02 Apr ASC 606 – Communication Software Industry

Table of Contents

-

-

-

- Background Information.

- Transition Approach.

- Policy Details.

- Step 1 – Identify the contract with a customer.

- Step 2 – Identify the performance obligations in the contract.

- Step 3 – Determine the transaction price.

- Step 4 – Allocate the transaction price.

- Step 5 – Recognize revenue as performance obligations are satisfied.

- Presentation of statement of financial position.

- Case Study.

-

-

Revenue is an important point of concern to the users of Financial Statements in assessing an entity’s Financial Performance and Position.

Accounting Standard Codification (ASC) 606 – Revenue from Contract with Customers is an Industry-wide revenue recognition guidance which has been formulated by the Financial Accounting Standard Board (FASB). This was a joint task by Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop common revenue standard for U.S. GAAP and IFRS.

ASC 606 is applicable across all the industries and aid in recognizing revenue from all the types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

We will be discussing revenue recognition guidelines for the Communication Software industry.

BACKGROUND INFORMATION

Company Background

ABC Incorporated is a Software company dealing in communication software like customers’ voice, video, fax, instant messaging and presence management provided into a single, easy-to-use system. For small and large businesses, it provides unify and simplify complex communications activities. For employees, deliver a culture of innovation, diversity, and individuality is available. Broad Client base includes Call Centers, Education, Employment, Financial Services, Government, Health Care, Hospitality, Legal, Manufacturing, Quick Service Restaurants, Retail. The company has a presence in few parts of the USA and UK. The offerings are sold directly to the corporates or through selling Partners.

Product Offerings

The major products Company offers:

- Hardware: Crystal clear Business IP Phones: The company has partnered with telecom device manufacturing companies and provides the device to the corporates as per the needs. These are provided to customers as a standalone device or bundled with communication

- Business VOIP: Unparalleled VoIP communications services to businesses, It can be tailored to meet the needs of any organization, from small to big enterprise businesses with a single location or several locations

- ABCChat: Multipurpose Chat Applications available with access through any device. The application allows chats between individuals or multiple groups, allows sharing of media over chat as well.

- ABC Voice Optimized WSD-WAN: Company has designed and built system and services to work together, of unmatched quality and reliability. Most hosted solutions have on-premise hardware. It has three variants for various segments of customers to suit the size of the business viz. Voice Optimized WSD-WAN A, Voice Optimized WSD-WAN B, Voice Optimized WSD-WAN C

- ABC Fax Personal il (faxes on a mobile device): reliable, cloud-based faxing for Incoming and outgoing faxes from Mobile device, the product is sold through partners to professionals

- Full Spectrum Communications (solution and support): Sold as a complete package of Hybrid, ABC Cloud, ABC Center, ABC PaaS, integrations platform: A Complete suite of advanced UC features including voice, chat, mobile, fax, and more

TRANSITION APPROACH

ASC 606 was effective for the Company beginning January 1, 2018, with early adoption permitted. The guidance allows for two transition methods.

a. Full retrospective adoption:

b. Modified retrospective application:

The Company elected to apply the modified retrospective method with the following practical expedient as provided by the new standard and as applicable:

a. For contracts that were modified before the beginning of the earliest reporting period presented, the Company will not restate the contract for those contract modifications. Instead, the Company will reflect the aggregate effect of all modifications that occur before the beginning of the earliest period presented.

POLICY DETAILS

General Accounting Treatment for Resellers

A “reseller” is defined as an entity licensed by the Company to market the Company’s software to users or other resellers. Licensing agreements with resellers typically include arrangements to sublicense, reproduce or distribute software. Resellers may be distributors of software, hardware or turnkey systems, or they may be other entities that include software with the products or services they sell.

Other entities that commonly act as intermediary channels (and should, therefore, be considered resellers) include:

a. Distributors;

b. Value-added resellers (VARs);

c. Original equipment manufacturers (OEMs);

d. System integrators; and

e. Indirect partners.

The Company generally contracts with the resellers and not directly with the end users, and the reseller is considered the customer of the Company. The transaction price is determined based on the contracted relationship with the reseller using the guidance discussed below.

Revenue Recognition Framework

The Company recognizes revenue to depict the transfer of promised goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods and services.

Depending on the circumstances, the guidance may be applied on a contract-by-contract basis, or the practical expedient described in ASC 606-10-10-4 of using the portfolio approach may be followed. The portfolio approach allows an entity to apply the guidance to a portfolio of contracts with similar characteristics so long as the result would not differ materially from the result of applying the guidance to individual contracts. The Company will decide whether to apply the portfolio approach on a case-by-case basis as appropriate.

The Company’s approach to applying each of these steps is discussed in detail throughout the remainder of this section.

IDENTIFY THE CONTRACT(S) WITH A CUSTOMER

Step 1 of the revenue recognition model requires the Company to identify the contract(s) with a customer. This section discusses the steps to determine whether a contract exists and specific considerations that may impact that determination. Each contract will need to go through this evaluation.

Per ASC 606-10-25-1, the five criteria for identifying a contract are as follows:

a. The parties have approved the contract and are committed to perform.

- Sales directly to end customers

- A signed purchase agreement. Or

- A standard purchase order of the form normally issued by the customer, supporting the customer’s commitment to receive and pay for products and/or services specified in the quotation and/or contract, which is approved by the Company’s legal and finance department.

