04 Apr ASC 606 Asset Management Company

Table of Contents

Revenue is an important point of concern to the users of Financial Statements in assessing an entity’s Financial Performance and Position.

Accounting Standard Codification (ASC) 606 – Revenue from Contract with Customers is an Industry-wide revenue recognition guidance which has been formulated by the Financial Accounting Standard Board (FASB). This was a joint task by Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop common revenue standard for U.S. GAAP and IFRS.

ASC 606 is applicable across all the industries and aid in recognizing revenue from all the types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

ASC 606 was introduced to improve the way revenue recognition was been carried out as per ASC 605. This document is to introduce the readers the impact of ASC 606 on Asset Management Company.

This document covers:

The timing, amount and pattern of Revenue Recognition for Asset Management Company.

BACKGROUND INFORMATION

Background

An asset management company (AMC) is a company that invests its clients’ pooled funds into securities that match declared financial objectives. Asset management companies provide investors with more diversification and investing options than they would have by themselves. AMCs manage mutual funds, hedge funds and pension plans, and these companies earn income by charging service fees or commissions to their clients. ABSL AMC Ltd is an asset management company dealing in diversified portfolios.

Understanding AMC

Typically, AMCs are considered buy-side firms. This simply refers to the fact that they help their clients invest money or buy securities. They decide what to buy based on in-house research and data analytics, but they also take public recommendations from sell-side firms. AMCs charge their investors set fees. In other cases, these companies charge a percentage of the total assets under management.

IMPACT ON AMC

- The implementation of Topic 606 and the five-step approach could have a significant impact on when asset managers recognize revenue.

- Asset managers typically earn revenues via two methods:

Management fees – generally charged as a percentage of assets under management (“AUM”), and

Incentive fees (or carried interest) – generally a percentage of profits, subject to clawback provisions, hurdle rates, and high watermark provisions.

MAJOR REVENUE STREAMS

- Two and Twenty: A compensation structure that hedge fund managers typically employ in which part of compensation is performance-based. More specifically, this phrase refers to how hedge fund managers charge a flat 2% of total asset value as a management fee and an additional 20% of any profits earned.

a. Performance Fees: Payment made to an investment manager for generating positive returns above hurdle rate. It is calculated as a percentage of the average AUM. The present going rate for the same is 7-20%.

b. Asset Management Fees: Charge levied by an investment manager for managing an investment fund. It is calculated as a percentage of the average AUM. The present going rate for the same is 0.01% – 3%. - Incentive Fees: Fee charged by a fund manager based on a fund’s performance over a given period and usually compared to a benchmark. (High water mark) It is calculated as a percentage of the appreciation. The present going rate for the same is 10%-20%.

- Commission / Brokerage: Fee charged by a broker to execute transactions or provide specialized services. It is calculated as a percentage of transaction value. The present going rate for the same is 0.25%-1.25%.

- 12-b 1 Fees: Fee charged by some mutual funds for promotion, distributions, marketing expenses, and often commissions. The fee is named after the line of legislation that made it. It is calculated as a percentage of transaction value. The present going rate for the same is 0.01%-1%.

- Transaction Fees: Fees charged for carrying out a transaction. The fee is named after the line of legislation that made it. It is calculated as a percentage of transaction value. The present going rate for the same is 0.25% – 0.75%.

- Annual Maintenance Fees: Fees charged for maintaining the client account. It is calculated as a percentage of the average AUM. The present going rate for the same is 0.25% – 1.5%.

- Advisory Fees: fee paid by investors for professional advisory services. It can be charged as a percentage of total assets or it may be associated with a broker-dealer transaction.

a. Asset Based: Here the fees are calculated as a percentage of the average AUM. The present going rate for the same is 0.25% – 0.40%.

b. Commission Based: Here the fees are calculated as a percentage of the average AUM. The present going rate for the same is 1% – 5%. - Set up Fees: Initial Charges to set up an interface for each client. It is calculated as a a fixed amount.

- Loads: Fees charged for entering and exiting a scheme.

a. Entry load: charged at the time an investor purchases the units of a scheme. It is calculated as a percentage of the average AUM. The present going rate for the same is 2% – 2.25%.

b. Exit load: charged at the time of exiting or redeeming a scheme. It is calculated as a percentage of the average AUM. The present going rate for the same is 0.25%.

