25 Mar ASC 842 – Classification and accounting treatment of Lease

A lease is a contract wherein the lessee (user) has to pay consideration to the lessor (owner) for use of an asset for a specified period of time.

The new leasing standard is one of the most significant changes in accounting to come about recently. ASC 842 strives to fundamentally record all leases on the balance sheet. The new standard defines how entities should account for leases. The new standard replaces the previous US GAAP standard 840. The aim of ASC 842 is to overcome a major loophole in ASC 840 – off balance sheet operating leases. The reason for implementing changes in the standard is to allow increased visibility into leasing obligations of the entity to the users of financial statements.

This document covers:

The document is intended to cover the following areas:

- Overview

- Classification criteria for Lease.

- Accounting treatment of Lease by lessees.

- Accounting treatment of Lease by lessors.

OVERVIEW OF ASC 842 REQUIREMENTS ON CLASSIFICATION OF LEASE.

EXCERPT FROM ASC 842 -10-25-1

“An entity shall classify each separate lease component at the commencement date. An entity shall not reassess the lease classification after the commencement date unless the contract is modified, and the modification is not accounted for as a separate contract in accordance with paragraph 842-10-25-8. In addition, a lessee also shall reassess the lease classification after the commencement date if there is a change in the lease term or the assessment of whether the lessee is reasonably certain to exercise an option to purchase the underlying asset. When an entity (that is, a lessee or lessor) is required to reassess lease classification, the entity shall reassess classification of the lease on the basis of the facts and circumstances (and the modified terms and conditions, if applicable) as of the date the reassessment is required (for example, on the basis of the fair value and the remaining economic life of the underlying asset as of the date there is a change in the lease term or in the assessment of a lessee option to purchase the underlying asset, or as of the effective date of a modification not accounted for as a separate contract in accordance with paragraph 842-10-25-8).”

- ASC 842 requires both lessors and lessees to determine the classification of all leases at the commencement of the lease.

- The commencement date would be the date when the lessor makes the underlying asset available for the lessees use.

- If a contract contains multiple components, the entity shall determine how to classify each component separately.

- Under ASC 842, lessees are required to classify leases into, Finance Lease, and Operating lease, while lessors are required to classify leases into, Sales-Type Lease, Direct Financing Lease, and Operating Lease.

- Reassessment of a lease would only be required when a contract is modified, and such modification is not treated as a part of a separate contract.

- Reassessment of the lease after the commencement date is required by a lessee if there is a change in the lease term, or on lessee’s assessment of whether it would reasonably be certain to exercise a purchase option.

