25 Nov Enhancement for MJE Processing

Enhancement for MJE Processing

Company Background:

ABC Co. provides integrated Information Technology (IT) solutions in the United States, Canada, and the United Kingdom. It operates through two segments, Corporate and Public. The company offers hardware products, such as notebooks/mobile devices, network communications, enterprise and data storage, video monitors, printers, desktop computers, and servers; and software products, including application suites, security, virtualization, operating systems, and network management.

Challenge:

During the time of close everyone is more focused on getting the financial operations and number finalized so that they would prefer to spend less time worrying about approving and posting the Manual Journal Entries.

The user was looking for an option where he could save time in approving and posting the MJEs since the volume of ABC Co. is 4M lines approx. per month. During the close, time is very essential and the current process to approve and post the MJE and then run Transfer accounting for each JE batch was very time-consuming.

The user had to first approve the MJE and then go to transfer accounting and first update the batch (which takes around 5-10 mins) and then again go and manually click on transfer to transfer the batch.

This tedious process during the time of Close was causing issues to the MJE approver to keep track of the approvals to be made and the updating and running transfer accounting.

Solution:

Zuora Revenue has the ability to create a job similar to Transfer Accounting Master job which reduces the time consumed for MJE approval and manually clicking on a transfer just by adding the Criteria Name (JE Batch ID) and Criteria Value field which will be the mandatory fields.

The following setups are performed to create the Job:

- Navigate to setups ➜ Applications ➜ Background Jobs

Create a new Job replicating the Transfer Accounting Master Job.

In the job parameters, it is recommended that parameter name i.e. Criteria name and Criteria value should be mandatory so that Job isn’t submitted with blank parameter values.

Job Details: The following need to be set up in template:

- Program Name: This name will be displayed in Reports Schedule Job> Schedule Jobs

Example: Transfer Accounting-MJE

- Procedure Name: It defines the procedure to be performed from the UI to run the program systematically step by step with the help of SQL.

The procedure name will be a replication of Transfer Accounting Master Job which is a Zuora Revenue Standard job.

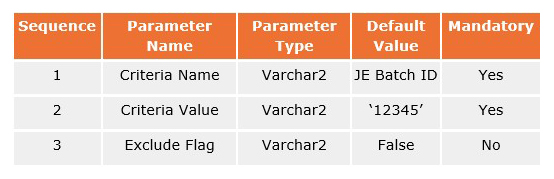

- Program Parameters: Go to Programs tab and enter the default Value in Criteria name as ‘JE Batch Id’. Make the Criteria name and Criteria Value parameters mandatory as shown below and click on Save.

The field Criteria name and Criteria value which is marked as mandatory need to be provided every time we run the job of Transfer Accounting-MJE.

- Navigate to Reports ➜ Schedule Jobs

Here we need to select the program name which was defined in the job details of background jobs. Save the program and click on the Parameters tab and fill the mandatory fields Criteria name and Criteria value.

Example:

Program Name: Transfer Accounting-MJE (Should be selected from the drop-down list)

Parameters:

Criteria Name: JE BATCH ID (Populate by default)

Criteria Value: ‘12345’

Exclude Flag: N (Populate by default)

So now the user need not worry about updating and posting the Manual Journal Entries process like before. There is no need to update and then run Transfer accounting for each JE batch which was really very time-consuming.

Using this job (Transfer Account – MJE), the user can simply enter the JE Head ID of the MJE which he has approved and submit the job.

This way the user does not have to wait for the batch to get updated first and then transfer.

It acts as a One-Click Transfer accounting process for the MJEs and saves up to crucial 15-20 mins per MJE time /80 hours per quarter (depends on the MJE passed) of the user during the close.

Did you find this article on ASC 606 case study helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding ASC 842, IAS 17, IFRS 16, IFRS 15, Revenue Recognition and ASC 606.