BACKGROUND:

Table of Contents

- Background Information.

- Transition approach

- Policy Details.

- Step 1 – Identify the contract with a customer.

- Step 2 – Identify the performance obligations in the contract.

- Step 3 – Determine the transaction price.

- Step 4 – Allocate the transaction price.

- Step 5 – Recognize revenue as performance obligations are satisfied.

- Presentation of statement of financial position.

- Case Study.

Revenue is an important point of concern to the users of Financial Statements in assessing an entity’s Financial Performance and Position.

Accounting Standard Codification (ASC) 606 – Revenue from Contract with Customers is an Industry-wide revenue recognition guidance that has been formulated by the Financial Accounting Standard Board (FASB). This was a joint task by Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop a common revenue Standard for U.S. GAAP and IFRS.

ASC 606 will be applicable across all industries and aid in recognizing revenue from all types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contracts or Leasing Contracts).

We will be discussing revenue recognition guidelines for the Electronic Gaming & Multimedia industry.

BACKGROUND INFORMATION

Company Background

ABC Inc. is a leading global developer and publisher of interactive entertainment content and services. They develop and distribute content and services on video game consoles, personal computers, and mobile devices. They also operate esports leagues and offer digital advertising within their content.

Offerings:

ABC Inc. generates revenue primarily through the sale of its interactive entertainment content and services, principally for the console, PC, and mobile platforms, as well as through the licensing of intellectual property.

They primarily offer the following Products and Services:

Full-games – Provide access to main game content, This is primarily targeted for Console and PC games.

Downloadable content – Provide players with additional in-game content to purchase add-on maps, clothes, etc (This is similar to In-App purchases that can be seen on Android or Apple mobile games

Microtransactions – Provide small pieces of additional in-game content at a relatively low price to enhance gameplay and give an edge over other players (extension of In-App purchases)

Subscriptions – Provide continual access to online games and their content

TRANSITION APPROACH

The ABC Inc. selected to apply the ‘modified retrospective method’ with the following practical expedient as provided by the new standard and as applicable:

For contracts that were modified before the beginning of the earliest reporting period presented, the Company will not restate the contract for those contract modifications. Instead, the Company will reflect the aggregate effect of all modifications that occur before the beginning of the earliest period presented.

POLICY DETAILS

Revenue Recognition Framework

The ABC Inc. recognizes revenue to depict the transfer of promised goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods and services.

Depending on the circumstances, the guidance may be applied on a contract-by-contract basis, or the practical expedient described in ASC 606-10-10-4 of using the portfolio approach may be followed.

The portfolio approach allows an entity to apply the guidance to a portfolio of contracts with similar characteristics so long as the result would not differ materially from the result of applying the guidance to individual contracts.

ABC Inc. being in Gaming industry and dealing with end customers (gamers) decides to Group it transactions based on the SKU, Seller, Region, and Currency. As this approach would be more appropriate rather than considering each end customer’s Contract as a separate Revenue Contract. The company’s approach to applying each of these steps is discussed in detail throughout the remainder of this section.

3.1 IDENTIFY THE CONTRACT(S) WITH THE CUSTOMER

STEP 1 of the revenue recognition model requires the organization to identify the contract(s) with a customer. This section discusses the steps to determine whether a contract exists and specific considerations that may impact that determination. Each contract will need to go through this evaluation.

Per ASC 606-10-25-1, the five criteria for identifying a contract are as follows:

a. The parties have approved the contract and are committed to perform.

- Sales to retailers/first parties

-

-

- Signed agreements and POs

-

- Sales to gamers (end customers)

-

-

- Through end user license agreement (“EULA”) digitally signed and agreed upon prior to installing/playing the game.

-

b. Each party’s rights are identifiable:

Rights are identifiable in contracts with first parties as well as in the EULA.

c. Payment terms are identifiable:

Payment terms are identifiable in contracts with retailers/first parties (no payment terms with end users as all payments come from the retailer/first party). The consideration from the sale of games comes from the retailers/first party and is not dependent upon their collections from end users, thus Contract is more directly with retailers/the first party.

