07 Sep Identifying Performance Obligation

Revenue is an important point of concern to the users of Financial Statements in assessing an entity’s Financial Performance and Position.

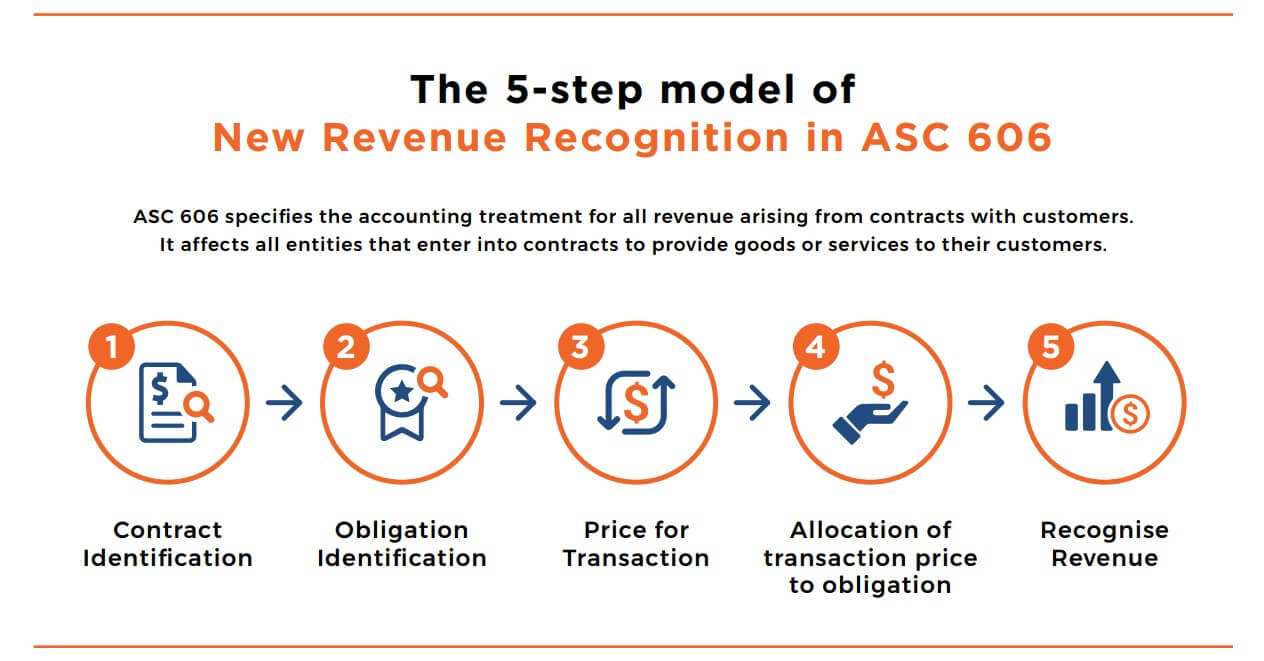

Accounting Standard Codification (ASC) 606 – Revenue from Contract with Customers is an Industry-wide revenue recognition guidance which has been formulate by Financial Accounting Standard Board (FASB). This was a joint task by Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop common revenue standard for U.S. GAAP and IFRS.

ASC 606 will be applicable across all the industries and aid in recognizing revenue from all the types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

1. WHAT IS PERFORMANCE OBLIGATION

In simple terms performance obligation is a “Promise” to deliver goods or services in lieu of payment (in advance or otherwise).

As per the guidelines:

At the inception of a contract, an entity shall assess the promises made in the contract to a customer and shall identify them as performance obligations. These may include:

- A good or a service (or a bundle of goods or services) that is distinct.

- A series of distinct goods or services that are substantially the same and that have the same pattern of transfer to the customer.

For example: Retailer Peter agrees to sell his customer, Bob, a new Washing Machine. The performance obligation, as per the customer invoice, is delivering the Washing Machine to Bob in exchange for the stated consideration. In another example, Star garage agrees to change some parts in David’s vehicle in exchange for the stated consideration. Here the particular service is considered as an performance obligation according to ASC606 Revenue Recognition Guidelines.

There are an infinite number of such transactions happening daily. Most of them are straightforward, and ASC 606 is easily applied. However, there are many contracts which may contain multiple performance obligations and for such contracts careful analysis and judgments maybe required.

Generally, performance obligations are specifically stated in the contract. However, performance obligations can also be suggested though not directly expressed in the contract if, when entering into the contract, the promises create a reasonable expectation on the part of the customer.

For instance, in the above examples: If the retailer Peter agrees at the time of the sale, to deliver the Washing Machine to the customer’s house, this may create a separate performance obligation. If the Star garage always washes the customer’s car after changing the oil, this may warrant a separate performance obligation. However, these are quite easy, other performance obligations require more complex judgment to spot. Especially when applying the guidance to complex contracts.

2. PROMISES IN THE CONTRACT ARE DISTINCT OR NOT

In the prior section, we discussed that performance obligations are distinct goods, services, or bundles of goods/services.

What is Distinct?