- Sales to distributors and resellers (channel partners)

- A signed contract accepted by the Company (which is approved by both Legal and Finance) and the channel partner.

- A purchase order from the channel partner.

- End User License Agreement (EULA) – End users are required to agree to EULA.

- An end customer’s name must be identified on the channel partner’s purchase order or separately provided.

- The Company does not consider the contract approved until both parties have executed the documents. Such execution is deemed to have occurred as of the last signature date.

- The approved contracts described above must be executed before the end of the accounting period in which revenue is to be recognized and be provided to the order entry location by midnight Pacific time. Faxed documents will not be considered received unless they are legible and complete.

- Contracts, in general, are reviewed and executed by the Legal Team. All non-standard contracts should be reviewed by the Revenue Team and approved by the [VP of Finance] prior to being executed.

b. Each party’s rights are identifiable: Rights should all be documented in writing within the terms and conditions of the approved contracts described above.

c. Payment terms are identifiable: Which are discussed in detail in the previous criteria “the parties have approved the contract and are committed to perform.”

d. The contract has commercial substance: When the risk, timing, or amount of the Company’s future cash flow is expected to change as a result of the contract. Generally, an executed contract is evidence of commercial substance.

e. Collection is probable based on the customer’s ability and intent to pay. The amount deemed collectible may be less than the contractual price: The collectability assessment only applies to consideration associated with goods or services to be transferred during the non-cancellable term of the contract. The Company’s contracts with its customers are usually non-cancellable. Generally, the Company will not enter into an arrangement for which the collectability criterion is not met.

Customers’ and Channel Partner’s creditworthiness will be assessed at the outset of an arrangement through a background check.

Examples of other situations that may call collectability into question include the following:

a. The customer not being required to make payment within a reasonable period after the due date (i.e. 120 days or less)

Generally, the Company believes that its contracts with customers will meet Step 1 of the revenue recognition model.

Combination of contracts

The Company combines two or more contracts entered into at or near the same time, same location and with the same customer and end user, and accounts for the combined contracts as a single arrangement if one or more of the following criteria outlined in ASC 606-10-25-9 are met:

a. The contracts are negotiated as a package with a single commercial objective.

b. The amount of consideration to be paid in one contract depends on the price or performance of the other contract.

c. The goods and services promised in the contracts (or some goods or services promised in each of the contracts) are a single performance obligation.

In the event that the Company enters into multiple contracts with a customer, the Company will evaluate the considerations above to determine whether the contracts should be accounted for together or as separate contracts.

The Company may enter into a transaction with a customer whereby the appliance, maintenance and support, and professional services are on different purchase orders. Such transactions will be combined as a single arrangement under ASC 606 if the contracts meet the criteria above.

Customers may subsequently add additional products or services that were not included in the original contract. In general, such transactions are not deemed to be separate contracts that should be combined for accounting purposes but rather the Company will consider whether such contracts are a modification to the original contract (see the Contract Modifications section below for further discussion).

Contract modifications

A contract modification exists when there is a change in the scope and/or the price of a contract. Upon approval of a change in an existing contract, it is accounted for as a separate contract, a termination of the existing contract and creation of a new contract, or as part of the existing contract.

A contract modification is accounted for as a separate contract (prospective treatment) when both of the following criteria are met:

- The additional goods and services are distinct from the goods and services in the original arrangement; and,

- The amount of consideration expected for the added goods and services reflects the standalone selling price of those goods and services.

A contract modification that does not meet the above criteria is considered a change to the original contract and is accounted for as either the termination of the original contract and the creation of a new contract, or as a continuation of the original contract, depending on whether the remaining goods or services to be provided after the contract modification are distinct from the goods or services transferred to the customer on or before the date of the modification.

A modification is accounted for on a prospective basis, or if said differently, a termination of the existing contract and creation of a new contract, if the goods and services subject to the modification are distinct from the other goods and services provided within the original contract but the consideration does not reflect the standalone selling price of those goods or services.

A modification is accounted for as a continuation of the original contract if the goods or services added or removed are not distinct from the goods and services already provided; such modifications are accounted for on a cumulative catch-up basis. This scenario is considered to be rare.

Once a contract modification has been determined to be either a separate contract, a termination of the existing contract and creation of a new contract, or as part of an existing contract, the business will recognize revenue for the contract consistent with the above policies.

Changes to existing SOWs will be evaluated as contract modifications, including changes to the nature of the professional service and the purchase of additional hours of professional services.

IDENTIFY THE PERFORMANCE OBLIGATIONS IN THE CONTRACT

Step 2 The Company’s revenue transactions may include a combination of the following:

- Full Spectrum Communications (solution and support)- Hybrid, Cloud, Center, PaaS, integrations platform, Complete suite of advanced UC features including voice, chat, mobile, fax, and more

