31 May ASC 606 – Telecommunication

Table of Contents

-

-

-

- Background Information.

- Transition Approach.

- Policy Details.

- Step 1 – Identify the contract with a customer.

- Step 2 – Identify the performance obligations in the contract.

- Step 3 – Determine the transaction price.

- Step 4 – Allocate the transaction price.

- Step 5 – Recognize revenue as performance obligations are satisfied.

- Presentation of statement of financial position.

- Case Study.

-

-

Revenue is an important point of concern to the users of Financial Statements in assessing an entity’s Financial Performance and Position.

Accounting Standard Codification (ASC) 606 – Revenue from Contract with Customers is an Industry-wide revenue recognition guidance which has been formulated by the Financial Accounting Standard Board (FASB). This was a joint task by Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop common revenue standard for U.S. GAAP and IFRS.

ASC 606 is applicable across all the industries and aid in recognizing revenue from all the types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

ASC 606 was introduced to improve the way revenue recognition was been carried out per ASC 605. This document is to introduce the readers the impact of ASC 606 on Telecom Company.

This article covers:

The timing, amount and pattern of Revenue Recognition for a Telecom Company.

BACKGROUND INFORMATION

Background and offerings

Telecom RG Inc. is a Telecom Company providing services like cellular voice, data and text services.

The Telecommunications industry comprises several subdivisions, including wireless, fixed-line and cable/satellite television (TV). Telecom companies generate revenue through various service offerings which include access to, and usage of, network and facilities for the usage of internet, voice, data and television services. The revenue these services generate is through subscription fees or monthly/yearly charges.

Some Telecommunication companies also sell or lease equipment such as handsets, modems, dongles (a wireless internet service adaptor), customer premises equipment (CPE includes wide array of devices such as routers, network switches, residential gateways (RG), set-top boxes, fixed mobile convergence products, home networking adapters, and Internet access gateways that enable consumers to access communications service providers’ services and distribute them around their house via a local area network), and a variety of accessories needed in the course of provision of above listed services.

The Telecommunications industry has evolved as a result of various factors such as consolidation, technology changes, and innovation. Examples include installment sales of wireless devices; multi-line plans, in which customers attach more than one device to a service; and bundled plans, including voice and internet services. Also, companies may provide services that expand beyond traditional core offerings such as online music or video streaming.

Impact of the new guideline on Telecoms

- The various offers that Telecom companies provide for the purchase of additional goods and services will require analysis of material rights being provided to the customers.

- Some costs incurred to acquire and fulfill a contract which is currently expensed will require a change in accounting policy as per the new standard, wherein they will be capitalized and amortized over the period the goods and services are services delivered.

- Entities will need to document additional data required under the new standard, for example, the data used to estimate the standalone selling price and to support additional disclosures.

- The newly introduced standard requires a lot of business estimates and judgments leading to more adjustments in the current and subsequent period and unified internal controls and methodologies in place to ensure consistency.

TRANSITION APPROACH

The Telecom RG Inc. selected to apply the ‘modified retrospective method’ with the following practical expedient as provided by the new standard and as applicable:

For contracts that were modified before the beginning of the earliest reporting period presented, the Company will not restate the contract for those contract modifications. Instead, the Company will reflect the aggregate effect of all modifications that occur before the beginning of the earliest period presented.

POLICY DETAILS

Revenue Recognition Framework

The Telecom RG Inc recognizes revenue to depict the transfer of promised goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods and services.

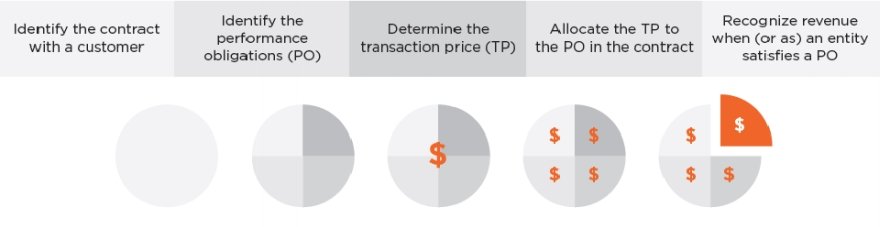

5 Step model for revenue recognition

Depending on the circumstances, the guidance may be applied on a contract-by-contract basis, or the practical expedient described in ASC 606-10-10-4 of using the portfolio approach may be followed. The portfolio approach allows an entity to apply the guidance to a portfolio of contracts with similar characteristics so long as the result would not differ materially from the result of applying the guidance to individual contracts. The Company will decide whether to apply the portfolio approach on a case-by-case basis as appropriate.

The Company’s approach to applying each of these steps is discussed in detail throughout the remainder of this section.

IDENTIFY THE CONTRACT(S) WITH A CUSTOMER

Step 1 of the revenue recognition model requires the Company to identify the contract(s) with a customer. This section discusses the steps to determine whether a contract exists and specific considerations that may impact that determination. Each contract will need to go through this evaluation.

Per ASC 606-10-25-1, the five criteria for identifying a contract are elaborated as follows:

a. The parties have approved the contract and are committed to perform.

- Sales directly to end customers

- A signed purchase agreement. Or

- A standard purchase order of the form normally issued by the customer, supporting the customer’s commitment to receive and pay for products and/or services specified in the quotation and/or contract, which is approved by the Company’s legal and finance department.

- The Company does not consider the contract approved until both parties have executed the documents. Such execution is deemed to have occurred as of the last signature date.

- The approved contracts described above must be executed before the end of the accounting period in which revenue is to be recognized and be provided to the order entry location by midnight Pacific time. Faxed documents will not be considered received unless they are legible and complete.

