05 Jul The Perks of Implementing NetSuite Advanced Financials for your Business

The Perks of Implementing NetSuite Advanced Financials for your Business

Automate the Manual Processes associated with billing your customers.

Financial Management is the backbone of any enterprise. It is one of the crucial aspects to function in any organization well. Financial Management is all-inclusive – consists of systematic planning, coordinating, controlling, managing, and monitoring financial activities within a company to increase profits. It also involves the procurement of funds and properly utilizing those. Financial management deals with overall monetary concerns related to account management, payments, risks involved, etc.

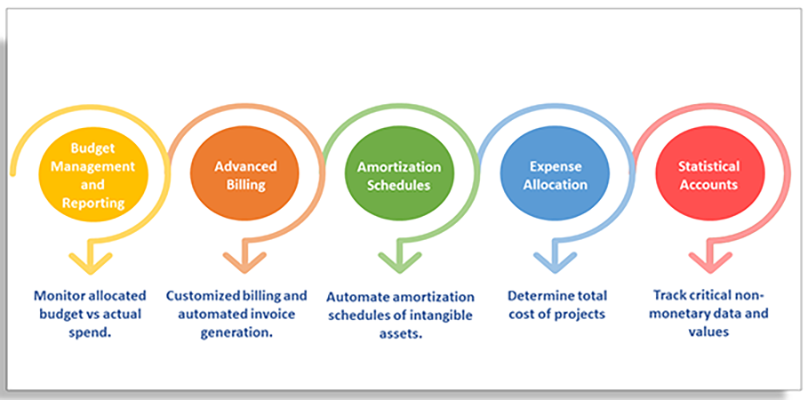

The accounting department needs essential tools to efficiently use financial records to assist business growth. Advanced Financial Management is a solution that offers complementary services to NetSuite. It provides solutions for expense allocations, amortization, statistical accounts, flexible billing management, better budget management, and reporting. It is one-stop software that brings together all the key business functions into one.

NetSuite Advanced Financials makes it easy to plan the budgets and take charge of your expenses accurately. It also reduces the difficulties of your billing, helping the finance department.

Advanced Financials from NetSuite

The Advanced Financial Features That Increase Visibility of your Financial Operations:

BUDGET MANAGEMENT AND REPORTING

Finance teams use budget management and reporting to monitor the allocated budget vs the actual spend.

- Helps in following up and keep track of your budgets.

- A single interface enables easy entry of budget for accounts.

- The Copy Budget Feature can make a copy of a budget based on another budget or can import an excel sheet of the existing budget.

- You can create a budget in excel and export it through CSV.

- Multiple Budget Features can simplify the budgeting process for you. It allows for multiple budget creation and management at once.

- Provides Budget income Statement and Budget vs Actual Report that helps to create own distinct budget reporting.

ADVANCED BILLING MANAGEMENT

Business owners charge their customers at decided intervals (e.g. Monthly, Quarterly, Annually) or at once for the products or services they offer.

Advanced Billing provides customized billing schedules and automates the generation of invoices.

- It lets users take complete charge of billing processes. It can manage the billing both ways – one time and on a recurring basis.

- It also allows you to bill your customers on different payment terms g. charging the customers in advance or splitting the charges for a given time.

- It comes with integrated revenue recognition functionality to easily set up billing schedules. It accommodates generating invoices of various types of sales e.g. billing plans based on installments, or billings that require advanced payment.

- Billing schedules are flexible. Billing cycles are applicable to the entire sales order or each item of the sales order. Users can conveniently create billing schedules on the sales order.

- Advanced billing management enables the integration of billing schedules with a sales forecast. With this, your upcoming bills can be spread over a period depending upon the billing schedules.

- It even offers an easy self-service facility that lets the clients manage their information, individual billing plans, payment method options.

- When combined with the Incentive Management module, you can link billing schedules to sales commissions and forecasts to get visibility of future finances.

AMORTIZATION SCHEDULES

Amortization of expenses is to distribute an intangible assets’ cost over the asset’s useful life. Intangible assets are not present physically e.g. Patents, Trademarks, Copyrights, etc. They do not have any resale value. This distribution of costs results in the remaining balance of that asset decreasing over the set period. It gradually lowers the book value of intangible assets.

- The NetSuite software helps businesses to automate schedules of amortization over the period.

- It enables the Amortization schedules to be linked to jobs. The expenses are amortized proportionately to the percentage of job completion. Amortizing helps in matching up the value of an asset to the revenue generated by that intangible asset.

EXPENSE ALLOCATIONS

To determine the total cost of a cost object, and accurate accounting, indirect expenses are to be considered. The company can allocate indirect expenses such as labor, rent, utilities, office stationery, etc. to estimate the full cost in financial statements.

- With NetSuite Advanced Financials, there is no need to assign the expenses into classes, departments, items, locations, etc. You can enter the expenses easily and later allocate them into a weighted formula.

- You can use the Allocation Schedules once or also can run it to repeat the schedule on regular basis.

- There are Dashboard Reminders, that can inform you when to process your active allocation schedules.

- Once you review, you can click and create a journal entry for schedules.

STATISTICAL ACCOUNTS

Statistical Accounts are non-monetary accounts to store the statistical information of different parameters.

- The Statistical Accounts feature of the Advanced Financial module helps finance teams to track critical non-monetary values and data such as headcount, common shares, and workspace. It then uses that information on reports and income statements.

- Automatically allocates non-monetary costs like overhead costs, rent expenses, etc. of the businesses

- Can run multiple allocation schedules in given sequences.

The Benefits of Advanced Financials to the Businesses

- Enterprises can monitor budget vs actual real-time to make sure budgets do not go out of control.

- Automating key processes like Amortization and Expense allocation, reduce manual efforts and errors, improving productivity.

- Management can manage multiple budget records including department, project, location, or item. Gives visibility and better financial controls.

- Automate the billing process, helps in saving manual time.

- Improve productivity with the automated allocation of expenses and amortization.

NetSuite Advanced Financial offers add-on features to its standard CRM and ERP modules. Along with its core features, the additional services from NetSuite Advanced Financials make it the best fit for any enterprise for financial management.

RevGurus a NetSuite Alliance Partner will help you to transform your business. We have a team with a strong technical background and good integration experience. Our financial team comprises qualified chartered accountants. We have certified NetSuite ERP Consultants who are authorized in ARM and Multi-Book too. We provide end-to-end solutions for companies to leverage NetSuite. Having successfully delivered projects for various SMBs and Fortune 500 Enterprises, we can help you to transform your business processes with NetSuite.