- Business VOIP devise combined with WAN and Business VOIP

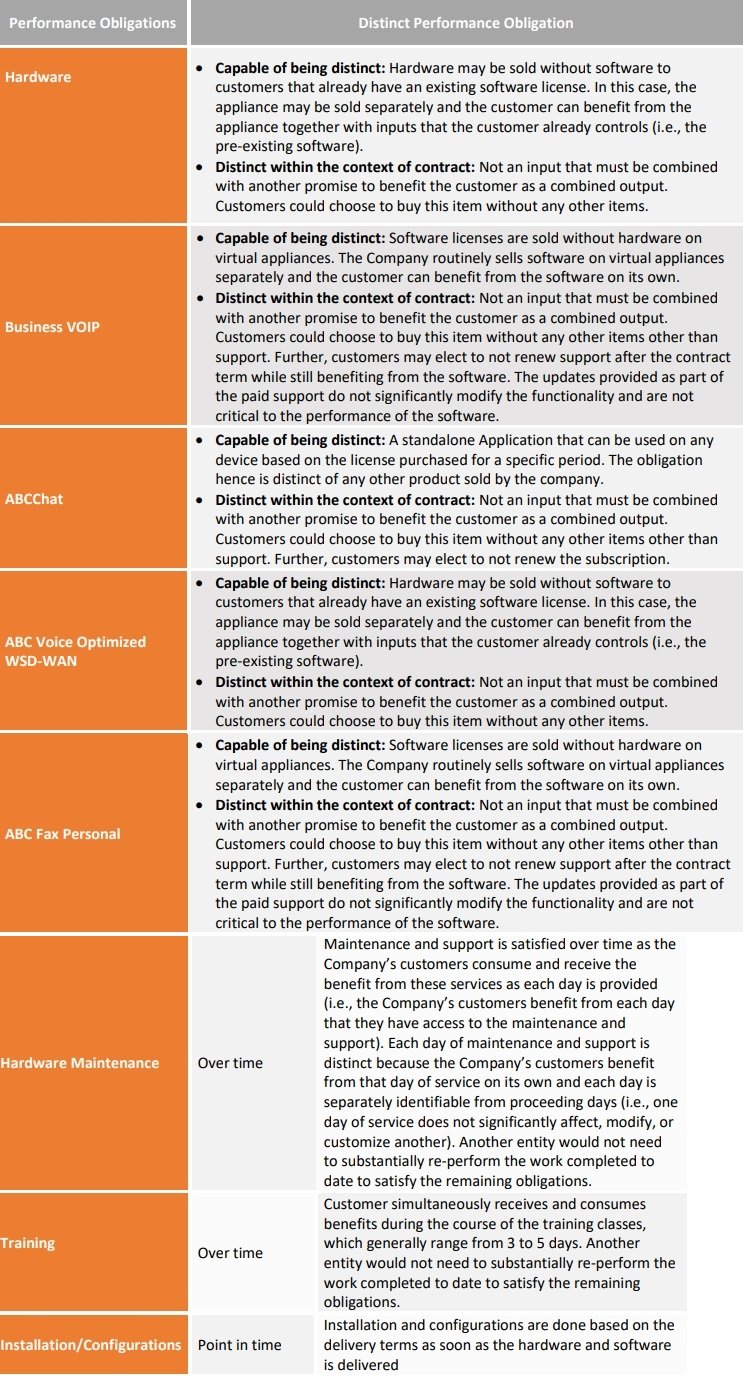

The table below outlines the Company’s distinct performance obligations and its assessment of why each performance obligation is capable of being distinct and is distinct within the context of the contract.

The policies below illustrate additional considerations of the Company when identifying performance obligations in the contract.

Determination of whether the item is immaterial in the context of the contract and therefore not considered for revenue recognition purposes

Standard user charges requirements may be immaterial in the context of a contract based on the following considerations:

a. The Company does not have a specified invoice amount pertaining to the promise.

b. The effort to provide the service is generally minimal. The required security is typically inherent to or achieved with minimal modification to, the existing build specifications of our products.

Standard warranties

The Company generally provides a 60-day standard warranty on hardware and software but may provide a standard warranty on hardware and software beyond such time period depending on contract negotiations. The warranty specifically related to the conformity of the products to the agreed-upon specifications. Customers have no option to purchase the warranty separately and there are no other services provided beyond the assurance that the product conforms to agreed-upon specifications. As such, the standard warranty is not considered a performance obligation and is accounted for as cost accrual under ASC 460, Guarantees.

Implied promises

The Company rarely provides customers a standard product roadmap, which describes in-development future product enhancements, features, and functionality but does not provide a specific release date. In cases where a roadmap is provided, the Company concluded that the roadmap has not created an upgrade right for a specified upgrade or enhancement.

Shipping and handling

The Company’s standard shipping term is FOB Origin or ExWorks. As such, the Company elects to account for shipping and handling as fulfillment activities rather than a separate performance obligation as allowed under the new standard. In the event that the Company’s shipping term is FOB destination for a customer, the Company elects to account for shipping and handling as fulfillment activities and will accrue the cost of these activities, if material, and recognize all revenue at the point in time which control of the goods is transferred to the customer therefore achieving a ‘matching’ of the revenue and related fulfillment costs.

Series of distinct goods or services

The Company’s contracts contain promises to deliver a distinct series of services that are substantially the same. If the distinct series of services meet both of the criteria below, they are considered to be a single performance obligation:

a. Each distinct service in the series that the Company have promised to transfer to the Company’s customer would meet the criteria of a performance obligation satisfied over time.

b. The same method would be used to measure the Company’s progress toward complete satisfaction of the performance obligation to transfer each distinct service in the series to the Company’s customer.