- Contracts, in general, are reviewed and executed by the Legal Team. All non-standard contracts should be reviewed by the Revenue Team and approved by the VP of Finance prior to being executed.

b. Each party’s rights are identifiable:

Rights should all be documented in writing within the terms and conditions of the approved contracts described above.

c. Payment terms are identifiable:

The Company is obligated to perform the services ordered by the customer and agreed to by the Company. The customer is also obligated to pay the Company the prices for agreed goods and services. The Company’s bills are payable immediately upon receipt of the bill without any deduction, unless other payment terms and conditions are expressly agreed.

d. The contract has commercial substance:

When the risk, timing, or amount of the Company’s future cash flow is expected to change as a result of the contract. Generally, an executed contract is evidence of commercial substance.

e. The collection is probable based on the customer’s ability and intent to pay:

The amount deemed collectible may be less than the contractual price: The collectability assessment only applies to consideration associated with goods or services to be transferred during the non-cancellable term of the contract. The Company’s contracts with its customers are usually non-cancellable. Generally, the Company will not enter into an arrangement for which the collectability criterion is not met.

Customers’ and Channel Partner’s creditworthiness will be assessed at the outset of an arrangement through a background check.

Combination of Contracts

The Company combines two or more contracts entered into at or near the same time, same location and with the same customer and end user, and accounts for the combined contracts as a single arrangement if one or more of the following criteria outlined in ASC 606-10-25-9 are met:

- In the event that the Company enters into multiple contracts with a customer, the Company will evaluate the considerations above to determine whether the contracts should be accounted for together or as separate contracts.

- The Company may enter into a transaction with a customer whereby the appliance, maintenance and support, and professional services are on different purchase orders. Such transactions will be combined as a single arrangement under ASC 606 if the contracts meet the criteria mentioned above.

- Customers may subsequently add additional products or services that were not included in the original contract. In general, such transactions are not deemed to be separate contracts that should be combined for accounting purposes but rather the Company will consider whether such contracts are a modification to the original contract (see the Contract Modifications section below for further discussion).

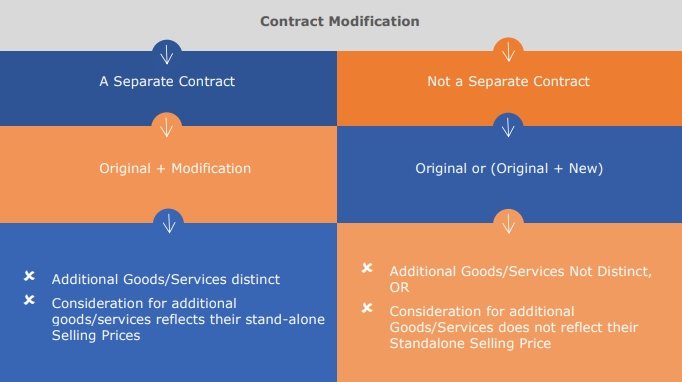

Contract Modification

A contract modification exists when there is a change in the scope and/or the price of a contract. Upon approval of a change in an existing contract, it is accounted for as a separate contract, termination of the existing contract and creation of a new contract, or as part of the existing contract.

Separate contract:

A contract modification is accounted for as a separate contract (prospective treatment) when both of the following criteria are met:

- The additional goods and services are distinct from the goods and services in the original arrangement; and,

- The amount of consideration expected for the added goods and services reflects the standalone selling price of those goods and services.

Existing contract / New Contract:

- A contract modification that does not meet the above criteria is considered a change to the original contract and is accounted for as either the termination of the original contract and the creation of a new contract, or as a continuation of the original contract, depending on whether the remaining goods or services to be provided after the contract modification are distinct from the goods or services transferred to the customer on or before the date of the modification.

- A modification is accounted for on a prospective basis, or said differently, a termination of the existing contract and creation of a new contract, if the goods and services subject to the modification are distinct from the other goods and services provided within the original contract but the consideration does not reflect the standalone selling price of those goods or services.

- A modification is accounted for as a continuation of the original contract if the goods or services added or removed are not distinct from the goods and services already provided; such modifications are accounted for on a cumulative catch-up basis. This scenario is considered to be rare.

Once a contract modification has been determined to be either a separate contract, a termination of the existing contract and creation of a new contract, or as part of an existing contract, the Company will recognize revenue for the contract consistent with the above policies.

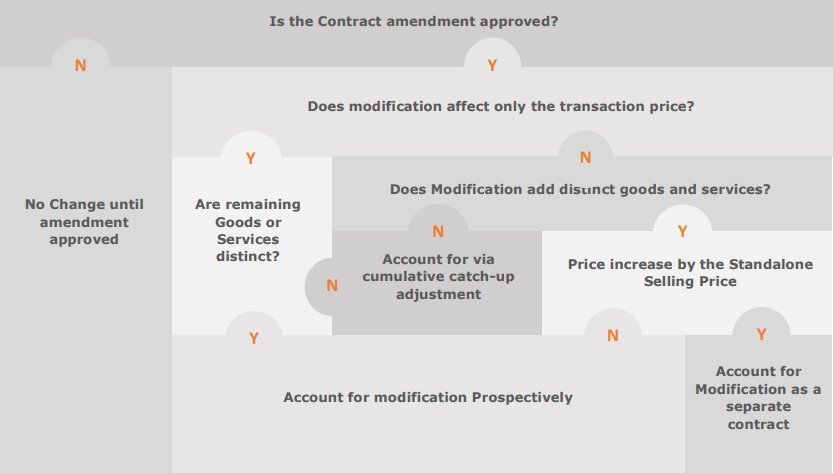

Flow Chart for a better understanding:

IDENTIFY THE PERFORMANCE OBLIGATIONS IN THE CONTRACT

Step 2 – This Step requires the Company to identify performance obligations and whether the promises to transfer either goods or services are distinct performance obligations. This section discusses the requirements and provides conclusions for our general performance obligations in our contracts with customers. Each contract will need to go through this evaluation.

ASC 606-10-25-14 states that at contract inception an entity shall assess the goods or services promised in a contract with a customer and shall identify, as a performance obligation:

A performance obligation is a promise to transfer goods and/or services to a customer. Telecom entities need to consider the common business practices and identify all the goods and services within the contract to determine which of those need to be grouped together in a single performance obligation and others to be recognized as a separate performance obligation.