ASC 606 IMPACT ON TWO AND TWENTY

Performance Obligation

Asset managers generally services over a period of time. Under Topic 606, such services sometimes will be accounted for as a single performance obligation. It can be reasonably concluded that each day of service is substantially the same because the nature of the AMC’s promise to the customer is one overall service.

- Two and Twenty

AMC’s are typically paid for their services through a combination of a base management fee and an incentive or performance fee. These fees are considered variable under ASC 606 since both types of fees are dependent on a variable base (i.e., assets under management or performance during a defined period). ASC 606 requires asset managers to estimate and limit the recognition of variable consideration so that revenue is recognized only when it is probable that it will not change substantially when the uncertainty associated with the variable consideration is resolved.

Two and Twenty, therefore, typically would be:

- Included in the transaction price at the end of each reporting period, when the uncertainty related to the amount of the AUM has been resolved

- Allocated to each reporting period as the fees relate specifically to the AMC’s efforts to provide services over the term of the contract.

Each increment of asset management service (that is, each daily provision of service) is satisfied over time as the customer simultaneously receives and consumes its benefits. Therefore, a time-based measure of progress is applied when measuring progress toward complete satisfaction of asset management services.

Variable consideration in the form of Two and Twenty fees should be excluded from the transaction price until it becomes probable that there will not be a significant reversal of cumulative revenue recognized. ASC 606 assists AMC’s in assessing whether it is probable that a significant revenue reversal will occur and in determining whether all or a portion of the performance fees is not constrained from being included in the transaction price (at the inception of the contract or upon subsequent re-evaluation).

BUNDLE INFORMATION

- A possible scenario where there is is the “Two and Twenty”.

- Apart from this, in accordance with the latest laws of disclosure, there can be other combinations of revenue streams for the bundle.

CONTRACT IDENTIFICATION METHOD

- The contracts are identified per Customer ID and then dissevered as per plans opted.

- Multiple layers of identification are also possible which is company specific.

GENERAL PERIOD OF THE CONTRACT

- Generally, the period of the contract ranges from one to five years.

- However, transactions are billed every quarter end.

- The revenue is recognized during the quarter and reinstated at the end of the respective quarter.

VARIABLE CONSIDERATION

- Per ASC 606-10-55-221, the bundle of ‘Two and Twenty’ is dependent on the net AUM which is not known until the end of the reporting quarter. This makes the revenue variable in nature giving rise to the concept of Variable consideration.

- Therefore, the possible treatment suggested is to recognize the revenue as on day 1 and then reinstate the same at appropriate intervals of time until the quarter end.

- Therefore, the revenue is proportionately released and recognized during the quarter according to day 1 calculations as ‘ESTIMATE’ and again reinstated at intervals as ‘ESTIMATE’.

- At the end of the quarter, the net AUM amount is derived and billed. At this time final reinstatement is done and the revenue recognition process for the quarter comes to an end. At this time the revenue is recognized as ‘ACTUAL’.

CONTRACT MODIFICATION

- In case of AMCs a major change in price, quantity or scope or a combination of any three would trigger contract modification.

- However, since the price change is dealt with in variable consideration, contract modifications are a rare case.

- Nevertheless, if there is contract modification, the effect can be retrospective and perspective, depending on the business.

