25 Mar Comparative Analysis ASC 842, IFRS 16 & IAS 17

A lease is a contract wherein the lessee (user) has to pay consideration to the lessor (owner) for use of an asset for a specified period of time.

The new leasing standard is one of the most significant changes in accounting to come about recently. ASC 842 strives to fundamentally record all leases on the balance sheet. The new standard defines how entities should account for leases. The new standard replaces the previous US GAAP standard 840. The aim of ASC 842 is to overcome a major loophole in ASC 840 – off-balance sheet operating leases. The reason for implementing changes in the standard is to allow increased visibility into leasing obligations of the entity to the users of financial statements.

This document covers:

The document is intended to cover the following areas:

- Overview

- Comparative analysis of ASC 842 and IFRS 16.

- Comparative analysis of IFRS 16 and IAS 17.

OVERVIEW

The new lease accounting regulations are set to change the way companies account for leases. The new standards will require entities that lease assets, or “lessees” to recognize on their balance sheets, assets, and liabilities of such leases. The guidance requires lessees to recognize assets and liabilities for leases having a lease term of more than 12 months. The new standards aim to aid the investors and other users of financial statements to understand the cash flows from leases.

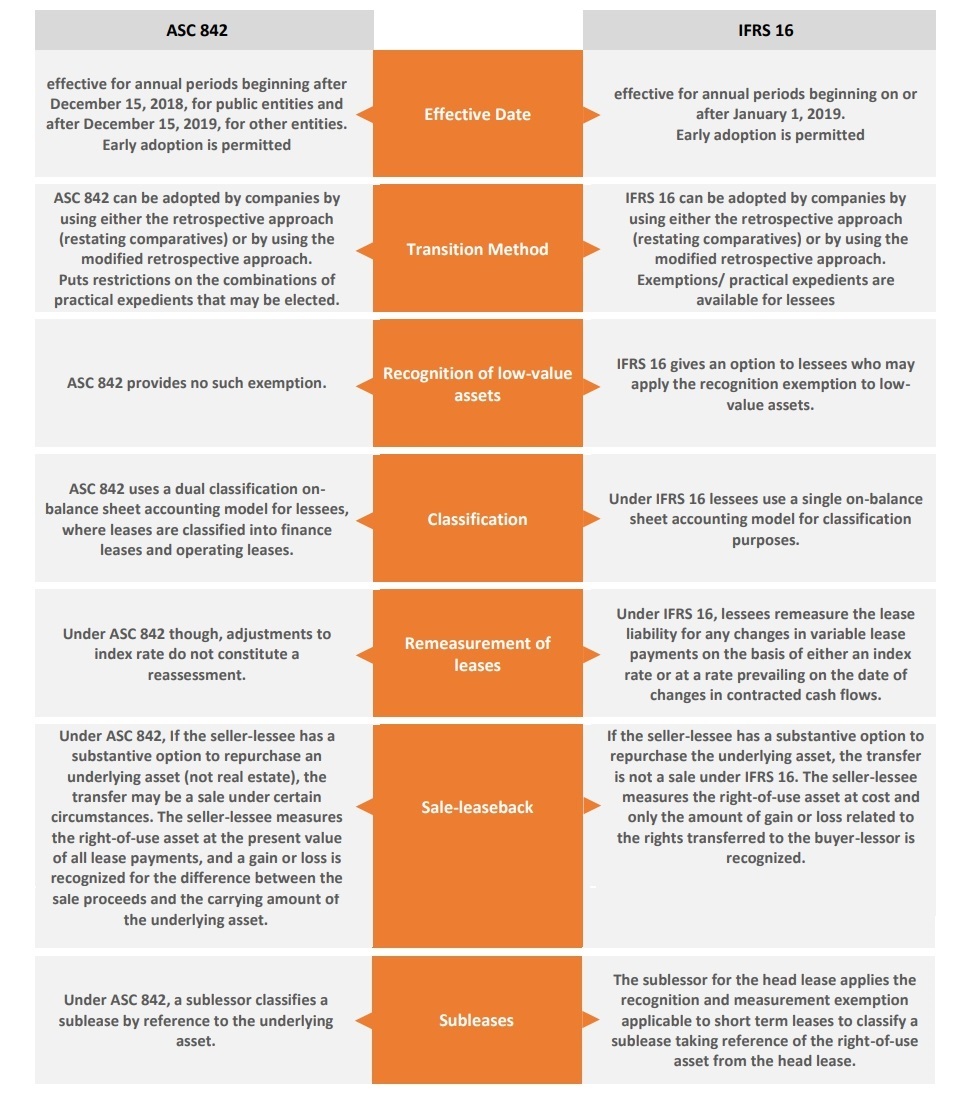

COMPARATIVE ANALYSIS OF ASC-842 AND IFRS 16

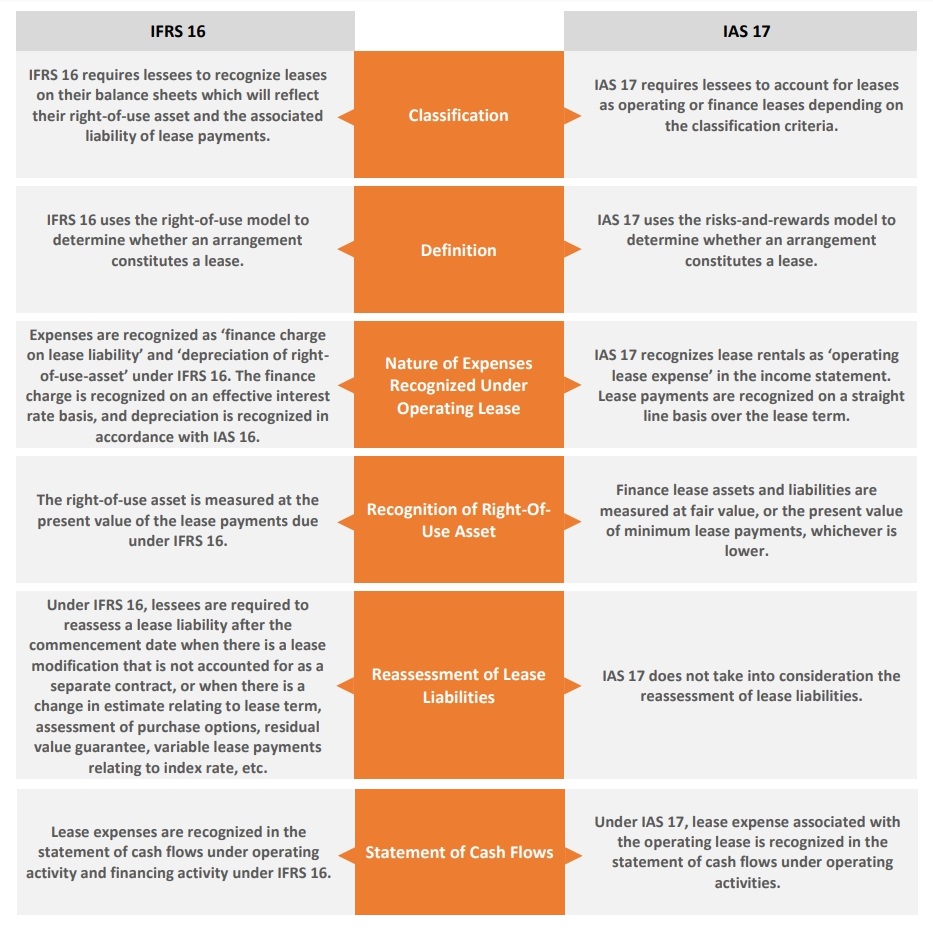

COMPARATIVE ANALYSIS OF IFRS 16 AND IAS 17

Did you find this article on lease helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding ASC 842, IAS 17, IFRS 16, IFRS 15, Revenue Recognition and ASC 606.