This is a crucial step in applying the 5-step model because revenue allocated to each performance obligation is recognized when the obligation is satisfied.

Telecom entities often sell products and services that are bundled together (example: voice, text, and data bundled together in a monthly subscription) and these bundles are generally distinct in terms of identification for contract terms, prices and performance obligation. These bundles may be provided to the customer on free, promotional or discounted rates so as to entice customers to enter into contracts. Example – Telecom companies may sell a mobile handset with the benefit of network usage attached to the device. In this case, if the customer is allowed to use the device with other network carriers then the sale of mobile handset and network usage are to be accounted as separate performance obligations. However, if the device is locked with telecom entities network then it is to be recognized a one single performance obligation. The entity will also have to consider the future promises given to the customer to buy other services at a discounted price and whether they can be recognized as a material right or not.

A good or service is distinct if both of the following criteria are met:

a. Capable of being distinct – the customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer

b. Distinct within the context of the contract – the promise to transfer the good or service is separately identifiable from other promises in the contract

In assessing whether an entity’s promises to transfer goods or services to the customer are separately identifiable, the objective is to determine whether the nature of the promise, within the context of the contract, is to transfer each of those goods or services individually or, instead, to transfer a combined item or items to which the promised goods or services are inputs.

A series of distinct goods or services that are substantially the same are accounted for as a single performance obligation if:

- Each would be a performance obligation satisfied over time; and

- The same method would be used to measure the company’s progress toward satisfaction

Material Rights

Some telecom companies might grant a customer the option to acquire additional services either at promotional or discounted prices. These options might include customer credits or discounts. Some telecom contracts give customer options for a premium TV channel, international voice, and data plans or data and calling in excess of plan limits.

Telecom entities have to determine whether these options give a material right to customers and can be recognized as a separate performance obligation.

Such an option provided to the customer should be recognized as a separate performance obligation if it provides a material right that customer would not have received had he not entered the contract. The entity should recognize the revenue allocated to the material right when it is exercised by the customer or when it expires.

If the customer is provided a right to buy additional goods and services at a price which is in range of prices charged for those goods and services i.e. Standalone selling prices, then such option does not give any material right.

The Company’s revenue transactions may include a combination of the following (Not exhaustive list):

Series of distinct goods or services

The Company’s contracts contain promises to deliver a distinct series of services that are substantially the same. If the distinct series of services meet both of the criteria below, they are considered to be a single performance obligation:

a. Each distinct service in the series that the Company have promised to transfer to the Company’s customer would meet the criteria of a performance obligation satisfied over time

b. The same method would be used to measure the Company’s progress toward complete satisfaction of the performance obligation to transfer each distinct service in the series to the Company’s customer

DETERMINE THE TRANSACTION PRICE

Step 3 – This Step of the revenue recognition model requires the Company to determine the transaction price for the contract. This section discusses the potential transaction price components and how they may increase or decrease the overall transaction price. Each contract will need to go through this evaluation.

The Company considers the terms of the contract and its customary business practices to determine the transaction price. The transaction price is the amount of consideration to which the Company expects to be entitled in exchange for transferring goods or services to a customer, excluding amounts collected on behalf of third parties such as sales taxes. The following items are taken into consideration when determining transaction price and are discussed in further detail throughout this section.

+ Fixed Consideration (includes consideration related to performance obligations and activation fees)

+ Estimated Variable Consideration

– Contingent Amounts (unless no revenue reversal is probable)

– Consideration Payable to the Customer

+ Noncash Consideration

± Significant Financing Component

– Amounts Collected on Behalf of Third Parties

= Transaction Price

When determining the transaction price, the Company assumes that the goods or services will be transferred to the customer based on the terms of the existing non-cancellable contract and does not take into consideration the possibility of the contract being canceled, renewed, or modified. The Company also considers the effects of the following:

1. Variable consideration (and the constraint)

Forfeitures, refunds, rights of return, price concessions, payments contingent on future events, and similar items give rise to variable consideration which, in turn, affects the transaction price for an arrangement. The Company will determine how much variable consideration can be included in the overall transaction price at contract inception. This determination is comprised of the following two steps:

a. Estimate the amount of variable consideration;

b. Determine whether any of the estimated amounts are subject to a probable revenue reversal (this concept is referred to as “the constraint” in the literature).

ASC 606-10-32-8 suggests two alternatives use (be consistently applied throughout the life of the contract) when estimating the amount of variable consideration:

a. The expected value method:

Sum of probability-weighted amounts in a range of possible consideration amounts

b. The most likely amount method:

The single most likely amount in a range of possible consideration amounts

Variable consideration may include amounts that could be refunded, returned, or uncollected from customers or resellers, rebates in the form of cash or credits provided to resellers for meeting certain sales targets, booking targets, etc., credits to end-users, price concessions, incentives, performance bonuses, penalties, usage-based fee, price protection, time and materials contracts, usage overages on subscription contracts, or other similar items.

In the case of a Company, variable consideration would be the amount refunded to a customer if he cancels the booking within the window provided by the Company.

2. Concessions

The Company may provide infrequent concessions to certain customers in order to keep customer loyalty to the Company intact. These concessions typically result in free or reduced-price maintenance and support services /extension of payment term

Under ASC 606, concessions are generally viewed as any post-execution change to the original agreement between the Company and the customer that increases the customer’s rights or the Company’s obligations. Concessions may impact the determination of performance obligations and/or transaction price and could be considered a contract modification. As such, concessions should be considered throughout the five-step revenue recognition framework. Discussion of concessions is placed in the transaction price section of the policy as transaction price is frequently impacted by concessions.