BACKGROUND TO CASE STUDY

Revenue Recognition Framework

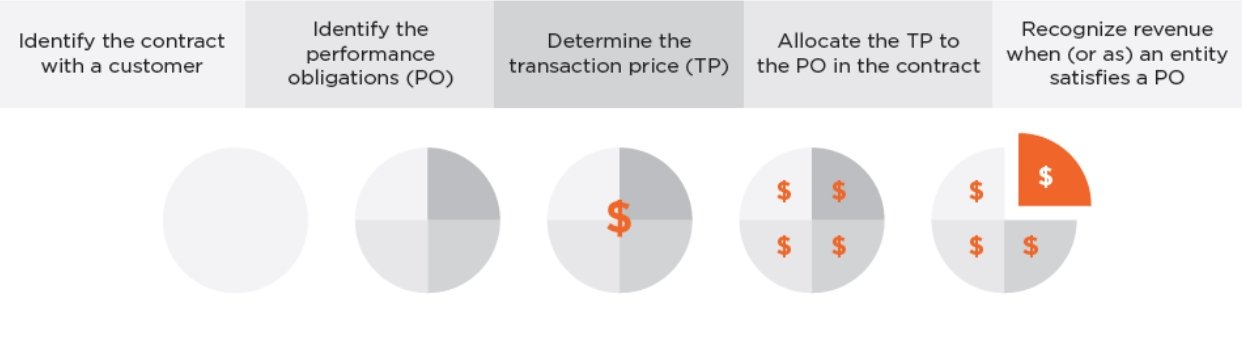

The 5-step model of ASC 606

Case Study

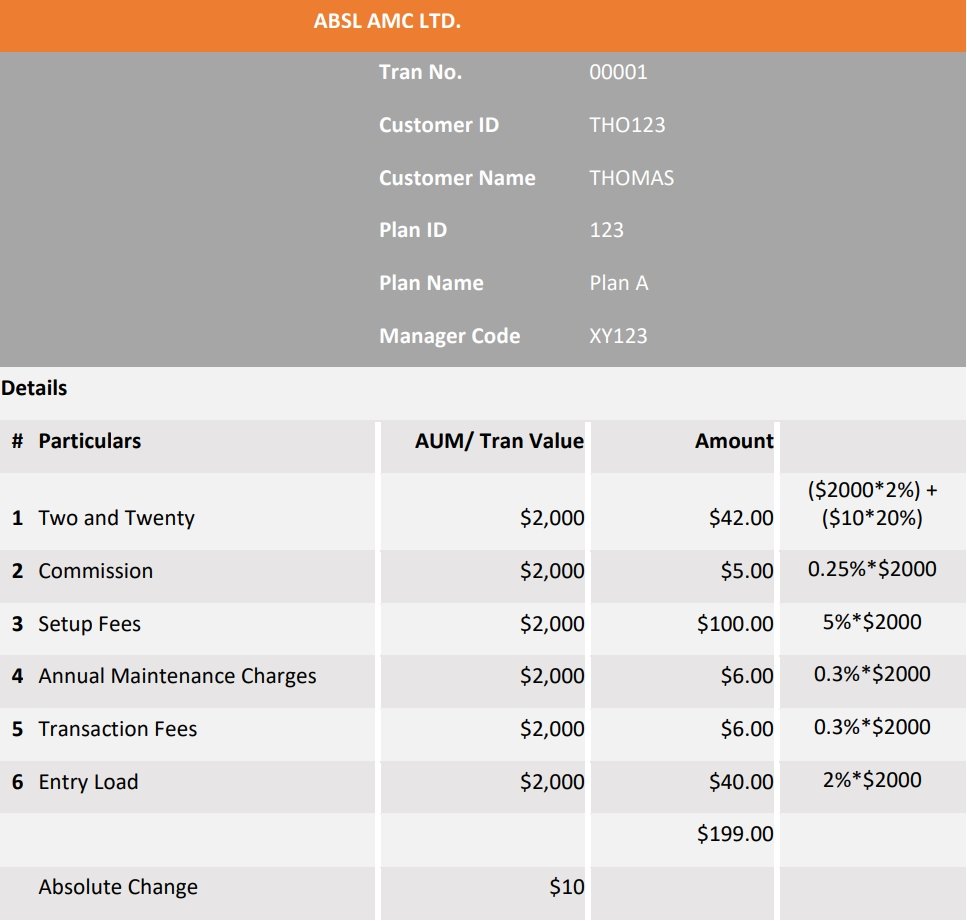

Assume, Mr. Thomas has entered into a contract with ABSL AMC Ltd. He has invested $2000. The ABSL AMC has received the amount and invested the same in diversified funds for income generation. The contract lasts for a period of a year with bills being raised at the end of each quarter. Income is calculated either as a fixed amount or a percentage of AUM.

1. IDENTIFY CONTRACTS WITH CUSTOMER

The contracts are identified per Customer ID and then dissevered as per plans opted. As per the case study, the Customer ID is THO123 and the Plan ID is 123. Thus, all the contracts with the respective Customer ID and Plan ID will be grouped as a contract.

