchange for goods or services that the Company has transferred to the customer when that right is conditional on something other than the passage of time will be presented as a contract asset.

The Company will not net receivables with contract liabilities.

CASE STUDY

Based on the above considerations and in reference to various requirements of the guidance, a typical transaction can be molded as below:

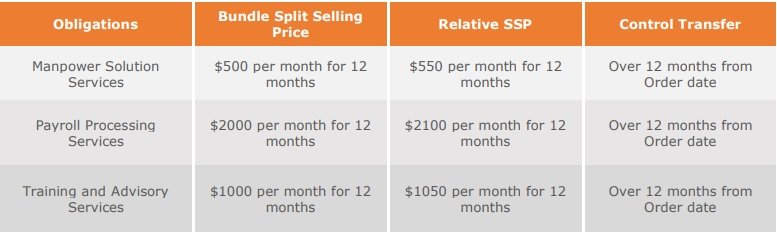

Contracted Selling Price with EXP Inc. from the USA for Staffing Solution Services is $ 42000 which is a bundle of Manpower Solution Services, Payroll Processing, and Training & HR Advisory services. Contract Start date is 1st Jan 2019 and Contract end date 31 Dec 2019, Services has been delivered in the month of Jan 2019, the rights to invoicing are established from the date of delivery.

Step 1 – Identify Contracts with Customer

Considering that all 5 criteria for identifying the contract with the customer is met and the contract is combined based on the customer and the contract entered with the same time and location.

Step 2 – Identifications of Performance obligations (PO)

For Manpower Solution Services: In this case, Over time recognition on Invoicing. It can be Point in Time based upon terms and conditions of a contract.

For Payroll Processing Services: Over time recognition on Invoicing

For Training and advisory Services Over time recognition from Order date

Step 3 – Determine the transaction price

It is assumed that the transaction price is based on Historical transactions.

Transaction price as per contract is

For Manpower Solution Services $6000($500*12)

For Payroll Processing Services $24000($2000*12)

For Training and advisory Services $12000 ($1000*12)

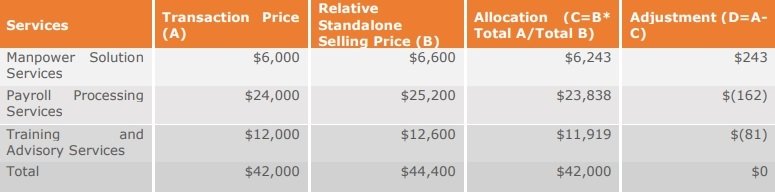

Step 4 – Allocation of Transaction Price (figures in $)

Based on Relative Standalone Selling price the allocation of Transaction price would be as below (Figures in $)

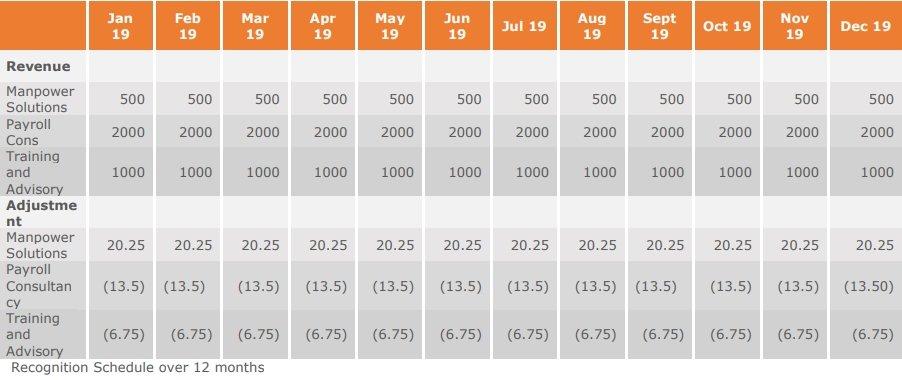

Step 5 – Recognition of Revenue (figures in $)

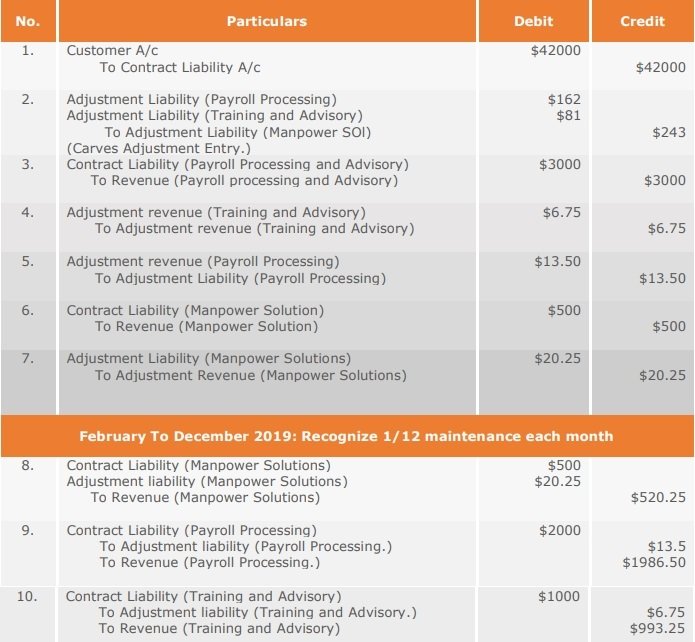

Accounting Entries

January 2019: Recognize Revenue Over 12 months

Disclosure Requirements

Notes:

Valuation hierarchy:

A three-level valuation hierarchy has been established under U.S. GAAP for disclosure of fair value measurements. The valuation hierarchy is based on the transparency of inputs to the valuation of an asset or liability as of the measurement date. The three levels are defined as follows.