The Company concluded that the following are each a series of distinct services that are considered to be single performance obligations based on the evaluation below:

a. Hardware

b. Software-as-a-service subscription

c. platform-as-a-service subscription

d. Add-on perpetual-license software with updates that are critical to the continued utility of the software

e. Maintenance and support

f. Usage-based license revenue share

If more than one obligation noted above is included in an arrangement with the customer, then the Company concludes it will have multiple series of distinct performance obligations.

Stand-ready obligations

A stand-ready obligation represents a service of ‘standing ready’ to provide goods or services or of making goods or services available for a customer to use as and when the customer decides. The appropriate measure of progress to apply to a stand-ready obligation that is satisfied over time might vary from one type of stand-ready obligation to another. Although the Company is obligated to provide these services throughout the term of the contract, the pattern of benefit to the customer may or may not be consistent throughout the term of the contract.

The Company concluded that the following performance obligations are stand-ready obligations based on the evaluation below:

a. Software-as-a-service subscription

b. Add-on perpetual-license software with updates that are critical to the continued utility of the software

c. Maintenance and support

d. Usage-based license revenue share

DETERMINE THE TRANSACTION PRICE

Step 3 The Company considers the terms of the contract and its customary business practices to determine the transaction price. The transaction price is the amount of consideration to which the Company expects to be entitled in exchange for transferring goods or services to a customer, excluding amounts collected on behalf of third parties such as sales taxes. The following items are taken into consideration when determining transaction price and are discussed in further detail throughout this section.

+ Fixed Consideration (includes consideration related to performance obligations and activation fees)

+ Estimated Variable Consideration

– Contingent Amounts (unless no revenue reversal is probable)

– Consideration Payable to the Customer

+ Noncash Consideration

± Significant Financing Component

– Amounts Collected on Behalf of Third Parties

= Transaction Price

When determining the transaction price, the Company assumes that the goods or services will be transferred to the customer based on the terms of the existing non-cancellable contract and does not take into consideration the possibility of the contract being canceled, renewed, or modified. The Company also considers the effects of the following:

Variable consideration (and the constraint)

Forfeitures, refunds, rights of return, price concessions, payments contingent on future events, and similar items give rise to variable consideration which, in turn, affects the transaction price for an arrangement. The Company will determine how much variable consideration can be included in the overall transaction price at contract inception. This determination is comprised of the following two steps:

a. Estimate the amount of variable consideration;

b. Determine whether any of the estimated amounts are subject to a probable revenue reversal (this concept is referred to as “the constraint” in the literature).

Below are potential issues that may be faced by the Company that may require an estimate of variable consideration and the constraint.

Variable consideration may include amounts that could be refunded, returned, or uncollected from customers or resellers, rebates in the form of cash or credits provided to resellers for meeting certain sales targets, booking targets, etc., credits to end-users, price concessions, incentives, performance bonuses, penalties, usage-based fee, price protection, time and materials contracts, usage overages on subscription contracts, or other similar items.

Sales returns

Generally, the Company does not grant rights to return. The Company does not sell customized products and knows at the time of shipment that the products meet the general specifications required by the contract. There is a long history of meeting the requirements and they have not experienced rejections of product or services by customers. As the Company can objectively determine that control of the good or service has been transferred to the customer and no deferral of revenue is necessary. Because rights of return exist and are used infrequently, the Company chooses to use the practical expedient allowed in ASC 606-10-10-4 of applying the portfolio approach to accounting for sales returns rather than analyzing the risk on a contract-by-contract basis.

Therefore, the Company estimates a general sales return reserve. The need for a sales return reserve is assessed on an annual basis to determine if there is a need to establish or update an estimated sales return reserve.

Concessions

The Company may provide infrequent concessions to certain customers in order to preserve the Company’s relationship or to extend the term of contracts. These concessions typically result in free or reduced price product exchange, free or reduced price maintenance and support services, an extension of payment term, or a credit to be applied against future purchases.

The Company will assess whether to include estimated concessions in the transaction price on a contract-by-contract basis when and if concessions are expected to be provided. As of the date of this policy, the Company does not have a history of granting concessions and, as such, estimated concessions will not be included in the transaction price.

Payment terms

Generally, the Company’s normal payment terms range from net 30 days to net 120 days from the date of invoice.

Although infrequent, arrangements that provide payments terms that extend beyond 120 days are deemed to include extended payment terms. Extended payment terms may increase the risk of a price concession; accordingly, arrangement consideration subject to extended payment terms is considered variable and thus subject to estimation and the application of the constraint. Specifically, the Company will determine the amount of the transaction price that is not subject to significant revenue reversal due to the extended payment terms based on the history of concessions on transactions with comparable payment terms.

The Company has elected to apply the practical expedient in ASC 606-10-10-4 of applying the portfolio approach to accounting for extended payment terms rather than analyzing the risk on a contract-by-contract basis.

The Company may also need to determine whether extended payment terms create a significant financing component on a case to case basis.

The existence of a significant financing component in the contract

In circumstances where the timing of payments provides the customer or the Company with a significant benefit of financing the transfer of goods or services to the customer, the Company adjusts the promised amount of consideration for the effects of the time value of money when determining the transaction price. The objective when adjusting the promised amount of consideration is to recognize revenue at an amount that reflects what the cash selling price of the promised good or service would have been if the customer had paid cash at the same time as control of that good or service transferred to the customer. The Company does not make such an adjustment in the following circumstances:

a. The customer paid for the goods or services in advance, and the timing of the transfer of those goods or services is at the discretion of the customer.

b. A substantial amount of the promised consideration is variable, and the amount or timing of that consideration is based on the occurrence or nonoccurrence of future events not controlled by the customer or the Company.

c. Financing is not the primary reason for the difference between the promised consideration and cash price.

d. The period between the transfer of goods or services and customer payment is one year or less (even if the overall contract has a duration greater than one year).