2. IDENTIFICATIONS OF PERFORMANCE OBLIGATIONS

3. DETERMINE THE TRANSACTION PRICE

As per ASC 606-10-55-221, the bundle of ‘Two and Twenty’ is dependent on the net AUM which is not known until the end of the reporting quarter. This makes the revenue variable in nature giving rise to the concept of Variable consideration. The estimates of this is taken on the day of entering into the contract. At quarter end the average AUM is determined which restates the revenue and catch up for the unrecognized part is triggered. This can be done on shorter intervals like monthly basis too.

Note: Here Two and Twenty is determined at 2% of the net AUM plus 20% of the absolute change in the value of net AUM on two given dates. Here AUM is $2000 and absolute change is $10. Absolute change means the difference between the AUM of previous day and the present day. On day 1 we take a minimum of $10.

4. ALLOCATION OF TRANSACTION PRICE

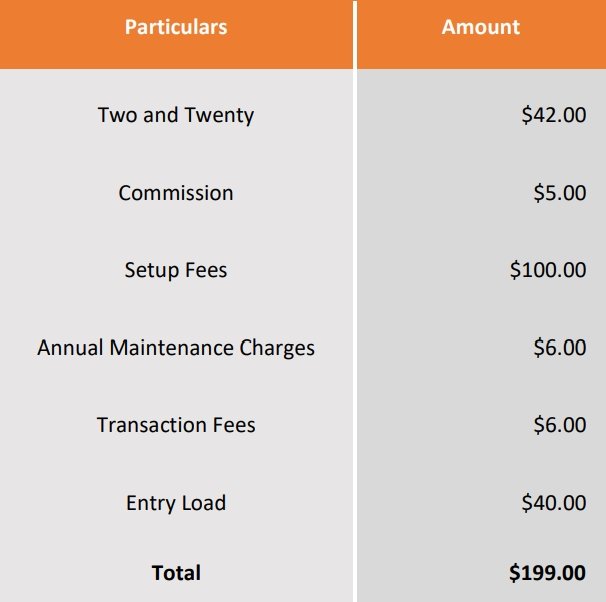

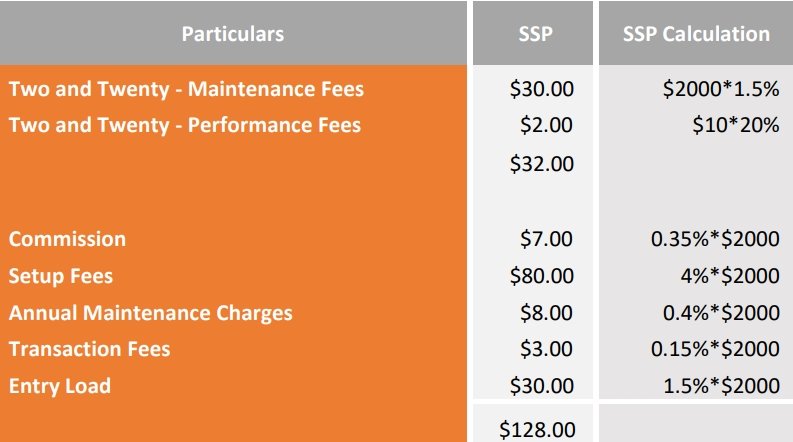

The Fees charged by the AMC is based on their business strategies. The company is free to opt any rate. However, the allocation happens at the standalone sell price determined by the going rates in the market. The same are reflected as follows:

SSP calculation

5. REVENUE RECOGNITION

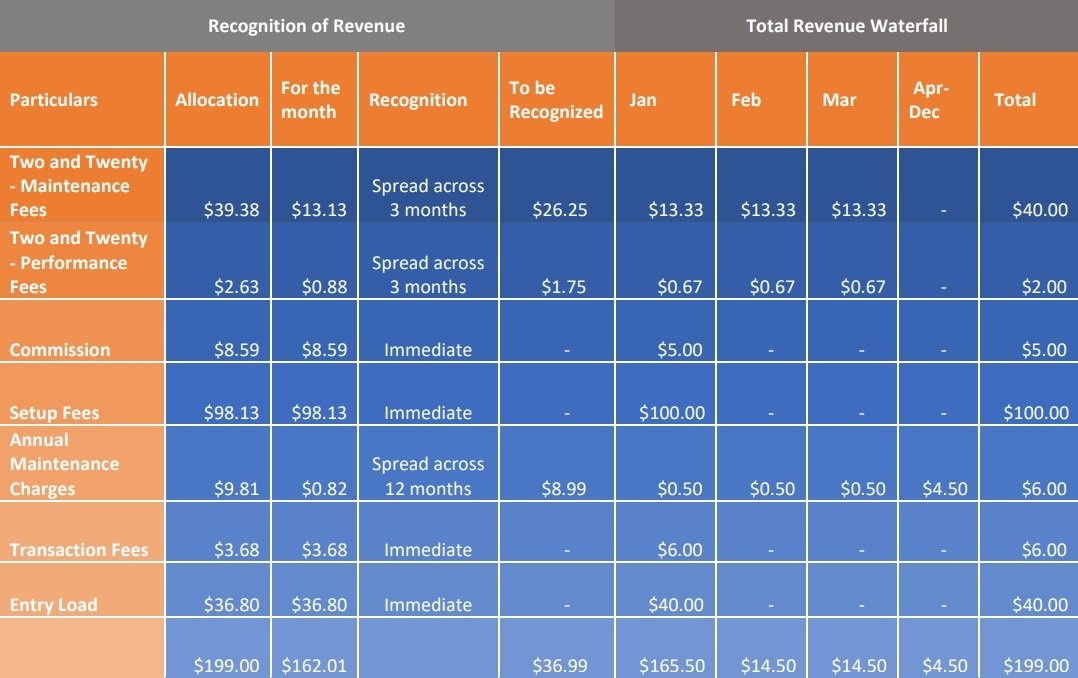

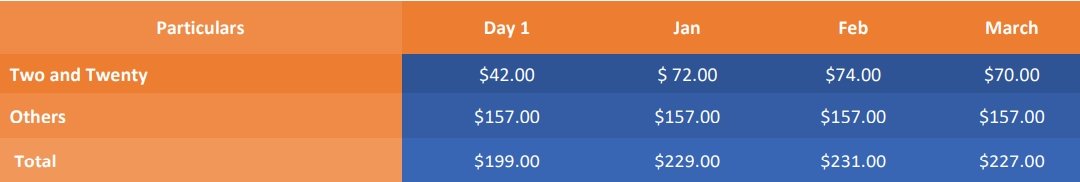

On Day 1

Revenue Schedule will be as follows:

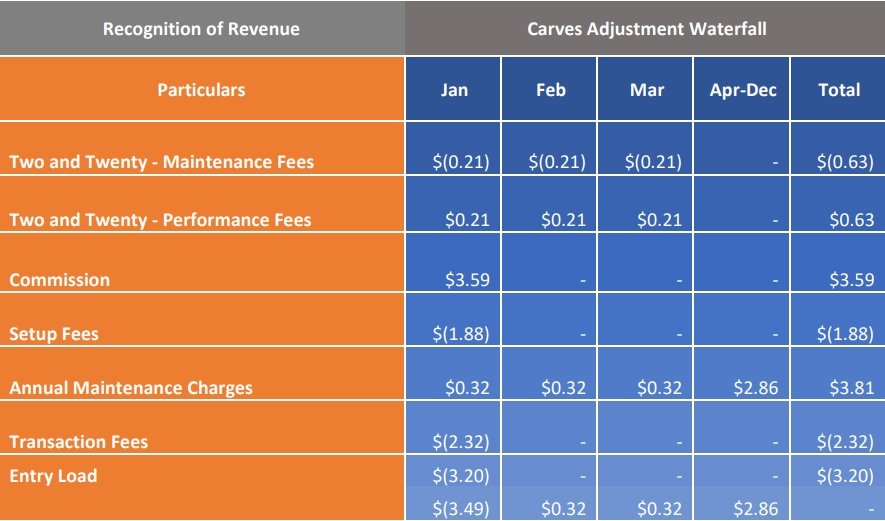

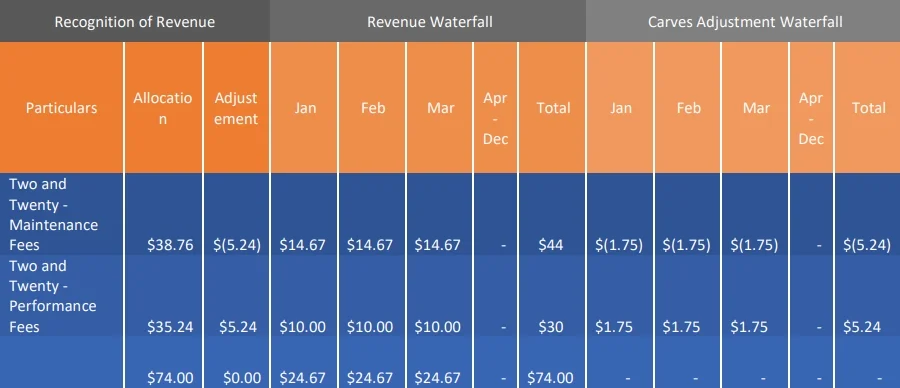

After monthly update for Two and Twenty – Month 1 (Reinstatement of revenue for Variable Consideration)

Say, the Net AUM at month end is $2100 and absolute change is $150.

Allocation of transaction price is re-determined as follows: (This waterfall is only for variable consideration)

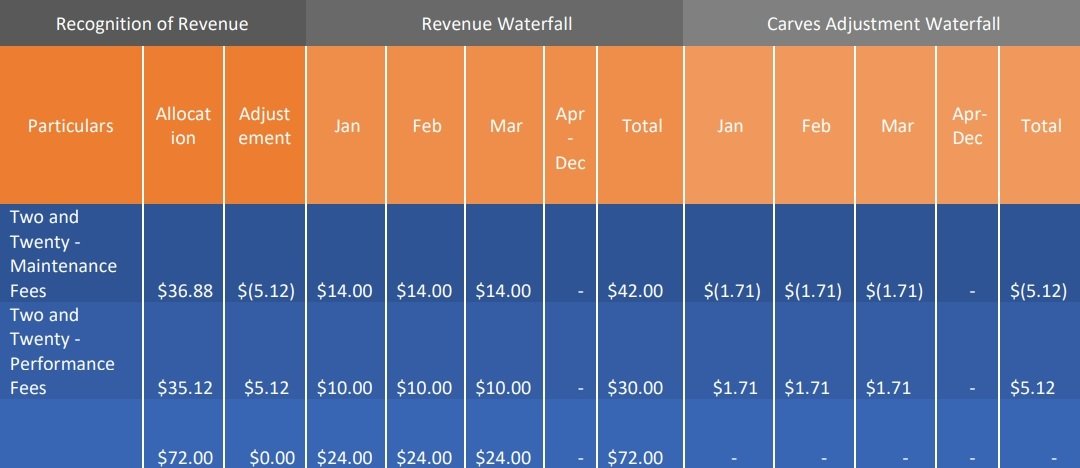

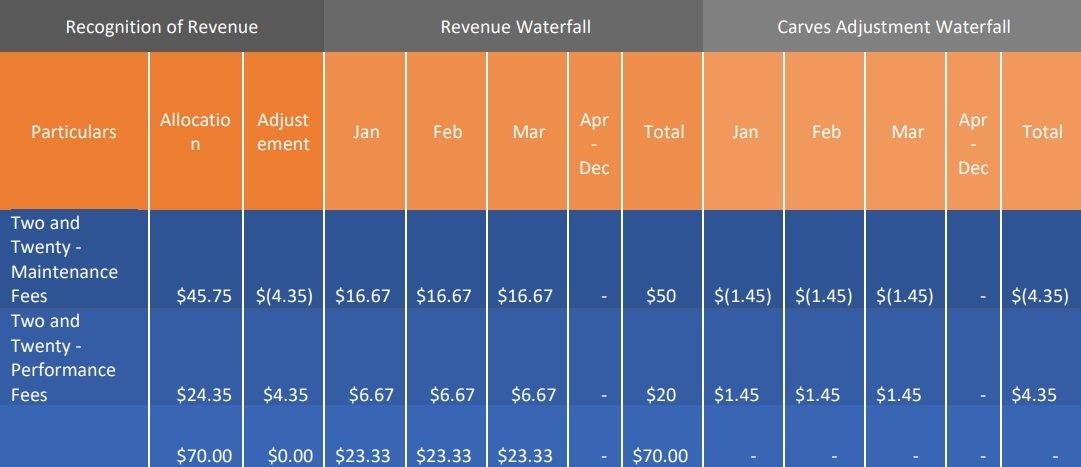

After monthly update for Two and Twenty – Month 2 (Reinstatement of revenue for Variable Consideration)

Say, the Net AUM at month end is $2200 and absolute change is $150.