Concessions may take many forms and include, but are not limited, to the following:

– Accepting returns that are not required under the terms of the original arrangement;

– Reducing the arrangement fee or extending the terms of payment; or

– Increasing the deliverables or extending the customer’s rights beyond those in the original transaction, without an appropriate increase in fees

The Company will assess whether to include estimated concessions in the transaction price on a contract-by-contract basis when and if concessions are expected to be provided. As of the date of this policy, the Company does not have a history of granting concessions and, as such, estimated concessions will not be included in the transaction price.

3. The Consideration payable to a customer

The Company evaluates consideration payable to a customer to determine whether the amount represents a reduction of the transaction price, payment for distinct goods or service, or a combination of the two. Consideration payable that does not exceed the fair value of distinct goods or services shall be accounted for as a purchase from suppliers. The consideration payable that exceeds the fair value of distinct goods or services shall be accounted for as a reduction to the transaction price with the remainder accounted for as a purchase from suppliers. If the Company cannot reasonably estimate the fair value of goods or services received from the customer, then it will account for all consideration payable to the customer as a reduction of the transaction price at the later of when the Company recognizes revenue for the transfer of the related goods or services and the Company pays or promises to pay the consideration.

4. Sales taxes

The Company excludes all taxes assessed by governmental authorities from the measurement of the transaction price as allowed by ASC 606-10-32-2A as the taxes collected by the Company are levied against its customers. The Company is considered an agent for the governmental authority and therefore the taxes collected are not included in the transaction price.

ALLOCATE THE TRANSACTION PRICE TO THE PERFORMANCE OBLIGATIONS IN THE CONTRACT

Step 4 – This Step of the revenue recognition model requires the Company to allocate the transaction price to the performance obligations in the contract. This section discusses how standalone selling prices are determined and how the transaction price will be allocated using the standalone selling prices or other appropriate methods. Each contract will need to go through this evaluation.

Allocating the transaction price to performance obligations

The Company allocates a portion of the total transaction price to each performance obligation based on the relative stand-alone selling price (SSP) of each performance obligation. The amount allocated, therefore, represents the amount of consideration to which the Company expects to be entitled in exchange for providing the goods or services included in the performance obligation. SSP is determined at the inception of the contract for each performance obligation.

Once the Company has determined the transaction price, a portion of the total transaction price is allocated to each performance obligation in a manner depicting the amount of consideration to which the Company expects to be entitled in exchange for transferring the goods or services to the customer (the “allocation objective”). The first step is to determine the SSP of each performance obligation. Once the SSPs have been determined, the second step is to allocate the transaction price based on the performance obligations’ relative SSPs.

However, in some cases, a discount or variable consideration may be allocated to one or more, but not all, performance obligations in the contract. See the discussion of these cases in sections. Allocating variable consideration, and Discount Allocation, below SSP, is determined at the inception of the contract for each performance obligation. After contract inception, no reallocation of the transaction price is made to reflect subsequent changes in SSPs.

Determining standalone selling prices

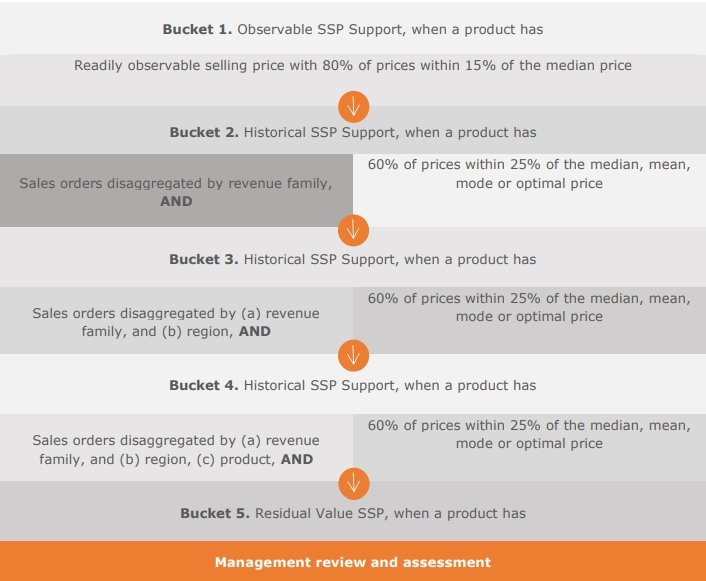

The following shows the Company’s decision-making process for selecting a standalone selling price:

SSP is the price at which the Company would sell a promised good or service separately to a customer. The best evidence of SSP is an observable SSP, which is the “price of a good or service when the entity sells that good or service separately in similar circumstances to and to similar customers” per ASC 606-10-32-3.

The Company considers SSP to be a range of prices. The Company will apply judgment in determining what constitutes an appropriate SSP range. Any such range will be established based on an analysis that maximizes observable inputs and supports an assertion that any price within that range would be a valid pricing point if the performance obligation were sold on a stand-alone basis.

Determining observable SSP

The Company first concludes whether an observable SSP exists. An observable SSP is the price of a good or service when the entity sells that good or service separately in similar circumstances and to similar customers. The Company conducts a regular analysis to determine whether various services have an observable SSP. If an observable SSP exists, it is used for allocation purposes. If there is a relatively narrow range of observable prices, then a stated contract price within that range is an acceptable SSP. The Company considers observable SSP to exist when

(a) 80% of contract prices for a separately sold service to be within 15% of an estimated SSP, and

(b) there are a sufficient number of observed contracts to reasonably estimate SSP.

Determining SSP based on historical prices

If the Company does not have an observable SSP then, the Company next assesses whether products have an estimated SSP by considering its historical pricing. Historical prices include both

a) observed in transactions within the last twelve months and

b) standalone and non-standalone transactions.

The Company considers historical SSP to exist when

c) 60% of contract prices for a separately sold service to be within 25% of an estimated SSP, and

d) there are a sufficient number of observed contracts to reasonably estimate SSP.