In the case where the gamers make microtransactions or in-app purchases, the payment terms are identified with the gamers’.

d. The contract has commercial substance:

When the risk, timing, or amount of the Company’s future cash flow is expected to change as a result of the contract. Generally, an executed contract is evidence of commercial substance. significant cash flows are expected as a result of the contracts with retailers/first parties and gamers.

e. The collection is probable based on the customer’s ability and intent to pay:

This will be evaluated on a contract-by-contract basis, variable consideration will be considered in separate retailer/first party contract reviews.

Considering the Nature of the industry Contract Modification is a rare scenario and is dealt with in accordance with the standard.

3.2 IDENTIFY THE PERFORMANCE OBLIGATIONS

STEP 2 of the revenue recognition model requires the company to identify performance obligations and whether the promises to transfer either goods or services are distinct performance obligations. This section discusses the requirements and provides conclusions for their general performance obligations in contracts with customers. Each contract will need to go through this evaluation.

ASC 606-10-25-14 states that at contract inception an entity shall assess the goods or services promised in a contract with a customer and shall identify, as a performance obligation, each promise to transfer to the customer either:

a. A good or service (or a bundle of goods or services) that is distinct:

b. A series of distinct goods or services that are substantially the same and that have the same pattern of transfer to the customer.

A good or service is distinct if both of the following criteria are met:

a. Capable of being distinct– the customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer

b. Distinct within the context of the contract– the promise to transfer the good or service is separately identifiable from other promises in the contract.

In assessing whether an entity’s promises to transfer goods or services to the customer are separately identifiable, the objective is to determine whether the nature of the promise, within the context of the contract, is to transfer each of those goods or services individually or, instead, to transfer a combined item or items to which the promised goods or services are inputs.

ABC Inc. has bifurcated sales into two distinct performance obligations: the License (Point in Time) and Services (Over Time).

Point in Time POB – License POB – A license is provided to the gamer after signing EULA. This is generally when the end user (gamer) takes control of the Product in case of Sell Thru and when products are provided to retailers in case of Sell In. These are recognized on an immediate basis. (This portion of Revenue accounts for 15-40% of total revenue across the industry)

Over Time POB – Services POB– These consists of ongoing activities associated with the online components of the game, such as future updates, content updates, hosting of online content and gameplay, and online matchmaking (the “online functionality”). The online functionality generally operates to support the additional features and functionalities of the game that are only available online. These are recognized ratably over the life of the gamer which is determined by various factors.

They recognize revenue for arrangements that include both a license of intellectual property and separate online functionality when control of the license transfers to their customers for the portion of the transaction price allocable to the license and ratably over the estimated service period for the portion of the transaction price allocable to the online functionality (Bundled service which is split and recognized).

3.3 DETERMINE THE TRANSACTION PRICE

Step 3 of the revenue recognition model requires the Company to determine the transaction price for the contract.

In the case of ABC Inc., the transaction price is determined based on contracts with the retailers and first parties which the company evaluates separately in reviews of each respective contract.

ABC Inc. follows a unit pricing method wherein the revenue recognition per unit is adjusted for discounts and returns which is referred to as Contra Revenue or Netting in the industry. This becomes very much relevant in cases where the revenue recognition is done on the basis of Sell Thru.

Variable considerations

Revenues from product sales are recognized after deducting the estimated allowance for returns and price protection, which are accounted for as variable considerations when estimating the amount of revenue to recognize.

Returns and price protection are estimated at contract inception and updated at the end of each reporting period as additional information becomes available. For tracking purpose they these lines are separately marked.

Taxes

Revenues are recorded net of taxes assessed by governmental authorities that are imposed at the time of the specific revenue-producing transaction between the company and their customer, such as sales and value-added taxes.

3.4 ALLOCATE THE TRANSACTION PRICE TO THE PERFORMANCE OBLIGATION IN THE CONTRACT

Step 4 of the revenue recognition model requires the company to allocate the transaction price to the performance obligations in the contract.

ABC Inc. uses Adjusted market assessment approach. This approach considers the market in which the goods or services are sold and estimates the price that a customer of that market would be willing to pay, including their pricing strategies for the product being evaluated and other similar products they may offer, competitor pricing to the extent data is available, and the replayability design of both the offline and online components of a game.

The Transaction price for a standalone base game is split into two components (a) recognize immediately upon Sell-In, (b) recognized over a period of time upon Sell-In or Sell-Thru. This split is in a specific ratio which is decided after assessing the market conditions and data on a case by case basis for SKU, reseller, region, etc. Thus this helps in complying with the allocation of the transaction price to performance obligations.

