06 Aug Step 1 – Identify the Contract with a customer

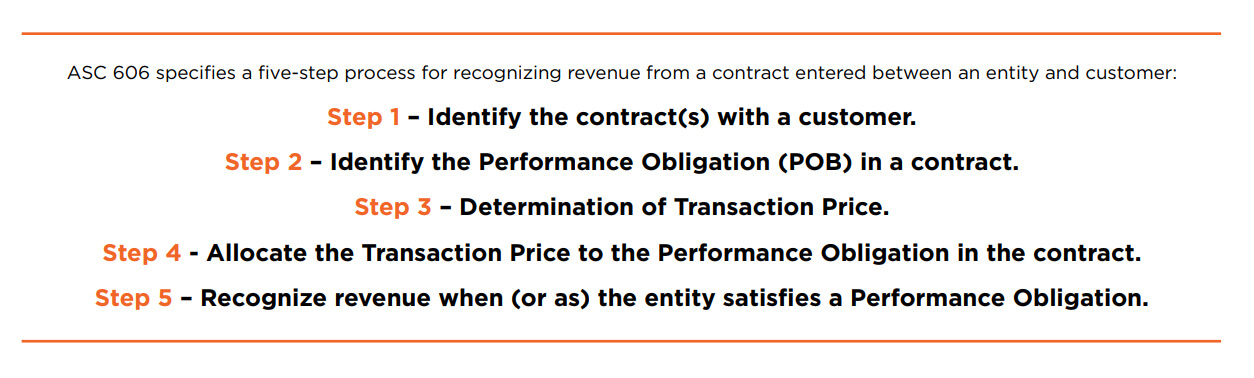

Being a crucial part of assessing an entity’s financial performance, revenue recognition is the foundation of financial accounting and reporting. The ASC 606 (Accounting Standard Codification), simply put, is a guide that helps entities to recognize revenue accruement by laying down clearly the principles to identify revenue contracts. It was formulated by the joint task force that comprised of the Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop a common revenue standard for U.S. GAAP and IFRS.

ASC 606 will be applicable across all industries and aid in revenue recognition according to U.S. GAAP, accruing from all the types of transactions, except those that are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

For the purpose of this blog, we will concentrate on Step 1 which deals with identifying a contract.

As per guideline ASC 606-10-25-2, a contract is an agreement between two or more parties that creates enforceable rights and obligations. There are some rights and obligations that abide the contract and enforcing them is a matter of law. Contracts can be stated explicitly in a written or oral form or can be implied by the entity’s customary business practices. Their nature might change according to the processes and practices that vary across industries, jurisdictions and entities. Even when they are varied within an entity according to the class and nature of goods and services, a contract remains enforceable and must be recognized.

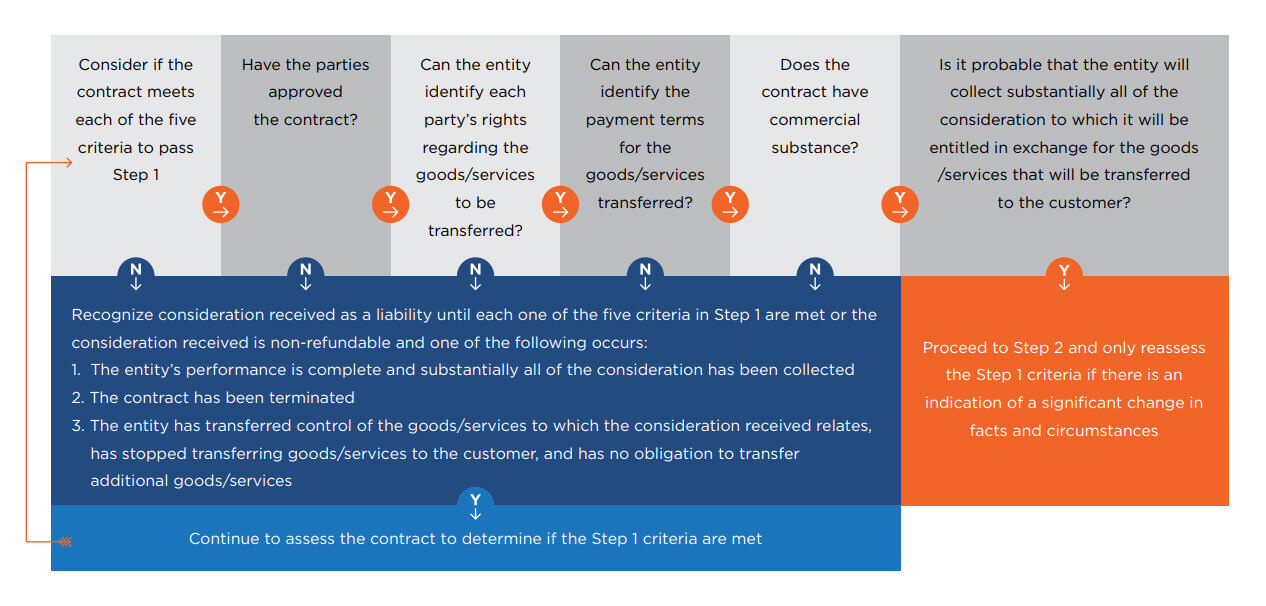

The essential parts of a contract include:

a. All parties have approved the agreement – Contracts may be written, oral or implied depending on entity’s normal business practices. Contract enforceability is a matter of law, an entity should consider the legal jurisdiction in which it operates as the rules for contract enforceability.

b. All parties are committed to fulfilling their obligations – If each party has the unilateral right to terminate a wholly unperformed obligation, then the standards states that no contract exists. This criterion addresses termination clauses

c. Each party’s rights are identifiable – A prerequisite for recognizing the contract and the rights and obligations within it is that the agreement must clearly indicate the goods and/or services to be provided. Through identifying the transfer of control, this helps to recognize the revenue.

d. The contract has commercial substance – In order to be recognized as a contract, it is important that it causes a change in risk to the customer, timing of delivery of the goods and services as also the amount of cash that flows to an entity. The contract must not entertain any social contract

e. Collectability is probable – The new standard requires vendor to evaluate a customer’s credit risk at the inception of the contract. Revenue recognition only takes place when payment is likely to be received.

Exceptional Considerations

A) Payment for Agreement with no contract

When payment is received for an agreement that does not qualify as a contract as per the guidelines, then the vendor can only recognize revenue when one of two events occurs as mentioned below.

I. Either the agreement has been terminated and the payment received is not refundable; or

II. The vendor does not owe any goods or services to the customer and all the transaction price has been received and is not refundable.

Example: A Real estate Broker enters into a contract to sell a building to a customer who plans to open a Shopping Mall. The Real estate Broker receives a non-refundable deposit from the customer. The remaining amount due is to be paid over time from the Shopping Mall’s revenues. There is significant risk that the remaining amount will be collected, so a contract does not exist according to the standard. The upfront deposit cannot be recognized as revenue until substantially the entire remaining amount owed is received, or the shopping mall gets closed and the contract is terminated.

B) 606-10-25-9

An entity can combine two or more contracts entered into with the same customer (or related parties of the customer) and account for the contracts as a single contract if minimum one of the following criteria is met:

I. The contracts are negotiated as a package (bundle) with a single commercial objective (For example, when you buy a product and get another product free at the supermarket)

II. The amount of consideration to be paid in one contract depends on the price or performance of the other contract. (For example, a ‘‘buy 2 at 100/-’’ offer at an apparel shop)

III. The goods or services promised and agreed in the contracts (or some goods or services promised in each of the contracts) are a single performance obligation.

Did you find this article on the Identification of contracts helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.