Allocation of transaction price is re-determined as follows: (This waterfall is only for variable consideration)

After Quarter update for Two and Twenty – Quarter Update (Reinstatement of revenue for Variable Consideration)

Say, the Net AUM at month end is $2500 and absolute change is $100.

Allocation of transaction price is re-determined as follows:

Reinstatement of revenue as of particular date – Summary

Journal Entries

Disclosure Requirements

Notes:

a. Valuation hierarchy:

A three-level valuation hierarchy has been established under U.S. GAAP for disclosure of fair value measurements. The valuation hierarchy is based on the transparency of inputs to the valuation of an asset or liability as of the measurement date. The three levels are defined as follows.

- Level 1 – inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

- Level 2 – inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

- Level 3 – one or more inputs to the valuation methodology are unobservable and significant to the fair value measurement. A financial instrument’s categorization within the valuation hierarchy is based on the lowest level of input that is significant to the fair value measurement.

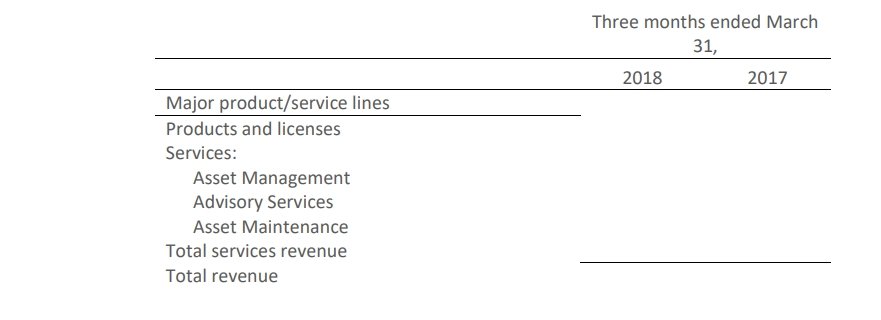

b. Disaggregation of Revenue:

The Company’s revenue was comprised of the following major product and service lines (in thousands):

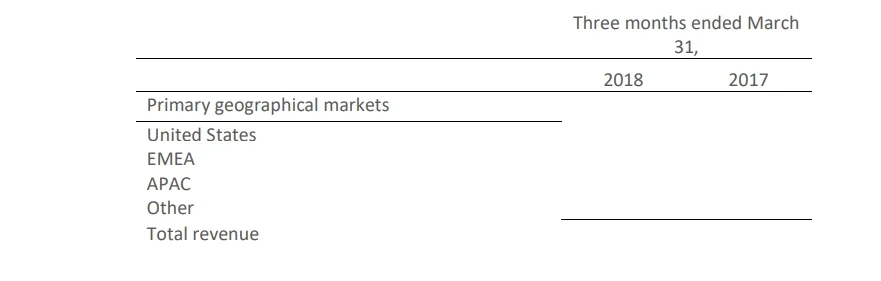

The Company’s revenue by geographic region, based on the customer’s location, is summarized as follows (in thousands):

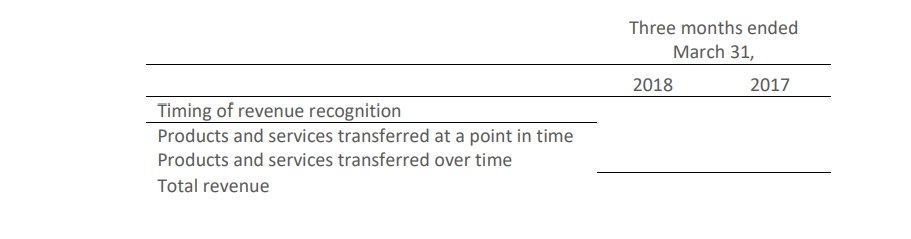

The following table presents the Company’s revenue by timing of revenue recognition (in thousands):

c. Contract Balances:

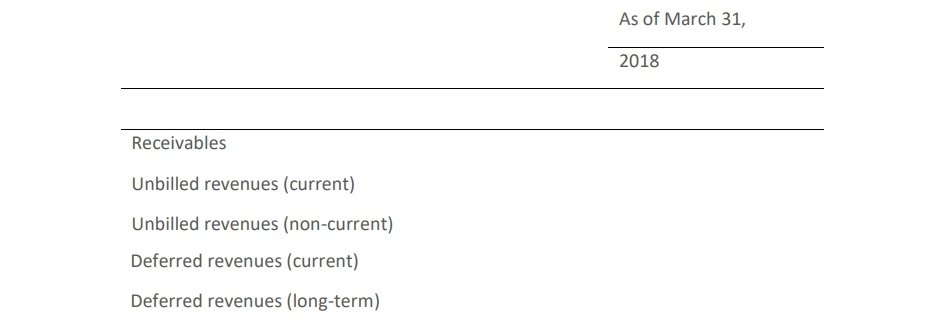

The following table provides information about receivables, unbilled revenues, and deferred revenues from contracts with customers (in millions). Unbilled revenues are presented as part of prepaid expenses and other current assets and other assets in the Company’s consolidated balance sheets:

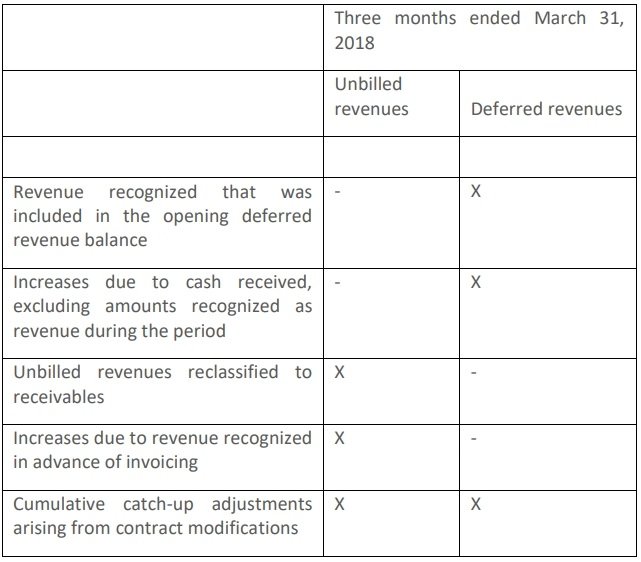

Significant changes in the unbilled revenues and the deferred revenues balances during the period are as follows:

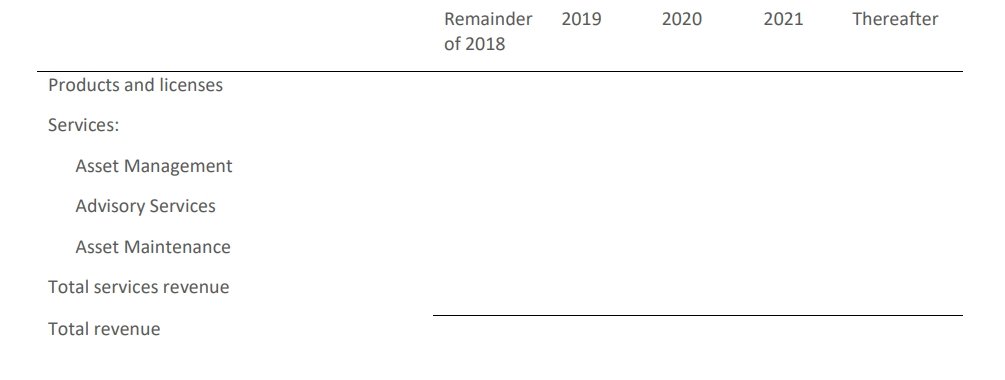

d. Transaction Price Allocated to the Remaining Performance Obligations:

The following table includes estimated revenue expected to be recognized in the future related to performance obligations that are unsatisfied (or partially unsatisfied) as of March 31, 2018 (in millions).

MAJOR ISSUES IN ADOPTING ASC 606

Issues:

- Understanding bundle information.

- Understanding the revenue recognition pattern of each class of service.

- Differentiating the treatment of variable consideration with contract modification.

- Determination of allocation in SSP ratio.

- Deciding the reinstatement intervals.

- Deciding on disclosures required for compliance.

Did you find this case study on ASC 606 helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.