Determining SSP for low-coverage products

If the historical standalone selling price is not available after disaggregating the product revenue family, Management reviews the specific item and makes its best estimate of SSP. This analysis may consider the following:

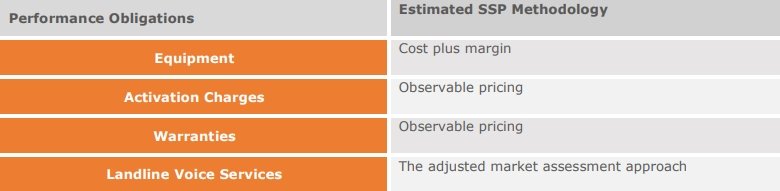

a. Adjusted market assessment

Prices based on SSP of similar goods or services or SSP observed in another market and adjusted for known differences in functionality, markets, etc.

b. Expected cost plus a margin

Prices based on a forecast of the expected costs plus an appropriate margin for the service.

c. Combined method

Prices established for a bundled (combined) performance obligation based on combining SSP of individual goods or services included in the bundle, and adjusting for the effect of bundling, as appropriate. The Company does not believe it will utilize this method.

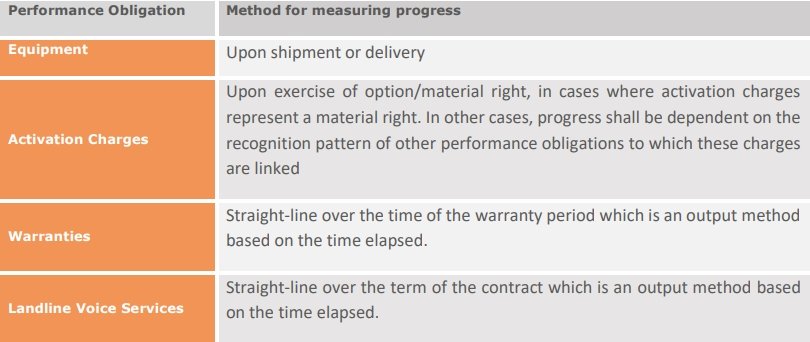

The following table outlines the Company’s distinct performance obligations and the method that is most frequently used to establish SSP:

Frequency of updating the SSP analysis

The Company estimates SSP on an annual basis, or as needed when standard discounts are updated or new products are introduced in the market. On a quarterly basis, the Company will revise its estimate of SSP if there is a material change in the SSP.

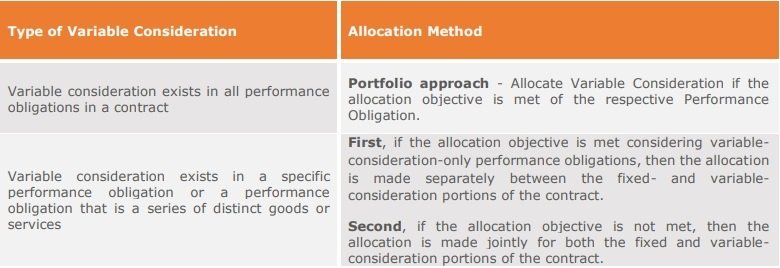

Allocating variable consideration

Variable consideration may be attributable to:

i. All of the performance obligations in a contract—including amounts that could be refunded, returned, or uncollected from customers or resellers, rebates in the form of cash or credits provided to resellers for meeting certain sales targets, booking targets, etc., credits to end-users, price concessions, incentives, performance bonuses, penalties, price protection, or other similar items;

ii. One or more, but not all, of the performance obligations in a contract—including time and materials contracts, and usage-based fees; and

iii. One or more, but not all, of the distinct goods or services, promised in a series of distinct goods or services that forms part of a single performance obligation—including usage overages on subscription contracts.

The Company will allocate variable amounts, along with subsequent changes to such amounts, entirely to one or more, but not all performance obligations when both of the following criteria are met:

I. The variable payment terms relate specifically to the entity’s efforts to satisfy the performance obligation; and

II. Allocating the variable amount of consideration entirely to the performance obligation is consistent with the allocation objective when considering all of the performance obligations and payment terms in the contract.

Portfolio approach – The new standard is applied to an individual contract with the customer. However, as a practical expedient, an entity may apply the revenue model to a host of contracts clubbing them together as a portfolio. A portfolio of contacts will consist of those contracts which exhibit similar characteristics and the entity reasonably expects that the effect of applying this approach as opposed to applying the 5-step model to the individual contract would not result in a material difference to the financial statements.

Allocation objective – At the commencement of the contract, the transaction price is generally allocated to each performance obligation on the basis of relative standalone selling prices. However, when specified criteria are met, a discount or variable consideration is allocated to one or more performance obligations in the contract. This is known as allocation objective.

RECOGNIZE REVENUE WHEN (OR AS) THE ENTITY SATISFIES A PERFORMANCE OBLIGATION

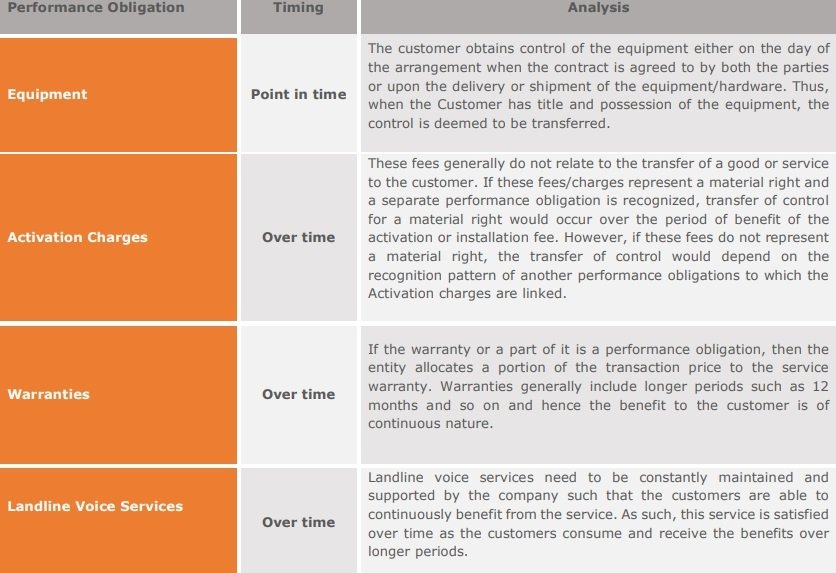

Step 5 – This Step of the revenue recognition model requires the Company to recognize revenue when (or as) it satisfies a performance obligation, which is determined by the transfer of control to the customer. This section discusses potential impacts to the timing of the transfer of control, the types of transfer of control and the likely recognition method for the Company’s various performance obligations. Each contract will need to go through this evaluation.