- Level 1 – inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

- Level 2 – inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

- Level 3 – one or more inputs to the valuation methodology are unobservable and significant to the fair value measurement. A financial instrument’s categorization within the valuation hierarchy is based on the lowest level of input that is significant to the fair value measurement.

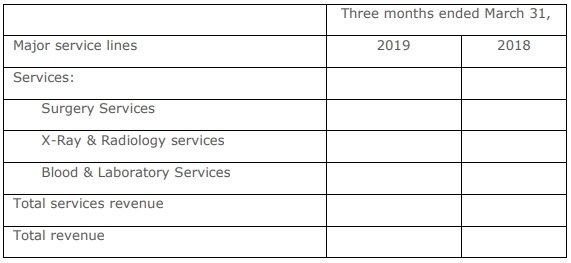

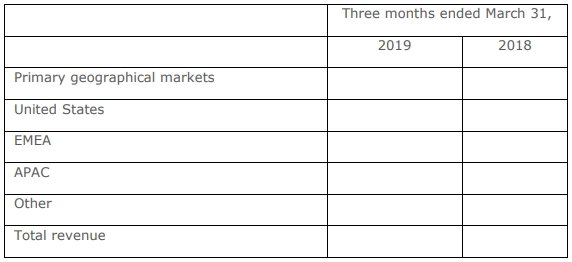

Disaggregation of Revenue:

The Company’s revenue was comprised of the following major product and service lines (in thousands):

The Company’s revenue by geographic region, based on the customer’s location, is summarized as follows (in thousands):

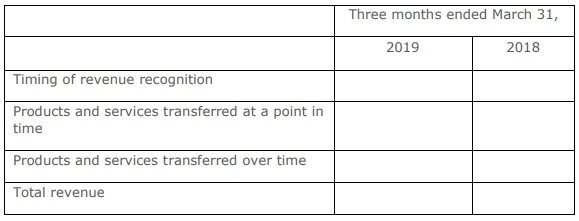

The following table presents the Company’s revenue by the timing of revenue recognition (in thousands):

Contract Balances:

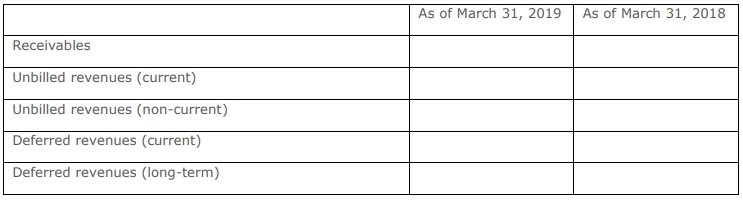

The following table provides information about receivables, unbilled revenues, and deferred revenues from contracts with customers (in millions). Unbilled revenues are presented as part of prepaid expenses and other current assets and other assets in the Company’s consolidated balance sheets:

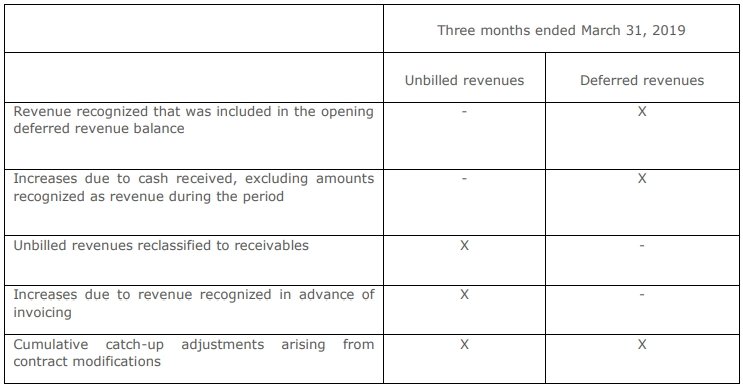

Significant changes in the unbilled revenues and the deferred revenues balances during the period are as follows:

Transaction Price Allocated to the Remaining Performance Obligations:

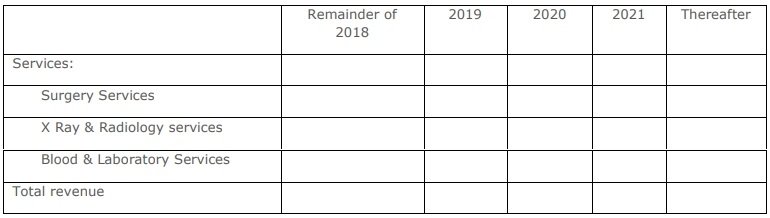

The following table includes estimated revenue expected to be recognized in the future related to performance obligations that are unsatisfied (or partially unsatisfied) as of March 31, 2019 (in millions).

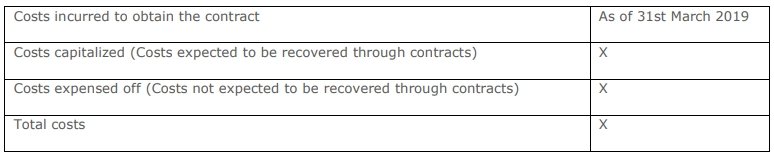

Contract costs:

Costs incurred to obtain the contract:

Costs incurred to fulfill the contract:

Did you find this case study on ASC 606 helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.