24 Mar Insights on: Material Rights, Variable Consideration, Termination for Convenience and Significant Finance Component

Insights on: Material Rights, Variable Consideration, Termination for Convenience and Significant Finance Component

- Material Rights:

Material Rights is an option given to a customer to acquire additional goods or services free of charge or at a discount. But there are few conditions/check points attached to it to conclude a transaction as Material rights:

1) These options might include customer award credits or other sales incentives and discounts. An option gives rise to a separate performance obligation if it provides a material right that the customer would not receive without entering into the contract.

2) If in a contract, an entity grants a customer the option to acquire additional goods or services, that option gives rise to a performance obligation in the contract only if the option provides a material right to the customer that it would not receive without entering into that contract (for example, a discount that is incremental to the range of discounts typically given for those goods or services to that class of customer in that geographical area or market). If the option provides a material right to the customer, the customer in effect pays the entity in advance for future goods or services and the entity recognizes revenue when those future goods or services are transferred or when the option expires.

3) However, having the option to acquire future products and services at a discount that would not be received without entering into the contract is not the only thing to consider in determining if a material right exists. We must also consider the price at which those products and services can be acquired. If a customer has the option to acquire an additional good or service at a price that would reflect the stand-alone selling price for that good or service, that option does not provide the customer with a material right even if the option can be exercised only by entering into a previous contract. In those cases, the entity has made a marketing offer that it shall account for in accordance with this Standard only when the customer exercises the option to purchase the additional goods or services.

4) If a customer has a material right to acquire future goods or services and those goods or services are similar to the original goods or services in the contract and are provided in accordance with the terms of the original contract, then an entity may, as a practical alternative to estimating the standalone selling price of the option, allocate the transaction price to the optional goods or services by reference to the goods or services expected to be provided and the corresponding expected consideration. Typically, those types of options are for contract renewals.

5) Renewal options, which are basically extensions of the current contract or early cancellations, which are the option for a customer to end a long contract earlier than planned. A customer option to renew could be considered an option for additional goods and services, which then opens the door for the entity to consider whether the option is a material right.

Example:

Vendor A sells Product X to Customer C for $1,000 and gives the customer a 40 percent discount voucher to be used on a future purchase within the next thirty days. The vendor plans on offering a 15 percent discount on all transactions in the next thirty days as part of a promotional event. The 40 percent discount voucher cannot be combined with the 15 percent promotional offer.

When evaluating for material rights, the Vendor only considers the discount that is incremental to any promotional discounts offered, which in this case is 25 percent (40 percent discount voucher less the 15 percent promotional event). Vendor A estimates that 80 percent of customers that receive the discount voucher will actually make additional purchases, and on average, each customer will purchase $1,000 of additional products. The standalone value of the discount voucher is therefore $200 ($1,000 additional products * 25% incremental discount * 80% probability the voucher is used). This calculation results in the following allocation of the original $1,000 transaction fee:

Vendor A will recognize $833 from the original transaction when ownership of Product X transfers to the customer. If Customer C does not use the voucher, the remaining $167 is recognized when the voucher expires.

- Variable Consideration:

Consideration is also considered variable if the amount an entity will receive is contingent on a future event occurring or not occurring, even though the amount itself is fixed. Variable consideration can come in many forms, such as discounts, rebates, refunds, credits, price concessions, incentives, performance bonuses, penalties, bonuses, and prompt payment discounts. A company should use the expected value or most likely outcome approach to estimate variable consideration, depending on which is the most predictive. Variable consideration included in the transaction price is subject to a constraint. The objective of the constraint is that a company should recognize revenue as performance obligations are satisfied to the extent it is probable (US GAAP) or highly probable (IFRS) that a significant reversal will not occur in future periods. Although the terminology differs, “highly probable” under IFRS means the same as “probable” under US GAAP. Management should update the assessment at each reporting period. If a company receives consideration from a customer and expects to refund some or all of that consideration to the customer, it recognizes a refund liability for an amount it expects to refund.

Example:

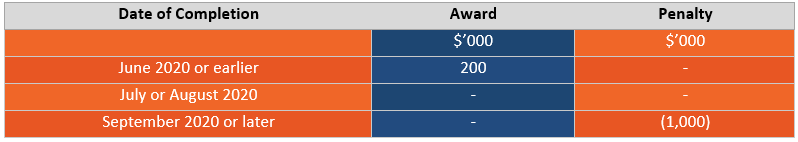

A construction company enters into a contract to build a bridge for $10 mn with an expected completion date of July 2020. The company determines that the over-time revenue recognition criteria of ASC 606 have been met. The contract contains award/penalty clauses depending on the date of completion as follows:

Due to the presence of a $1m penalty clause, the fixed consideration is $9m with any additional revenue being variable consideration.

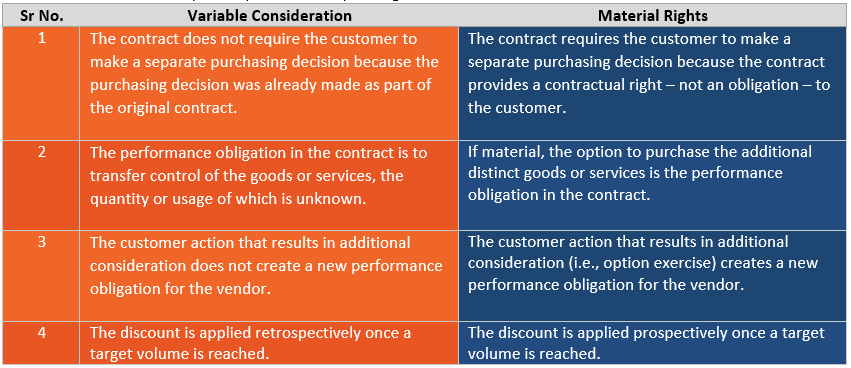

Key Differences between Variable Consideration and Material Rights:

When a contract contains an unknown quantity of outputs, this uncertainty may be accounted for as either variable consideration or optional purchases, depending on the nature of the contract.