The Company recognizes revenue when (or as) it satisfies a performance obligation by transferring promised goods or services to its customers. The good or service is considered transferred when the customer gains control of the good or service. Control of an asset refers to the ability to direct the use of and obtain substantially all of the remaining benefits from the asset. Control also means the ability to prevent other entities from directing the use of and receiving the benefit from, a good or service. If control transfers over time, revenue will be recognized over time in a manner depicting The Company’s performance in transferring control of the good or service. If control transfers at a point in time, revenue will be recognized at that point.

Per ASC 606-10-25-27, transfer of control occurs over time if one of the following criteria is met:

a. The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs

b. The entity’s performance creates or enhances an asset that the customer controls as the asset is created or enhanced

c. The entity’s performance does not create an asset with an alternative use to the entity (e.g., the ability to sell the asset to a different customer), and the Company has an enforceable right to a proportionate amount of payment if the customer were to terminate the contract. Generally, our professional services meet this condition as

I. the nature of our professional services are generally customized to our customer’s specific requests and needs, and

II. these services are not transferable to other customers (i.e., they provide value to the Company.

The customer receives and consumes the benefits as the entity performs if another entity would not need to substantially re-perform the work completed to date to satisfy the remaining obligations. The fact that another entity would not have to re-perform work already performed indicates that the customer receives and consumes the benefits throughout the arrangement.

If a performance obligation is not satisfied over time it is satisfied at a point-in-time. Per ASC 606-10-25-30, indicators of transfer of control that would likely result in point-in-time revenue recognition include:

a) The Company has a present right to payment for the asset

b) The customer has legal title to the asset

c) The Company has transferred physical possession of the asset

d) The customer has the significant risks and rewards of ownership of the asset

e) The customer has accepted the asset.

The following table summarizes how the Company transfers control for each performance obligation based on the above guidelines.

Once the determination of how control is transferred, the method for measuring the progress of satisfying a performance obligation must be selected. For performance obligations satisfied over time, a company may select either an output method or input method as provided under ASC 606.

Contract Costs

Costs to obtain a contract.

- Telecom entities may often pay commissions to in-house sales agents or third-party dealers, agents for the acquisition of new customers to telecom entity’s network. Commission paid for acquiring new customers depends on various factors such as length of the contract, type of service or network plan selected, additional services or options purchased with those plans etc. The longer the term of the service plans, the greater the revenue generated from the customer resulting in greater commission payouts. The additional costs of obtaining new contracts are those that the entity would not have incurred if the contract had not been obtained.

- Earlier telecom companies used to expense the commission costs as and when they were incurred. However, ASC 606 requires the telecom entities to capitalize on the additional costs of acquiring new contracts including commission costs if they are expected to be recovered. Alternatively, for practical reasons, companies are allowed to expense these costs if the amortization period or the contracts for which these costs were incurred are less than one year. Contracts costs recognized as an asset are to be amortized on a systematic basis in line with the pattern of transfer of goods and services to which the asset relates. Costs that will be incurred irrespective of whether the contract is obtained are to be expensed as and when they are incurred.

- Some telecom companies provide free or heavily discounted service, the network plans to customers along with telecom equipment such as wireless handsets to attract new customers. However, as per the new standard, these promotional costs will not be accounted for as costs to obtain new contracts.

Costs to fulfill a contract.

- Telecom entities incur significant costs for setup, installation, and activation of telecom equipment for the customers. The entities need to determine whether the installation and set up activity is eligible for capitalization under other standards (example – property, plant, machinery, etc.) then that particular guidance applies to such costs. If these costs are incurred relating to a particular contract, create a resource for the telecom entity and are not covered by any other standard, they need to be capitalized.

- Costs that give rise to an asset must continue to be recoverable throughout the contract period to meet the criteria for capitalization and therefore any asset recorded by the entity is subject to an impairment assessment at the end of each reporting period.

PRESENTATION ON THE STATEMENT OF FINANCIAL POSITION

Presentation

- Telecom entities record contract assets and contract liabilities depending on their business practices. The standard requires that an entity present contract assets and liabilities in the statement of financial position.

- Contract assets and liabilities should be presented at the contract level and not at the line level i.e. at the performance obligation level. Thus, the entity should aggregate contract assets and liabilities within a contract into one single contract liability and asset and not recognize it separately for each performance obligation or line level.

- Standard does not require the entity to comply with usage of terms contract assets and contract liability, however, presentation of the financial information should be in such manner that the users of financial statements can clearly distinguish between unconditional right to consideration (e.g. receivables) and conditional right to receive consideration (e.g. contract assets, unbilled receivables).

- Telecom entities need to provide information regarding contracts that would generate contract assets (e.g. service agreements with lock-in period) and contract liabilities (prepayments from customers for service plans).

Disclosures

- Telecom entities are required to provide a comprehensive set of disclosures about revenue from a contract with customers in the financial statements. The disclosures also apply to interim financial statements.

- For public entities, the disclosures include qualitative and quantitative information about contracts with customers, revenue disaggregation’s, significant judgments and policies decided by the entity for consistent application of the standard, costs capitalized while obtaining the contract and costs incurred for the fulfillment of the contract. Non-public entities can voluntarily opt for the same level of disclosures as the public ones or decide for a reduced level of disclosures.