3.5 RECOGNIZE REVENUE WHEN (OR AS) THE ENTITY SATISFIES A PERFORMANCE OBLIGATION

Step 5 of the revenue recognition model requires the company to recognize revenue when (or as) it satisfies a performance obligation, which is determined by the transfer of control to the customer.

As determined in step 2 of the revenue model, there are 2 distinct performance obligations included within the sale of a Game, the License and Services.

License – This includes all of the content that can be played offline without any further support from ABC Inc.

This content is delivered at a point in time as it requires no further action from ABC Inc. in order for the customer to receive the benefits of the asset.

Services – This performance obligation is delivered over a period of time, and thus revenue should also be recognized over the period of time in which the customer consumes the service.

Revenues associated with the sales of subscriptions via initial software purchases and standalone subscriptions sales are deferred until the subscription service is activated by the consumer and are then recognized ratably over the subscription period as the performance obligations are satisfied.

It should also be noted that certain products are shipped to retail before the launch date or can be downloaded by gamers (but not activated/played) before the launch date (Street date). In such cases, the revenue is recognized only after the launch date is elapsed. The recognition will be based on whether the product is Sell In (retailer based) or Sell Thru (end gamer-based) product.

Typically, the company uses a mid-month convention as users keep purchasing games throughout the month, Hence for the first month only half of the monthly revenue is recognized using the mid-month convention.

The exception to the above convention is the Launch month for a new product, where the company recognizes revenue for only half number of days in the launch month, and remaining is pushed to the last month.

3.6 INDUSTRY-SPECIFIC POINTS

- Sell In vs Sell Thru – Sell In is the activity of shipping products to the Retailer whereas Sell Thru the activity when a product is sold by that retailer and activated by End User.

- Estimated offering period – (Gamer’s life / Duration) is based on the estimation of the internal and external Technical Accounting Teams and various other data sources. Also the number of days/months over which a particular title is to be amortized and recognized can change on a year-on-year basis depending on new data for analysis.

- Launch Date – Revenue on a particular title is not recognized until it is launched. Generally, these dates are confirmed in advance, however, in some cases, the dates are not confirmed so Revenue is in a deferred state till the launch date is announced and lapsed.

PRESENTATION ON THE STATEMENT OF FINANCIAL POSITION

The company records a receivable related to revenue when they have an unconditional right to invoice and receive payment and records deferred revenue when cash payments are received or due in advance of their performance, even if amounts are refundable.

Deferred revenue is comprised primarily of unearned revenue related to the sale of products with online functionality or online hosted arrangements. These sales are typically invoiced and collected at the beginning of the contract period, and revenue is recognized ratably over the estimated service period.

Deferred revenue also includes payments for product sales pending delivery or activation; subscription revenues; licensing revenues with fixed minimum guarantees; and other revenues for which they have been paid in advance and earn the revenue when they transfer control of the product or service.

Returns and price protection are estimated at contract inception and updated at the end of each reporting period as additional information becomes available.

Case Study

Based on the above considerations and in reference to various requirements of the guidance, a typical transaction can be molded as below:

ABC Inc. sales a retail game where

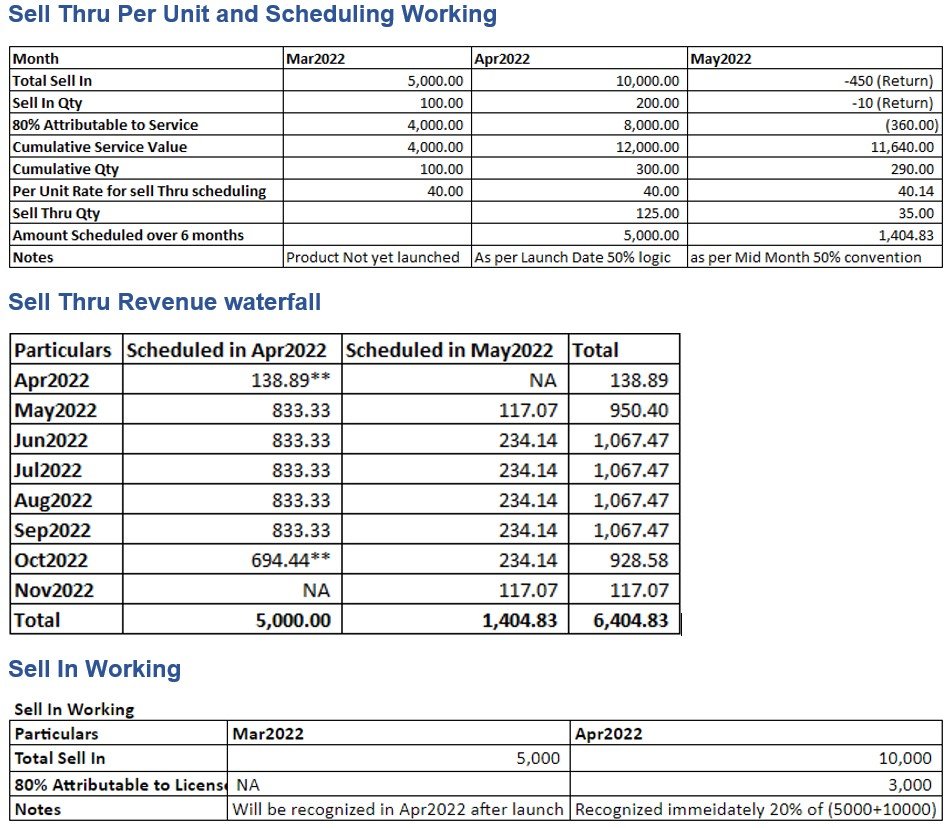

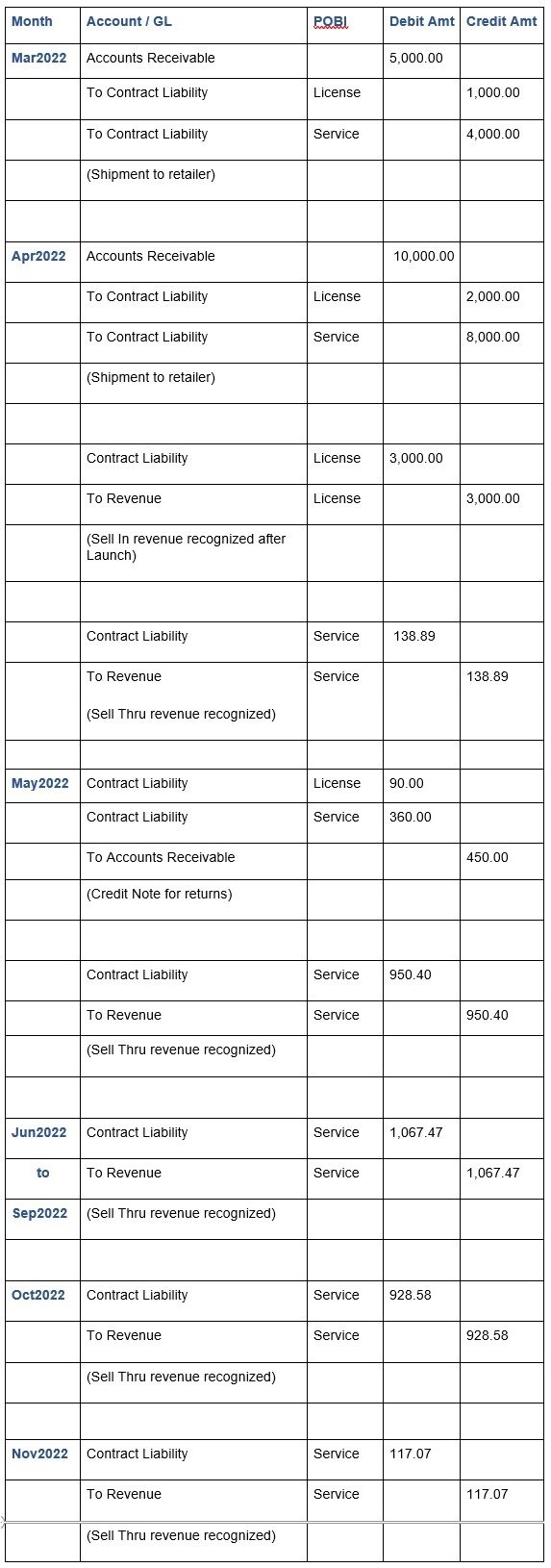

(1) In Mar2022, shipped 100 units @ $50/unit (Launch Date of Product is 20Apr2022)

(2) In Apr2022 Shipped additional 200 units @ $50/unit

(3) In Apr2022 customers purchased (Sell Thru) 125 units from retailer

(3) In May2022, customers purchased 35 units (Sell Thru) and 10 units are returned @ $45/unit to retailer.

