15 Aug Disclosure of Contract Asset, Contract Liability and Receivable

The amount of revenue an entity generates and how they recognize their revenue are two questions that are indicative of the financial health of that entity.

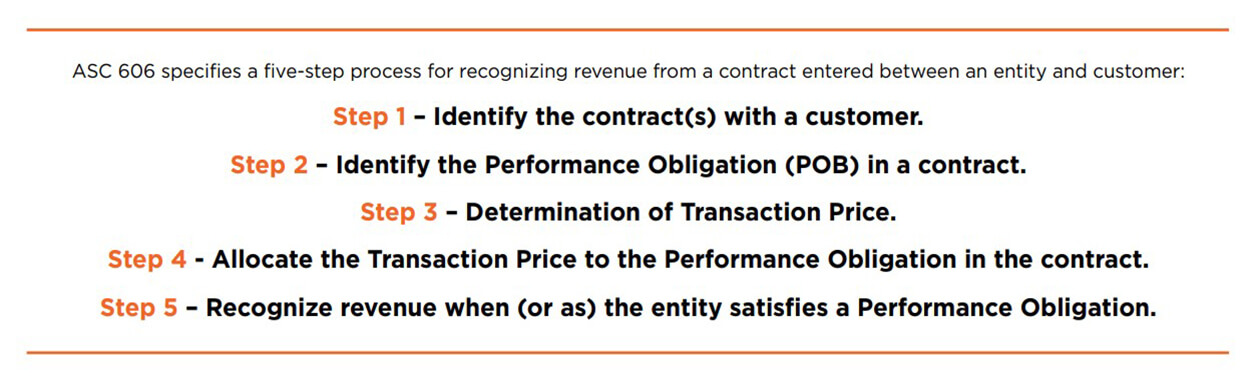

To standardize how entities, recognize revenue, FASB (Financial Accounting Standard Board) and IASB (International Accounting Standards Board) have formulated ASC 606. It is an Industry-wide revenue recognition guidance to clarify the principles for Revenue Recognition and to develop common revenue standards for U.S. GAAP and IFRS.

ASC 606 will be applicable across all the industries and aids in Revenue Recognition from all the types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

In this document we will be looking at the disclosure of contract asset, contract liabilities, and receivables and how it affects revenue recognition according to the new ASC 606 guidelines.

In 2014, the Financial Accounting Standards Board (FASB) issued its landmark standard, Revenue from Contracts with Customers. It is generally combined with the new equivalent IFRS guidelines and sets out a single and comprehensive framework for revenue recognition across all major industries. It comes in-effect in 2018 for public companies and in 2019 for all other companies and covers virtually all industries in U.S. GAAP, including those that previously followed industry-specific guidelines like the real estate, construction and software industries. For many businesses, the timing and pattern of revenue recognition will change, and, in some cases, the changes will be very significant and will require careful restructuring so that the financial statements of these companies are not untowardly disrupted.

1. Disclosure requirement:

FASB ASC 606-10-50-1 indicates that “the objective of the disclosure requirements in the revenue standard is for an entity to “disclose sufficient information” to enable users of financial statements to “understand the nature, amount, timing, and uncertainty of revenue and cash flow” arising from contracts with customers.” The standard further says that “an entity shall consider the level of detail necessary to satisfy the disclosure objective and how much emphasis to place on each of the various requirements.”

2. Contract Asset and Contract Liability:

The netting process is a reporting requirement mentioned in the new guidance under ASC 606-10-45-1 which is to be performed in every accounting period. Netting in brief is classification of balances in to Contract Asset or Contract Liability in financial statement.

ASC 606-10-45-1 exhibits the classification of a contract as either ‘contract asset’ or ‘contract liability’ which are generated from revenue from contracts under ASC 606 in an entity’s financial statements.

3. Understanding Contract Asset, Contract Liability and Receivables

3.1 What does guidance ASC 606 indicate on presentation of Assets and Liabilities that arises from Contracts

with customers?