- Termination for Convenience:

When a contract is terminated for convenience, the contract is being terminated simply because one party decides to terminate the agreement. It’s not necessarily due to poor performance, and it’s not because one party breached the agreement. However, termination of convenience will only be an option where a contract features a termination for convenience clause. In the event, that the agreement contains express terms for termination, the contract can be terminated by the said clause. The clause for terminating an agreement for convenience created empathy that the contractual obligations and relations are coming to a closure where a party is allowed to end the terms without the accountability of a cause for such termination. It is the right and duty of the parties to make sure that the clause is clear as well as unambiguous and establishing terms on how the clause is applied and further liability.

Accounting Standards Codification (ASC) 606 defines a contract as an agreement between two or more parties that creates enforceable rights and obligations. Because termination clauses frequently impact the contractual period of enforceable rights and obligations, entities should evaluate termination clauses to determine whether the contract term differs from the stated term in the contract. Some of the points to be considered for TFC are as below:

1) Some contracts may have no fixed duration and can be terminated or modified by either party any time.

2) ASC 606 doesn’t apply to wholly unperformed contract. Wholly unperformed contract is-

– The entity has not yet transferred any promised goods or services to the customer.

– The entity has not yet received and is not yet entitled to receive, any consideration in exchange for promised goods or services.

3) At all times throughout the duration of the contract, the entity must be entitled to an amount (recovery of the costs incurred by an entity in satisfying the performance obligation plus a reasonable profit margin) that at least compensates the entity for performance completed to date if the contract is terminated by the customer or another party for reasons other than the entity’s failure to perform as promised.

4) At times, a customer may have a right to terminate the contract only at specified times during the life of the contract or the customer might not have any right to terminate the contract. In such a case, the entity to continue to transfer to the customer the goods or services promised in the contract and require the customer to pay the consideration promised in exchange for those goods or services. In those circumstances, an entity has a right to payment for performance completed to date because the entity has a right to continue to perform its obligations in accordance with the contract and to require the customer to perform its obligations (which include paying the promised consideration).

Example:

A termination for convenience clause can’t be exercised in bad faith. One common example used of bad faith is where a customer terminates their contractor or sub when their work is 90% complete in order to avoid making final payment or in an attempt to keep retainage. Also, the customer can’t enter the agreement intending to terminate prior to completion.

Another example, a trickier one, is terminating a contract for convenience in order to award the remainder of the work to some other contractor or sub. In this situation, there’s probably a good argument for either side re: whether the termination was made in good faith or in bad faith. Keep in mind, though – if another business offers to undercut a contractor or sub who’s already under contract, tortious interference could come into play.

Conclusion

Termination clauses and renewal options frequently affect the contract term by changing the contractual period of enforceable rights and obligations. In determining the contract term, entities must consider many factors, such as the nature of cancellation or renewal options, the substantiveness of any termination penalty, the enforceability of contracts with contingency funding, and any past practice of non-enforcement. Consulting with legal experts may also be necessary to determine legal enforceability or resolve conflicting termination rights. By identifying the proper contract term, entities will then be able to identify the appropriate performance obligations, determine the correct transaction price, and create the required disclosures in accordance with ASC 606.

- Significant Finance Component:

If the timing of payments agreed to by the parties to the contract (either explicitly or implicitly) provides the customer or the entity with a significant benefit of financing the transfer of goods or services to the customer, the entity will need to adjust the promised amount of consideration for the effects of the time value of money when determining the transaction price. As a practical expedient, an entity does not need to adjust the promised amount of consideration for the effects of a significant financing component if the entity expects, at contract inception, that the period between when the entity transfers a promised good or service to a customer and when the customer pays for that good or service will be one year or less. Significant financing component exists when consideration will be received after one year from the fulfilment of the performance obligation. In this case, the seller would have given finance to the customer in addition to fulfilment of the contract. The future receipt should be discounted and split between revenue and finance interest income. There is no financing component if the consideration will be received within one year from fulfilment of the performance obligation.

In determining whether a contract contains a financing component and whether that financing component is significant to the contract, the entity must consider all relevant facts and circumstances, including both of the following:

1) The difference, if any, between the amount of promised consideration and the cash selling price of the promised goods or services, and

2) The combined effect of the expected length of time between when the entity transfers the promised goods or services to the customer and when the customer pays for those goods or services, and the prevailing interest rates in the relevant market.

Example:

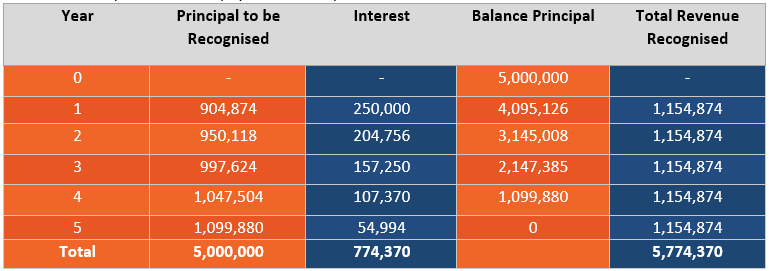

An entity entered into a contract for 5 years in exchange of consideration of $5.7 Million. Discount rate-5%. The customer has the option to either pay $5 Million upfront or in instalments-

Total Revenue Recognized= (5,000,000*5, 1.05) = 1,154,874

Principal to be Recognized= Total revenue recognized- Interest

Interest= Balance principal of earlier year*5%

Balance Principal= Balance of previous year- Principal recognized in current period

Did you find this article helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.