The Company’s contracts do not include a significant financing component for one of the reasons outlined below:

a. Prepayment does not result in a significant change in pricing compared to payment over time.

b. The Company and the customer have business reasons other than financing for entering into such contracts, which includes reducing the administrative burden of more frequent invoicing and payments.

Should one of the considerations above not apply to a contract, the Company will further evaluate whether a significant financing component exists, and, if so, adjust the transaction price for the time value of money.

Noncash consideration

Any noncash consideration received from a customer is measured at fair value and included in the transaction price. If a reasonable estimate of the fair value of the noncash item cannot be made, the Company will use the stand-alone selling price of the good or service that is provided in exchange for the noncash consideration.

Consideration payable to a customer

The Company evaluates consideration payable to a customer to determine whether the amount represents a reduction of the transaction price, payment for distinct goods or service, or a combination of the two. Consideration payable that does not exceed the fair value of distinct goods or services shall be accounted for as a purchase from suppliers. Consideration payable that exceeds the fair value of distinct goods or services shall be accounted for as a reduction to the transaction price with the remainder accounted for as a purchase from suppliers. If the Company cannot reasonably estimate the fair value of goods or services received from the customer, then it will account for all consideration payable to the customer as a reduction of the transaction price at the later of when the Company recognizes revenue for the transfer of the related goods or services and the Company pays or promises to pay the consideration.

Principal versus agent considerations

The Company currently has no products or services which involve third-parties other than resellers. A determination of whether the Company is obligated to provide a good or service (i.e., the Company is the principal) or to arrange for a third-party to provide the good or service (i.e., the Company is the agent) is necessary in determining the amount of revenue to recognize. There is no principal agent relationship between the resellers and the company.

Sales taxes

The Company excludes all taxes assessed by governmental authorities from the measurement of transaction price as allowed by ASC 606-10-32-2A as the taxes collected by the Company are levied against its customers. The Company is considered an agent for the governmental authority and therefore the taxes collected are not included in the transaction price.

ALLOCATE THE TRANSACTION PRICE TO THE PERFORMANCE OBLIGATIONS IN THE CONTRACT

Step 4 of the revenue recognition model requires the Company to allocate the transaction price to the performance obligations in the contract. This section discusses how standalone selling prices are determined and how transaction price will be allocated using the standalone selling prices or other appropriate methods. Each contract will need to go through this evaluation.

Allocating transaction price to performance obligations

The Company allocates a portion of the total transaction price to each performance obligation based on the relative stand-alone selling price (SSP) of each performance obligation. The amount allocated, therefore, represents the amount of consideration to which the Company expects to be entitled in exchange for providing the goods or services included in the performance obligation. SSP is determined at the inception of the contract for each performance obligation.

Once the Company has determined the transaction price, a portion of the total transaction price is allocated to each performance obligation in a manner depicting the amount of consideration to which the Company expects to be entitled in exchange for transferring the goods or services to the customer (the “allocation objective”). The first step is to determine the SSP of each performance obligation. Once the SSPs have been determined, the second step is to allocate the transaction price based on the performance obligations’ relative SSPs. However, in some cases, a discount or variable consideration may be allocated to one or more, but not all, performance obligations in the contract. See discussion of these cases in sections Allocating variable consideration, and Discount Allocation, below.

SSP is determined at the inception of the contract for each performance obligation. After contract inception, no reallocation of transaction price is made to reflect subsequent changes in SSPs.

Determining standalone selling prices

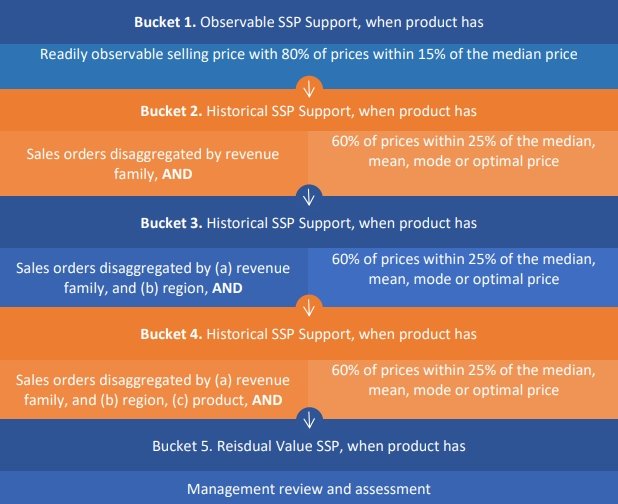

The following shows the Company’s decision-making process for selecting standalone selling price:

SSP is the price at which the Company would sell a promised good or service separately to a customer. The best evidence of SSP is an observable SSP, which is the “price of a good or service when the entity sells that good or service separately in similar circumstances to and to similar customers” per ASC 606-10-32-32.

The Company considers SSP to be a range of prices. The Company will apply judgment in determining what constitutes an appropriate SSP range. Any such range will be established based on an analysis that maximizes observable inputs and supports an assertion that any price within that range would be a valid pricing point if the performance obligation were sold on a stand-alone basis.

