28 Aug Foreign Exchange Accounting

Revenue is an important point of concern to the users of Financial Statements in assessing an entity’s Financial Performance and Position.

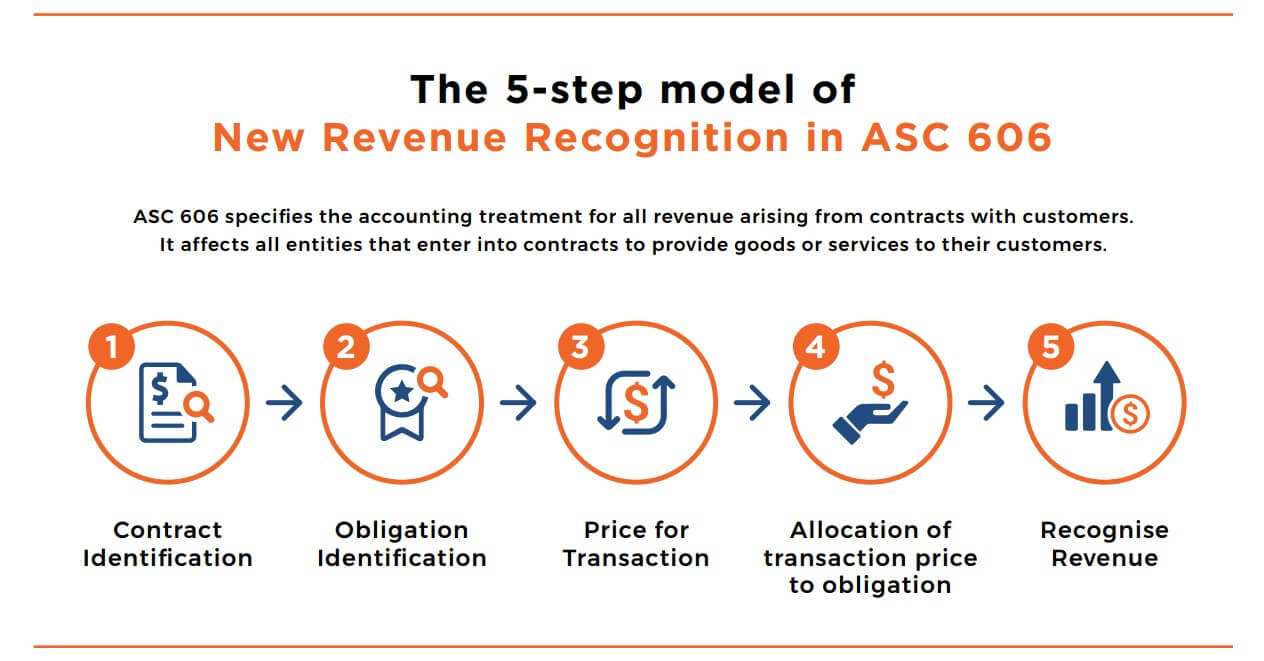

Accounting Standard Codification (ASC) 606 – Revenue from Contract with Customers is an Industry-wide revenue recognition guidance which has been formulate by Financial Accounting Standard Board (FASB). This was a joint task by Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop common revenue standard for U.S. GAAP and IFRS.

ASC 606 will be applicable across all the industries and aid in recognizing revenue from all the types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

1. INTRODUCTION TO FOREIGN EXCHANGE ACCOUNTING

With businesses increasingly tapping foreign markets, there was a need to create guidelines on the treatment of revenue earned in foreign currency. Foreign Exchange Accounting covers the accounting of the transactions which are carried by a business in different currencies (Foreign currency) other than functional currency, and records such transactions in the functional currency of the reporting entity, based on the exchange rate in effect on the date of transaction.

This also takes into picture any gains or losses that occur due to change in the expected exchange rate between the functional currency of the entity and the currency in which a transaction is denominated.

The two situations in which business should not recognize a gain or loss on a foreign currency transaction are:

1. When a foreign currency transaction is designed to be an economic hedge of a net investment in a foreign entity, and is effective as such; or

2. When there is no expectation of settling a transaction between entities that are to be consolidated.

2. TYPES OF CURRENCIES

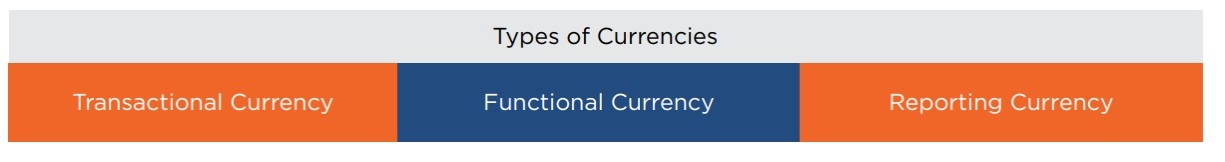

To have clearer picture on foreign exchange accounting, the norm has classified currencies based on their business usage:

Transactional currency – This is the currency in which payment is made. All the transactions are converted into the transactional currency for which payment Is done.