As per internal assessment, 20% of Sell In is considered as point in time (License) and rest 80% as overtime (Services). Thus each Sell In split into License and Service POBs.

Step 1 – Identify Contracts with Customer

Considering that all 5 criteria for identifying the contract with the customer are met and the contract is combined based on the customer and the contract entered with the same time and location. A proper agreement with the retailer and EULA with the customer.

Step 2 – Identifications of Performance obligations

License/ Offline portion recognized immediately (upon shipment to retailer)

Services/ Online portion recognized over service period commencing upon sell-thru from retailer to customer.

Step 3 – Determine the transaction price.

The transaction price is determined based on contracts with the retailers and adjusted for any returns and discounts.

The Mar 2022 transaction price of $5,000 ($50*100 units) is divided amongst License and Services in 20:80.

Similarly Apr 2022 Transaction price of $10,000 ($50*200 units) is divided amongst License and Services in 20:80 and also adjusted for discounts and returns.

Step 4 – Allocation of Transaction Price

The transaction price is split into 20:80 as a standard ratio in the industry for such products

– Allocate 20% to Offline, recognized at sell-in

– Allocate 80% to Online, recognized over 6 months estimated gamer life upon sell-thru

Step 5 – Revenue Recognition

As the game is yet to be launched, no revenue recognition will happen in Mar2022, thus the sell-in amount would appear as a deferred balance even for the License POB amount in Mar2022.

In Apr2022 20% of Sell In amount from Mar2022 and Apr2022 will be recognized on immediate basis i.e. Game License – 20% of ($5,000 + $10,000) i.e. $3,000.

Remaining 80% of ($5,000 + $10,000) i.e. $12,000 which is attributable to Services POB will be adjusted for discounts and return for deriving the per unit price as shown below :

Accounting Entries:

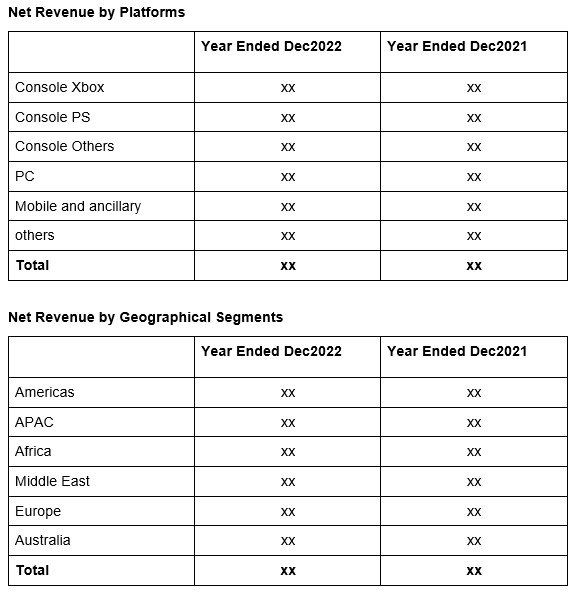

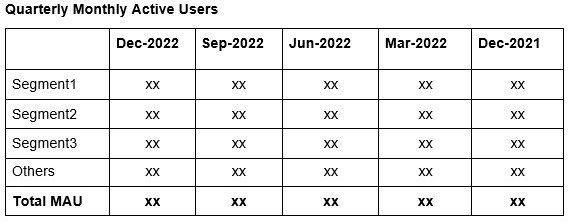

Disclosures

Excerpts of Notes to the financial statement:

Item X. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Did you find this article on ASC 606 case study helpful? Click here for more Information on ASC 842, IFRS 16, IAS 17, ASC 606 and IFRS 15 or to write to us! We will be happy to answer any questions/queries regarding this and any other topics regarding ASC 842, IAS 17, IFRS 16, IFRS 15, Revenue Recognition and ASC 606.