Determining observable SSP

The Company first concludes whether an observable SSP exists. An observable SSP is the price of a good or service when the entity sells that good or service separately in similar circumstances and to similar customers. The Company conducts a regular analysis to determine whether various services have an observable SSP. If an observable SSP exists, it is used for allocation purposes. If there is a relatively narrow range of observable prices, then a stated contract price within that range is an acceptable SSP.

The Company considers observable SSP to exist when (a) 80% of contract prices for a separately-sold service to be within 15% of an estimated SSP, and (b) there are a sufficient amount of observed contracts to reasonably estimate SSP.

Determining SSP based on historical prices

If the Company does not have an observable SSP then, the Company next assesses whether products have an estimated SSP by considering its historical pricing. Historical prices include both

a. observed in transactions within the last twelve months, and

b. standalone and non-standalone transactions.

The company evaluates its sales orders by disaggregating its product historical prices in the following order until it achieves a historical standalone selling price:

a. Revenue family,

b. Region, then

The Company considers historical SSP to exist when

a. 60% of contract prices for a separately-sold service to be within 25% of an estimated SSP, and

b. there are a sufficient number of observed contracts to reasonably estimate SSP.

Specifically, for the APJ region, the above steps do not always provide the appropriate coverage. When necessary, the following progression is used to disaggregate the product historical prices to achieve a historical standalone selling price.

a. Region,

b. Country group (high discount and low discount)

c. Country

Determining SSP for low-coverage products

If historical standalone selling price is not available after disaggregating the product revenue family, Management reviews the specific item and makes its best estimate of SSP. This analysis may consider the following:

a. Adjusted market assessment – Prices based on SSP of similar goods or services, or SSP observed in another market, and adjusted for known differences in functionality, markets, etc.

b. Expected cost plus a margin – Prices based on a forecast of the expected costs plus an appropriate margin for the good or service.

c. Combined method – Prices established for a bundled (combined) performance obligation based on combining SSP of individual goods or services included in the bundle, and adjusting for the effect of bundling, as appropriate. The Company does not believe it will utilize this method.

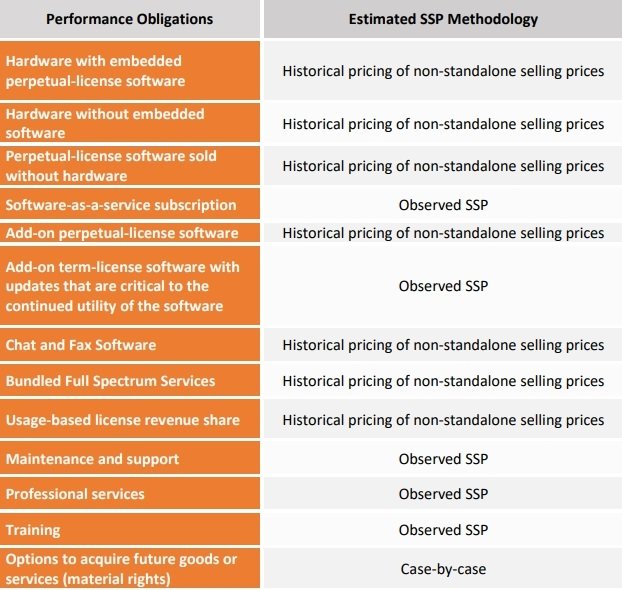

The following table outlines the Company’s distinct performance obligations and the method that is most frequently used to establish SSP:

Frequency of updating the SSP analysis

The Company estimates SSP on an annual basis, or as needed when standard discounts are updated or new products are introduced in the market. On a quarterly basis, the Company will revise its estimate of SSP if there is a material change in the SSP. For specifics of given period’s analysis please refer to said documentation.

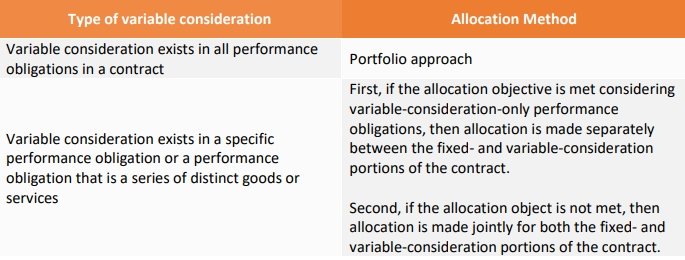

Allocating variable consideration

Variable consideration may be attributable to:

a. All of the performance obligations in a contract—including amounts that could be refunded, returned, or uncollected from customers or resellers, rebates in the form of cash or credits provided to resellers for meeting certain sales targets, booking targets, etc., credits to end-users, price concessions, incentives, performance bonuses, penalties, price protection, or other similar items;

b. One or more, but not all, of the performance obligations in a contract—including time and materials contracts, and usage-based fees; and

c. One or more, but not all, of the distinct goods or services promised in a series of distinct goods or services that forms part of a single performance obligation—including usage overages on subscription contracts.

The Company will allocate variable amounts, along with subsequent changes to such amounts, entirely to one or more, but not all performance obligations when both of the following criteria are met:

a. The variable payment terms relate specifically to the entity’s efforts to satisfy the performance obligation; and

b. Allocating the variable amount of consideration entirely to the performance obligation is consistent with the allocation objective when considering all of the performance obligations and payment terms in the contract.