Functional currency (ASC 830-10-45-7) – Once the functional currency for a foreign entity is determined, that determination shall be used consistently unless significant changes in economic facts and circumstances indicate clearly that the functional currency has changed. This currency is the primary currency in which all the transaction of inflow and outflow takes place, basically the primary economic environment in which the business operates. This currency may be different from the currency used by its parent company or subsidiary.

Reporting currency (ASC 830-10-20) – This currency is used for entities’ presentation of financial statements. This is used to compile transactions of all different currencies into one currency for easy and complete understanding.

Example: Consider an example of a company ‘A’ having basic operations carried in India and headquarter is in USA, making some business transactions in GBP. In this case, the Transactional currency is GBP (Great Britain Pound), Functional currency is INR (Indian Rupees) and Reporting currency is USD (US Dollars).

3. FOREIGN CURRENCY TRANSACTIONS

The foreign exchange accounting gets initiated because of Foreign currency transactions, so what is foreign currency transaction?

Foreign currency transactions are the transactions denominated in any currency other than functional currency for that particular entity. These are converted into the functional currency at a later date.

Examples of these transactions are –

Revenue, Intercompany adjustments, Tax imposed by government etc.

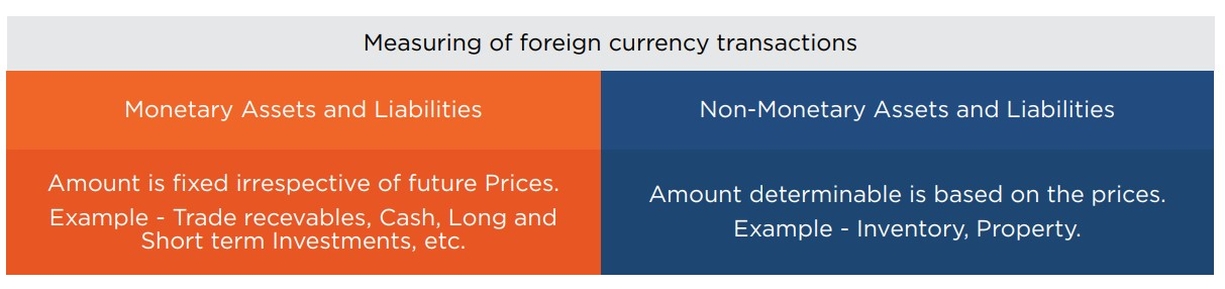

When determining whether an asset or liability is monetary or nonmonetary, a reporting entity should consider the guidance in ASC 830-10-45-18 and ASC 255.

After the measurement of currency transaction gain or loss as discussed in ASC 830-10-45-17.

4. ACCOUNTING ENTRIES

4.1 MONETARY ASSETS AND LIABILITIES

XYZ Ltd, a UK based business sells goods to ABC Ltd, a US based business for $1,000 on 1st March 2018, when the exchange rate was £1 to $1.29.

Following entry will be passed in books.

On 31st March 2018 Payment is made by ABC Ltd., exchange rate at this point of time was £1 to $1.35, due to which XYZ Ltd. suffered a loss of £34.4531. The following entry will be passed in the books.

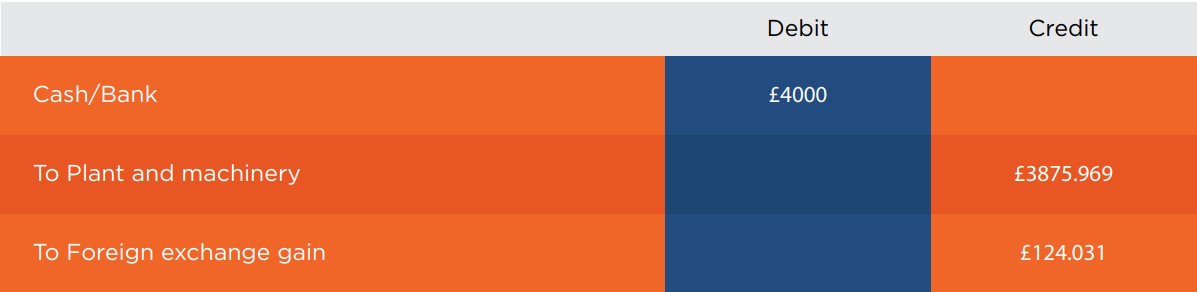

4.2 NON-MONETARY ASSETS AND LIABILITIES

XYZ Ltd buys plant and machinery from ABC Ltd for $5,000 when exchange rate was £1 to $1.29. Following entry to be passed.

After a month, when exchange rate moves to £1 to $1.25, payment is made by XYZ Ltd. to ABC Ltd. The following entry will be passed in the books.

All the line items of the balance items are recalculated for closing the accounts and further translation gain and loses are to be calculated for the same. Later, when payments are made, then again gain and losses are calculated, and the accounts are adjusted accordingly.

Did you find this article helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.