However, what does it mean to be distinct? Two conditions are necessary for goods/services to be considered distinct, the answer must be yes to BOTH of the following questions:

1. Capable of Being Distinct: Can the customer benefit from the good or service on its own or together with other readily available resources?

2. Distinct within the Contract: Is the entity’s promise to transfer the good or service separately identifiable from other promises in the contract?

If the answer to both of these is yes, then the good/service/bundle is a performance obligation.

If the promised good or service is determined to not be distinct, an entity should continue to combine it with other promised goods or services until it becomes distinct.

For point (1) above: Indicators that an entity can get benefited from a good or service including the fact that an entity regularly sells such a good or service

For point (2) above: Factors that indicate that a promise is separately identifiable are:

1. The entity does not provide a significant service of integrating the good or service with other goods or services promised in the contract into a bundle of goods or services that represent the combined output for which the customer has contracted. (In other words, the entity is not using the good or service as an input to produce or deliver the combined output specified by the customer.)

2. The good or service does not significantly modify or customize another good or service promised in the contract.

3. The good or service is not highly dependent on, or highly interrelated with, other goods or services promised in the contract. For example, if a customer decides not to purchase the good or service without significantly affecting the other promised goods or services in the contract, this might indicate that the good or service is not highly dependent on those other promised goods or services.

Note – If the promises do not meet the requirements for separating, the performance obligations shall be combined into one performance obligation. A contract could have several performance obligations which in themselves include sets of promises that are not distinct and cannot be separated.

3. SOME EXAMPLES OF APPLYING THE GUIDANCE, DERIVED FROM THE ASC 606 EXAMPLES, FOLLOW:

3.1. Goods and services are not distinct: Say, a School, for the purpose of extending the school building, enters into a contract with a contractor. The contract states that the contractor would be responsible for the overall management, including maintenance of the site, construction of the building, and other site work, and also includes the various goods and services that would be provided.

All the promised goods and services are capable of being distinct as other entities can also provide the same. However, the goods and services are not distinct in the context of the contract, as the entity provides significant services in integrating to all the promises to deliver a newly constructed wing, that the school had contracted for. Since both the above criteria are not being met, the contract contains one single performance obligation, that is, to construct the entire new extension as per the promise!

3.2. Distinct goods and services: An IT company enters into a contract to deliver the following to a customer: a software license, installation services, subsequent software updates, and online technical support services for a period of three years.

Let us analyze the promises other than that of the software license: Other entities working within the same industry also routinely provide installation services which does not significantly modify the software originally provided. Therefore, the customer can benefit from the service on its own by adding other readily obtained resources, i.e. the software license.

The software license is a separately delivered item and can function without the frequent updates or the technical support. Thus, the customer can benefit from the license on its own. The updates and technical support are also separately available as the entity sells the products separately.

The contract thus has four performance obligations:

- Software license

- Installation services

- Software updates

- Technical support

Revenue will be recognized as and when each one of the obligations is fulfilled by the entity.

3.3. Customization services: Considering the same facts in the above example of IT company, consider that the software requires significant customization as per the customer’s requirements. In this situation, since the customer cannot obtain the special customizations from another entity, the customer cannot obtain the benefit of the software license from readily obtained resources. The software license and custom installation services are thus clubbed into one performance obligation. Hence, here the contract has three performance obligations:

- Software license and custom installation

- Software updates

- Technical support

Revenue will be recognized as and when each obligation is satisfied by then entity. Specifically, in this example the consideration related to the software license itself could not be recognized until the customization services are completed.

4. ASSESSING EXPLICIT AND IMPLICIT PROMISES IN THE CONTRACT:

Say for example, a contract states that the vendor will provide free maintenance services without additional considerations. (This is same as maintenance services provided to new vehicles sold with free maintenance service for a specified period.) The maintenance services will be outsourced to a third party. The entity determines that this arrangement constitutes a separate promise, as the maintenance could be provided by a third party, and therefore is distinct. As such, the consideration for the product is allocated between two performance obligations.

Implicit promise of service:

The entity has a history of providing free maintenance for the products sold. There is no specific mention of the same in the contract (either with the distributor or the end user), but the entity determines that the end user has an expectation of free maintenance services based on the entity’s history of the provision of the free service. In this case, the entity determines that there are two performance obligations.

Services that are not a performance obligation:

Say, a contract with a distributor does not contain an explicit promise of free maintenance, nor does the entity have a history of providing any such service to its customers, that might indicate that free maintenance should be expected by the end user. However, if after the delivery of the products to the distributor and before the sale of the same to the end user, the manufacturer unilaterally decides to provide free maintenance and also notifies the distributor of its intention to do the same, it will not be considered a separate performance obligation, since the free maintenance was not part of the contract or negotiated for by any parties.

5. POINT IN TIME AND OVER TIME:

Revenue Recognition either over a period of time or at a point in time, depending on when a performance obligation is fulfilled in a contract. If an “entity transfers control of a good or a service over time,” then that entity “satisfies the performance obligation and recognizes revenue over time.” Therefore, before recognizing any revenue, an entity should determine when control over a promised good or service (that is, an asset) is transferred to a customer, whether it is transferred over time or at a point in time.