CLASSIFICATION CRITERIA FOR LEASE – LESSOR AND LESSEE

5 CRITERION PROCESS TO CLASSIFY A LEASE

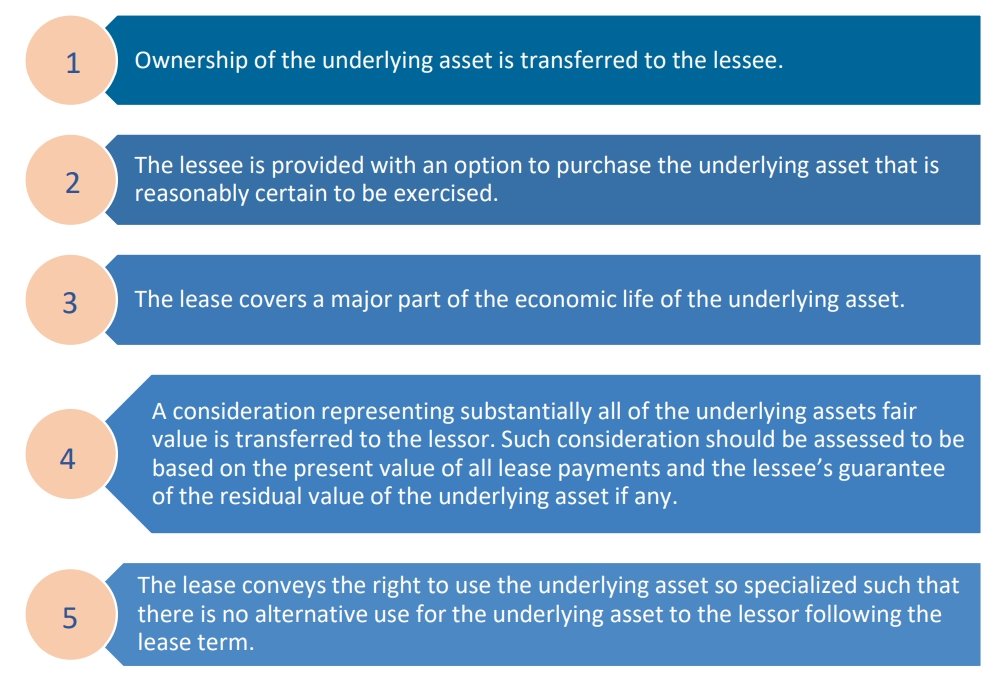

At the commencement of a lease, an entity must consider five criteria for classifying the lease. These criteria help to identify whether a lease allows the lessee to have effective control over the underlying asset. A lessor is deemed to have transferred control of the underlying asset to the lessee if the lease meets any of the following five criteria –

A lease meeting any of the above criteria would be classified as finance lease by the lessee, and as a sales-type lease by the lessor. And, if the lease meets none of the criteria specified, the lease would then be termed as an operating lease by the lessee, and as either a direct financing lease or operating lease by the lessor subject to further analysis.

CLASSIFICATION OF A LEASE INVOLVING LAND

Under ASC 842, both the lessor and lessee are required to separately account for the land component unless this would have an insignificant effect on the entity’s accounting practice.

ACCOUNTING TREATMENT BY LESSEES

FINANCE LEASE

- The lessee would record a right-of-use asset and a lease liability in the balance sheet.

- Interest and Amortization expenses are generally recorded separately in the income statement.

- Interest expense is determined using the effective interest method and amortization is usually recorded on a straight-line basis on the right-of-use asset.

- In the statement of cash flows, repayments of the principal amount should be classified as a financing activity, and variable lease payments should be classified as part of operating activities.

- The interest of lease liability will follow classification as based in ASC 230.

OPERATING LEASE

- The lessee would record a right-of-use asset and a lease liability in the balance sheet.

- Lease expense is presented as a single line item as operating expense in the income statement.

- Lease expense is to be recorded on a straight line basis over the lease term by adding the interest expense to the amortization of the right-of-use asset.

- Interest expense is determined using the effective interest method and amortization on a right-of-use asset is determined by calculating the difference between the straight line expense and interest expense on lease liability.

- The right-of-use asset is tested for impairment in accordance with ASC 360.

- Operating lease payments are to be classified as part of operating activities.

- Lease payments that are capitalized as the cost of bringing an asset to its intended use are to be classified as an investing activity.

ACCOUNTING TREATMENT BY LESSORS

SALES TYPE LEASE

- In a sales-type lease, the underlying asset is derecognized and the net investment in the lease is accounted for in the balance sheet.

- The net investment in the lease is calculated on the basis of the sum of the present value of all future lease payments, and unguaranteed residual value.

- Interest income is added, and payments collected are decreased from the net investment.

- Selling profit or loss is recorded at the commencement of lease in the income statement.

- Interest income is determined using the effective rate of interest method.

- Cash receipts from all leases are accounted for as part of operating activities in the statement of cash flows.

DIRECT FINANCING LEASE

- In a direct financing lease, the underlying asset is derecognized and the net investment in the lease is accounted for in the balance sheet.

- The net investment in the lease is calculated on the basis of the sum of the present value of all future lease payments, and unguaranteed residual value.

- Interest income is added, and payments collected are decreased from the net investment.

- Selling profit is deferred, and loss if any is recorded at the commencement of the lease.

- Interest income is determined using the effective rate of interest method.

- Cash receipts from all leases are accounted for as part of operating activities in the statement of cash flows.

OPERATING LEASE

- The underlying is recorded on the balance sheet and is depreciated over its useful life.

- Such useful life could extend beyond the lease term.

- Lease revenue and depreciation are accounted for on a gross basis in the income statement.

- Cash receipts from all leases are accounted for as part of operating activities in the statement of cash flows.

CLASSIFICATION OF LEASES BETWEEN RELATED PARTIES

ASC 842-10-55-12

- The standard requires lessors and lessees to account for related party leases on the basis of legally enforceable terms and conditions of the lease.

- This eliminates the requirement as outlined in ASC 840 for lessors and lessees to evaluate the economic substance of a lease to determine the accounting treatment.

- For related party transactions lessors and lessees are required to follow guidelines as outlined in ASC 850, Related Party Disclosures.

Did you find this article on lease helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding ASC 842 and ASC 606.