In general, the Company expects both of the criteria above to be met for performance obligations (or a series) with variable consideration. The Company will allocate variable consideration in the following manner:

Discount Allocation

A discount in a contract is allocated to all performance obligations unless the discount allocation exception applies. If the exception applies, the discount is allocated entirely to one or some of the performance obligations. As outlined in 606-10-32-37, the exception applies when:

a. Each distinct item in the contract is regularly sold on a standalone basis.

b. A bundle of some of those distinct items is also regularly sold on a standalone basis and at a discount to the standalone selling prices of the individual distinct items that comprise the bundle.

c. The discount attributable to the bundle described above is substantially the same as the discount in the contract.

d. An analysis of the distinct items in each bundle provides observable evidence of the performance obligation to which the discount belongs.

The Company does not typically have contracts for which a discount should be allocated to one or more, but not all, of the performance obligations as we do not typically have specific discounts related to bundled services. Generally, the same discount is applied to all performance obligations for a contract. As such, discounts offered will be allocated proportionately to all performance obligations in the contract.

RECOGNIZE REVENUE WHEN (OR AS) THE ENTITY SATISFIES A PERFORMANCE OBLIGATION

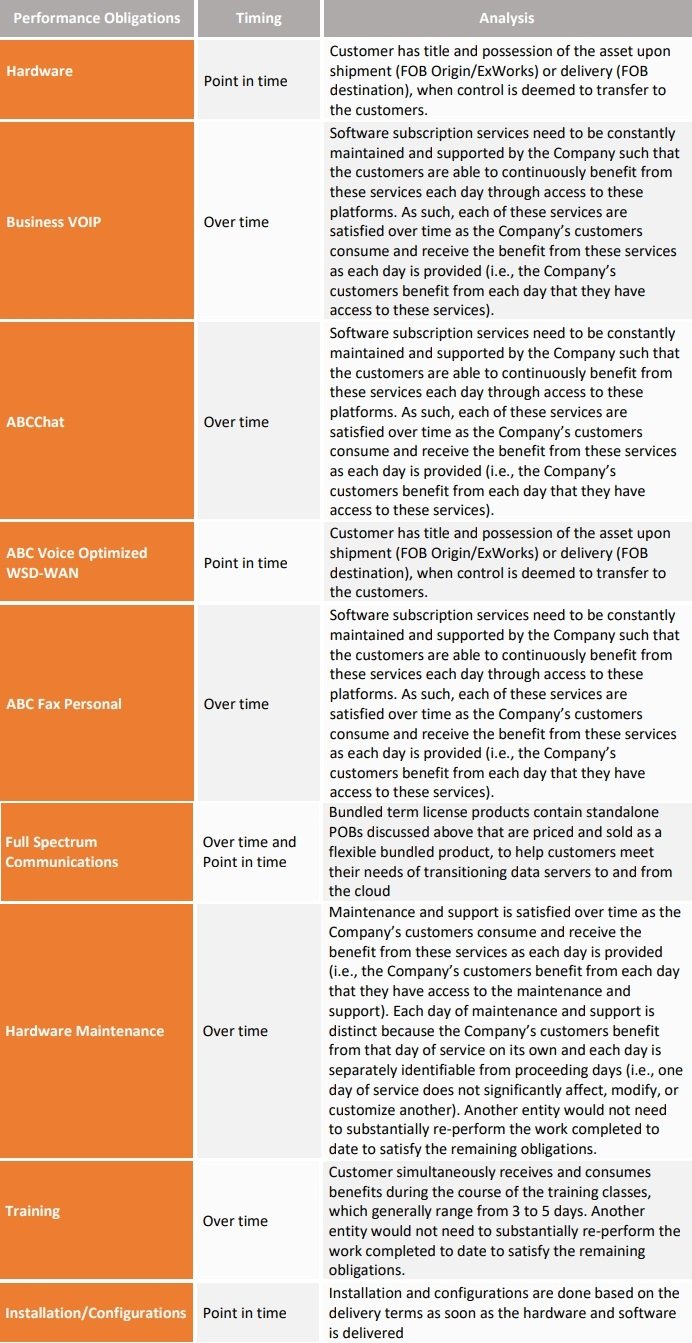

Step 5 in evaluating whether the revenue related to software licenses, including add-on software and stand-alone software (perpetual and time-based), should be recognized at a point in time or over time, the Company considered whether the nature of the promise in granting the software license to the customer is to provide either a right to access the software throughout the license period (or its remaining economic life, if shorter) or a right to use the software as it exists at the point in time at which the license is granted. A software license that provides a right to access is a performance obligation satisfied over time. A software license that provides a right to use is satisfied at a point in time.

The following table summarizes how the Company transfers control for each performance obligation based on the above guidance.