ASC 606-10-25-27 requires an entity meeting at least one of the three criteria in order to demonstrate that control over an asset is transferred over time. If one of the criteria is met, then the entity should recognize revenue over time. The three criteria in ASC 606-10-25-27 are listed below:

1. “The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs.” (Criterion 1)

2. “The entity’s performance creates or enhances an asset (for example, work in process) that the customer controls as the asset is created or enhanced.” (Criterion 2)

3. “The entity’s performance does not create an asset with an alternative use to the entity, and the entity has an enforceable right to payment for performance completed to date.” (Criterion 3)

Criterion 1

Criterion 1 is mainly for services that are consumed by customers continuously over a period of time. However, many service providers may have difficulty in determining whether or not their customers consume benefits as they perform each obligation; this is due to the subjectivity in determining what the “benefits” are. To address this issue, the new standard requires the service provider to assess, in a hypothetical situation, if another provider would need to substantially re-perform the work completed to date. If another provider does not need to substantially re-perform the work done, then the original service provider should establish that control is transferred over time; consequently, the customer is assumed to receive and consume the benefit as the service provider performs an obligation.

For example, LKP Company has a contract with a customer to ship goods from Point A to Point B. LKP uses a hypothetical situation where LKP stops at a point between Point A and Point B and cancels the contract. It then enters into a contract with another shipper to deliver the goods to the destination B.

Here, the analysis lies in determining whether the other shipper needs to redo a substantial amount of work that LKP has already performed (e.g., go back to Point A and restart from there), which is highly unlikely in this case. Therefore, LKP may assume that the customer is receiving the benefit as it performs the delivery.

Criterion 2

For example, Fixers Corp Ltd(“Fixers”) has a contract to renovate a customer’s office building. The customer retains the legal title of the building and owes an outstanding loan on the building; Fixers has the physical possession of the building during the renovation period.

Although Fixers has the physical possession of the building during the renovation, the risks and the rewards of owning the building lie with the customer. In case of any natural disasters damaging the building, the customer would incur a loss on the building. On the Other hand, if the value of the building increases during the renovation period, the customer would benefit because of the increased value. Additionally, the legal title and outstanding loan also states that the customer has control over the building. In this case, Fixers contract with this customer may meet Criterion 2, hence it should recognize revenue over time.

In the FASB’s Basis for Conclusion, the FASB observed that for some performance obligations, it is not clear if the customer has control over the asset that is built or enhanced as the entity performs the obligations. Criterion 3 is designed to offer more guidance for such situation as discussed above.

Criterion 3

ASC 606-10-25-27 includes Criterion 3 mainly for entities that provide services or goods that are specifically tailored to one customer. This criterion has two requirements that an entity must meet to demonstrate that control is transferred to the customer over time as the entity fulfills an obligation. First, the asset must not have an alternative use to the entity. Second, the entity must have an enforceable right to payment.

Alternative Use. To assess if an asset has an alternative use, the entity should consider practical limitations as well as contractual restrictions. This assessment should be made at the inception of the contract; nevertheless, should a modification in the contract arises at a future date and that modification substantially changes the performance obligation in the contract, then the entity should make a subsequent assessment.

Practical Limitations: In considering practical limitations of directing an asset to another use, the entity should consider whether the asset is designed and produced to fit unique specifications of the customer. This could be determined by evaluating whether or not (a) the entity would incur a significant cost to rework the asset for a different purpose or (b) the entity would only be able to sell the asset at a significant loss. Moreover, an entity should complete this evaluation based on the asset’s expected final form, not the asset’s form while in production.

For example, Consultants Corp has a contract with a customer to provide consulting services in the form of a deliverable at the completion of the contract. The completed product, would be unique to the customer; making it highly unlikely for Consultants Corp to sell this deliverable to another customer without a significant amount of rework on the same. Consultants Corp can ascertain that the consulting deliverable does not have an alternative use.

Contractual Restrictions: Practical limitations may not always be a viable method to prove that an asset has no alternative use; hence, contractual restrictions may be more relevant than practical limitations (e.g. some real estate contracts). Criterion 3 requires the contractual restrictions be substantive. It means that an asset must not be fundamentally interchangeable with other assets that the vendor owns; additionally, the vendor should not be able to transfer that asset to another customer without incurring significant loss or breaching the contract with the customer.

For example, Brokers Ltd has a contract to sell a farmland to the William family. The farmland is similar to many of the farmlands in the area; however, the contract guarantees a specific farmland to the William family. If Brokers sells this farmland to another customer, then the William family is entitled to a penalty payment from Brokers for a breach in the contract. In this situation, the contractual restriction is substantial because the farmland is not interchangeable with other farmlands that Brokers sells; additionally, Brokers would incur a loss by breaching the contract if it were to transfer the Farmland to another customer.

All the line items of the balance items are recalculated for closing the accounts and further translation gain and loses are to be calculated for the same. Later, when payments are made, then again gain and losses are calculated, and the accounts are adjusted accordingly.

Did you find this article on the Identification of Performance Obligation helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.