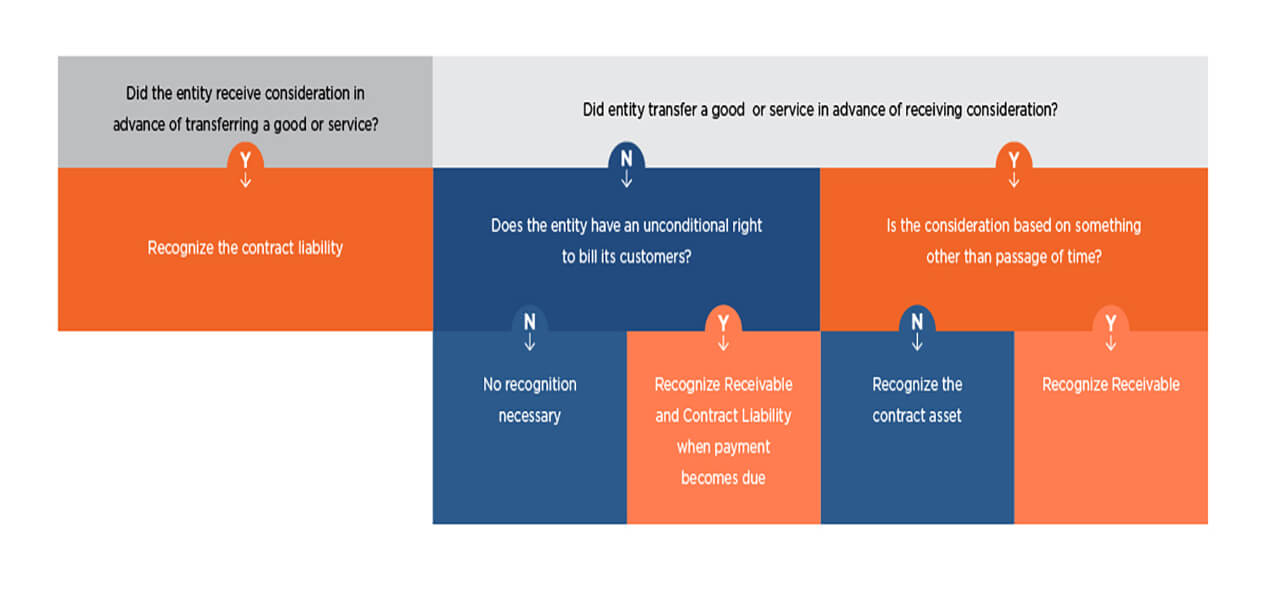

- Guidance indicates that, “When either of the parties to a contract has performed, an entity shall present the contract in the statement of financial position as a contract asset or a contract liability, depending on the relationship between the entity’s performance and the customer’s payment.” An entity shall present any unconditional rights to consideration separately as a receivable.

3.2 What is Contract Asset/Contract Liability/ Receivables?

- As per ASC 606, A contract asset arises when an entity transfers a good or performs a service in advance of receiving consideration from the customer as agreed upon. A contract asset becomes a receivable once the entity’s right to the receive consideration becomes unconditional.

- A contract liability arises when an entity receives consideration from its customer (or has the unconditional right to receive consideration) in advance of performance.

- For accurate Revenue Recognition, Contract assets, receivables and contract liabilities should be presented separately on the statement of financial position or in the footnotes. Entities should look to other accounting standards (for example, balance sheet offsetting guidance in ASC 210-20) to assess whether it is appropriate to net contract assets and contract liabilities that arise from different contracts (for example, multiple contracts with the same customer) that are not required to be combined as per the revenue standard.

- A receivable is distinguished from a contract asset if the receipt of the consideration is unconditional. The standard requires that receivables be presented separately from contract assets as the receivables and contract assets are subject to different levels of risk. Although both are subject to credit risk, contract assets are also subject to other risks (e.g., performance risk). Once an entity’s right to consideration becomes unconditional, the contract asset should be reclassified as a receivable – even if the entity has not generated an invoice (i.e., unbilled receivable).

Example: On January 1, 2019, an entity enters into a cancellable contract to transfer a product to a customer on March 31, 2019. The contract requires the customer to pay consideration of $1,000 in advance on January 31, 2019. The customer pays the consideration on March 1, 2019. The entity transfers the product on March 31, 2019. The amount required by the client to be paid in advance in this example is an unconditional right to receive the consideration and will be considered as receivable.

- If a customer pays consideration, or the entity has a right to an amount of consideration that is unconditional (receivable), In such cases before the entity transfers a good or service to the customer, the entity shall present the contract as a contract liability when the payment is made or the payment is due (whichever is earlier).

3.3 How should offset of Revenue related accounts be generally be performed?

- For contracts having multiple performance obligations, contract assets and contract liabilities should be netted together at the contract level. Entities should ideally present the contract as a contract asset or a contract liability for each revenue contract (or a group of contracts that are required to be combined under the new standard) rather than to present multiple contract assets and/or contract liabilities for the same revenue contract based on individual performance obligations in the revenue contract.

3.4 Is it necessary to use terms as ‘Contract Asset’ and ‘Contract Liability’?

- The guidance of ASC 606 does not mandate entities to use the specific terms “contract asset” and “contract liability”. Entities may use alternative descriptions if they provide sufficient information to distinguish between those contracts where rights to receive consideration from the customer are conditional (contract assets) from those where the right to receive the consideration is unconditional (receivables) and where an entity receives consideration from its customer or has the unconditional right to receive consideration) in advance of performance (Contract Liability).

3.5 How is contract Asset and Contract Liability disclosed?

- In addition to disclosure of Contract asset, Contract liability, and Receivables in financial statements, entities should also present them as current and non-current (Short term and long term in other words) in a classified statement of financial position. Contract assets and liabilities should be disclosed separately from other balances related to revenues outside the scope of ASC 606 like receivables from contract revenues should be disclosed separately from receivables that arise from leasing contracts.

* When presenting contract assets and receivables, a company can net contract assets and liabilities at a contract level but should also present them separately in aggregate in financial statements.

Did you find this article helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.