- Disaggregated revenue disclosure should depict categories of revenue in such a way that the nature, amount, timing of revenue and cash flows are distinct for different streams. While disaggregating the revenue, telecom entities should consider how it will affect the presentation of information in financial statements as well as from an investor point of view. Revenue may be disaggregated on the basis of service plans (cellular network, data usage, text), types of customers (prepaid, postpaid, residential, commercial), types of contracts (monthly, fixed term) and geographical locations.

- The Entity does not require to duplicate the disclosure required by other standards. For example – an entity that is providing revenue disaggregation disclosure as per segment reporting is not required to give the same disclosure as per this standard.

- Qualitative and quantitative disclosures include information about performance obligations, contract assets, and contract liabilities, capitalized costs incurred for obtaining the contract, costs incurred for fulfilling the contract.

- Disclosures should also be made about significant judgments made for applying the standard along with changes made to existing policies which will result in changes to the amount and timing of revenue recognition. Entities will need to disclose Judgements and changes in judgments made for determining the transaction price, performance obligations and its satisfaction, allocation of the transaction price to performance obligation, estimating the standalone selling price, variable consideration, determining whether some rights give rise to material rights and their accounting, allocation of discounts to contracts.

- The disclosure requirements also apply to interim financial statements.

CASE STUDY

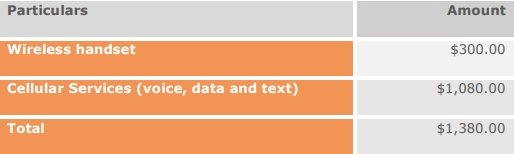

Telecom RG Inc. enters into a 12-month contract which includes cellular voice, data and text services with customer A. At the commencement of the contract, RG Inc. transfers a handset to customer A and customer A pays $300 to RG Inc. which is less than the standalone selling price of the wireless handset. The 12-monthly contract includes fixed monthly voice minutes and internet data. During the contract duration of one year, Customer A cannot change the cellular network services of RG Inc. without terminating the contract and if he does so, he will have to shell out contract termination penalty of $200. RG Inc. decided the total transaction price for the contract as $1380 ($300 for the wireless handset and $90 (billing) x 12 months = $1080 for the cellular services). This example does not take into consideration whether the contract includes a significant financing component.

STEP 1 – Identify Contracts with Customer

The contract is mutually agreed upon between the customer and the Company. Terms of payment are defined in the contract. Also, the payment is enforceable as well as collectible from the customers.

The Company combines two or more contracts entered into at or near the same time, same location and with the same customer or end user, and accounts for the combined contracts as a single arrangement.

The contracts are identified as per Customer ID and then dissevered as per plans opted. As per the case study, the Customer ID is A30695 and the Plan ID is RG123. Thus, all the contracts with the respective Customer ID and Plan ID will be grouped as a contract.

STEP 2 – Identifications of Performance obligations

STEP 3 – Determine the transaction price

The transaction price consists of two components hardware (wireless handset) and service (cellular service). Customer A is paying $300 at the inception of the contract for the mobile handset. The rest of the consideration i.e. $1080 will be charged over 12 months at the rate of $90 monthly.

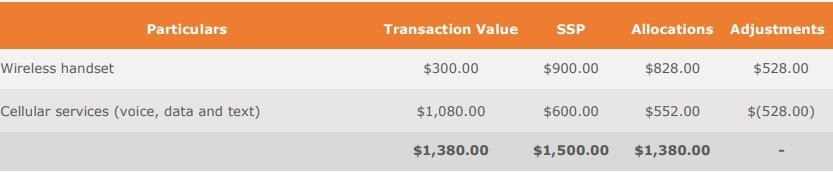

STEP 4 – Allocation of Transaction Price

The customer is paying $300 at the inception of the contract for the wireless handset which is much lower than the standalone selling price of that handset. Whereas RG Inc. is charging $1080 for telecom cellular services which is much higher than the standalone selling price of the service.