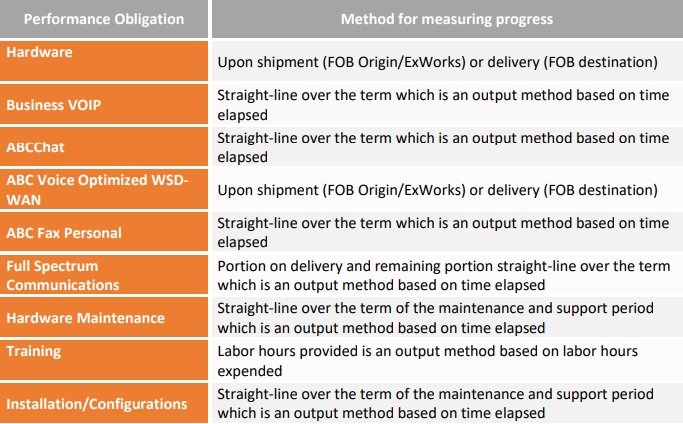

Once the determination of how control is transferred, the method for measuring progress of satisfying a performance obligation must be selected. For performance obligations satisfied over time, a company may select either an output method or input method as provided under ASC 606. The methods selected by the Company for measuring progress of each of its performance obligations is as follows:

PRESENTATION ON THE STATEMENT OF FINANCIAL POSITION

The Company will present a contract liability or a contract asset in its statement of financial position when either party to the contract has performed. The Company performs by transferring goods or services to its customers, and the customer performs by paying consideration to the Company. Unconditional rights to consideration will be separately presented as receivables. A right to consideration is unconditional if only the passage of time is required before payment becomes due.

Obligations to transfer goods or services to a customer for which the Company has received consideration, or for which an amount of consideration is due from the customer, will be presented as contract liabilities. It is noted that in extremely rare situations, customers contracts contain a right to right to terminate for convenience, where amounts paid by the customer are refundable. In these situations, the customer has paid for future goods or services, but because of the termination clause an agreement does not exist and thus the Company does not have an obligation to transfer goods or services except as the customer requests (i.e. doesn’t terminate). The amount of consideration received for which the Company is not currently obligated is not considered a contract liability, but rather will be classified as a customer deposit and included in Other Liabilities.

Rights to consideration in exchange for goods or services that the Company has transferred to a customer when that right is conditional on something other than the passage of time will be presented as a contract asset.

The Company will not net receivables with contract liabilities.

CASE STUDY

Based on the above considerations and in reference to various requirements of the guidance, a typical transaction can be molded as below:

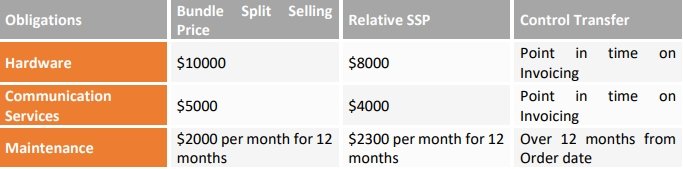

Contracted Selling Price with LMN Inc from USA for Communication Product MN is $ 39000 which is a bundle of Hardware, Communication Service and Maintenance (for invoicing, the bundle will be split in ratio of 10:5:24). Contract Start date 1 Jan 18 Contract end date 31 Dec 18, Product has been delivered in month of Jan 2018, the rights to invoicing is established from date of delivery, Invoice for the Communication Product MN is generated in month of Feb 2018.

Step 1 – Identify Contracts with Customer

As the contract with customers identified based on locations, LMN Inc. USA contracts will be considered as a one class of contract. It could be identified as Contract no. LMN_USA.

Step 2 – Identifications of Performance obligations (PO)

For Hardware: Point In time recognition on Invoicing

For Communication Services: Point In time recognition on Invoicing

For Maintenance: Over time recognition from Order date

Step 3 – Determine the transaction price

Transaction price as per contract is

For Hardware (H) $10000

For Communication Services (S) $5000

For Maintenance (M) $24000 ($2000*12)

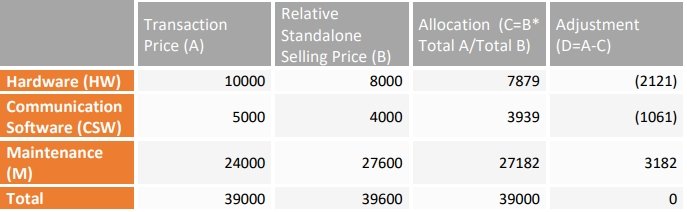

Step 4 – Allocation of Transaction Price

Based on Relative Standalone Selling price the allocation of Transaction price would be as below

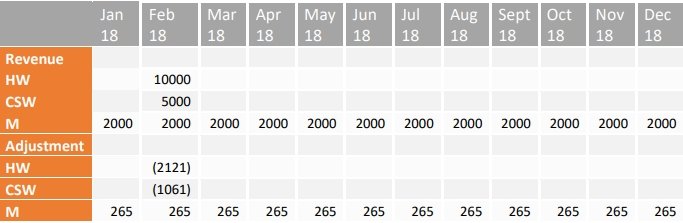

Step 5 – Recognition of Revenue

Recognition Schedule over 12 months

Accounting Entries

Disclosures

Excerpts of Notes to financial statement:

Item X. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Critical Accounting Policies

Revenue Recognition

Note (Y) Summary of Significant Accounting Policies

Revenue Recognition

Products and License Revenue

Services revenue

Deferred Costs

Note (Z) Changes in Accounting Policies including Impacts on Financial Statements

Note (M) Revenue

Disaggregation of Revenue

Contract Balances

Significant changes in the unbilled revenues and the deferred revenues balances during the period

Transaction Price Allocated to the Remaining Performance Obligations

Did you find this article on ASC 606 case study helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding ASC 842, IAS 17, IFRS 16, IFRS 15, Revenue Recognition and ASC 606.