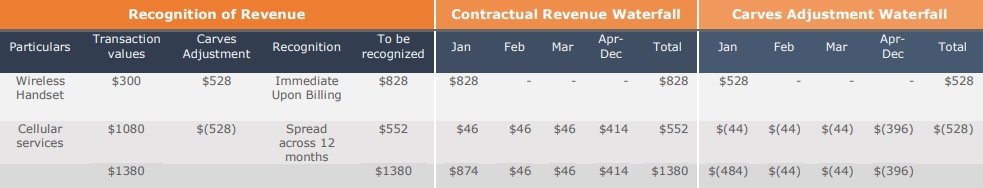

STEP 5 – Revenue Recognition

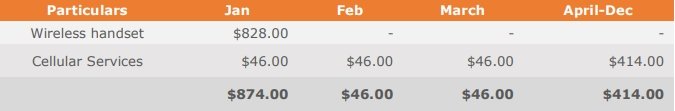

Net Revenue Recognition Schedule

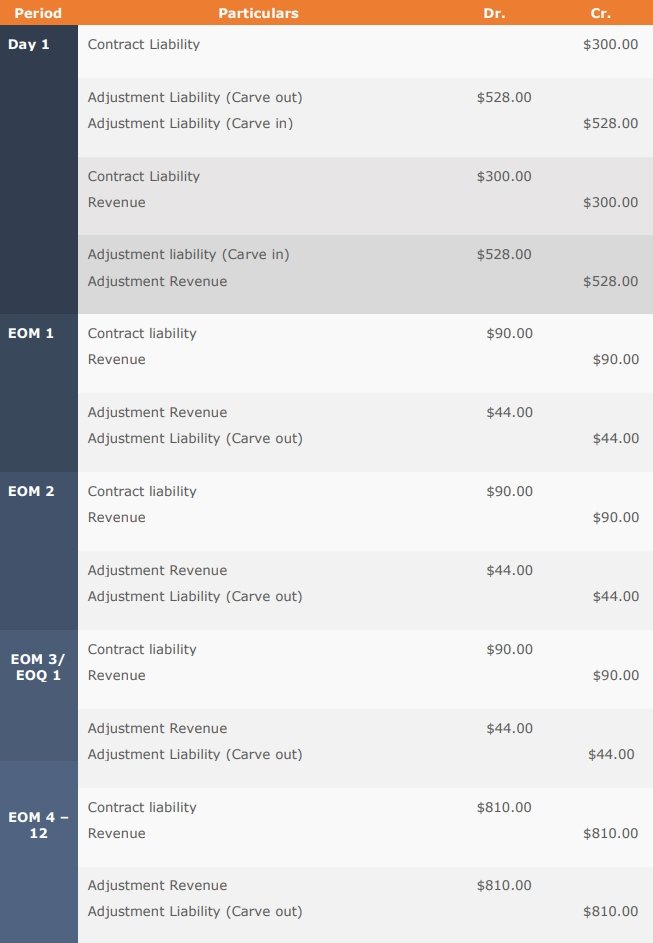

Journal Entries for revenue recognition

Disclosure Requirements

Notes:

Valuation hierarchy:

A three-level valuation hierarchy has been established under U.S. GAAP for disclosure of fair value measurements. The valuation hierarchy is based on the transparency of inputs to the valuation of an asset or liability as of the measurement date. The three levels are defined as follows.

- Level 1 – inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

- Level 2 – inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

- Level 3 – one or more inputs to the valuation methodology are unobservable and significant to the fair value measurement. A financial instrument’s categorization within the valuation hierarchy is based on the lowest level of input that is significant to the fair value measurement.

Disaggregation of Revenue:

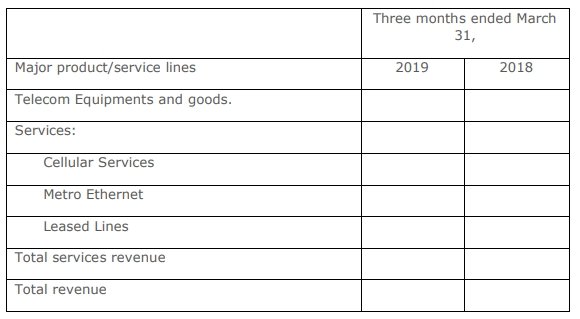

The Company’s revenue was comprised of the following major product and service lines (in thousands):

The Company’s revenue by geographic region, based on the customer’s location, is summarized as follows (in thousands):

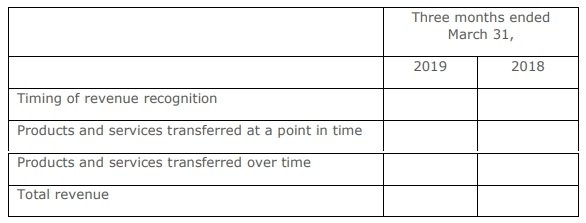

The following table presents the Company’s revenue by the timing of revenue recognition (in thousands):

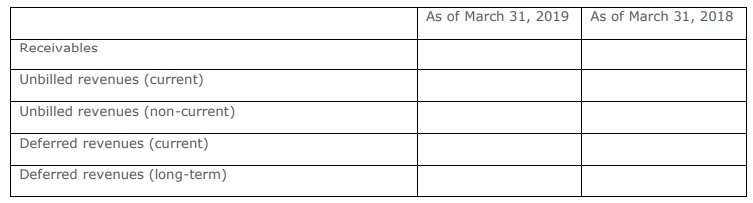

Contract Balances:

The following table provides information about receivables, unbilled revenues, and deferred revenues from contracts with customers (in millions). Unbilled revenues are presented as part of prepaid expenses and other current assets and other assets in the Company’s consolidated balance sheets:

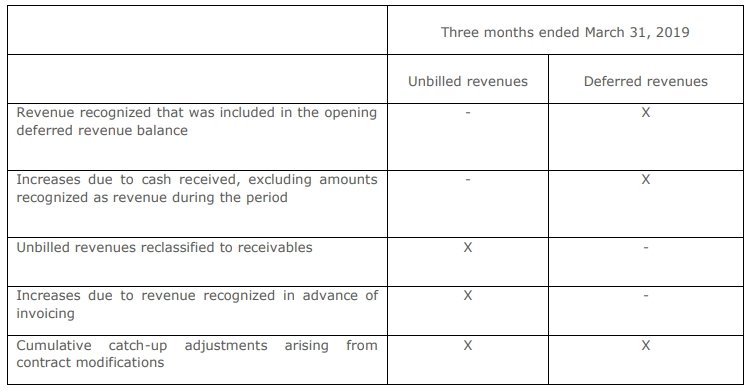

Significant changes in the unbilled revenues and the deferred revenues balances during the period are as follows:

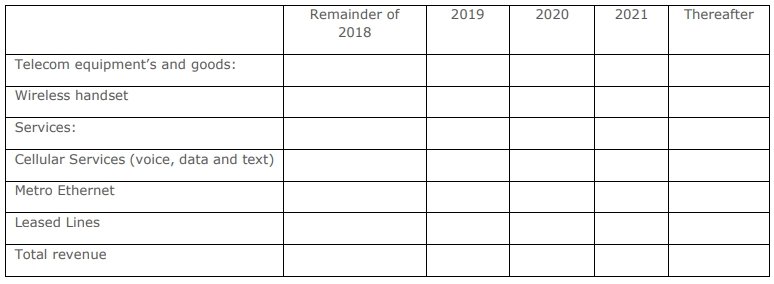

Transaction Price Allocated to the Remaining Performance Obligations:

The following table includes estimated revenue expected to be recognized in the future related to performance obligations that are unsatisfied (or partially unsatisfied) as of March 31, 2019 (in millions).

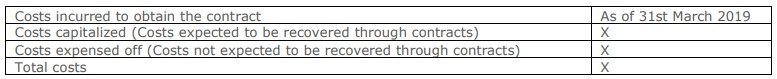

Contract costs:

Costs incurred to obtain the contract:

Costs incurred to fulfill the contract:

Did you find this case study on ASC 606 helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.