18 Apr Step 4 – Allocation of Transaction Price

Revenue is an important point of concern to the users of Financial Statements in assessing an entity’s Financial Performance and Position.

Accounting Standard Codification (ASC) 606 – Revenue from Contract with Customers is an Industry-wide revenue recognition guidance which has been formulated by the Financial Accounting Standard Board (FASB). This was a joint task by Financial Accounting Standard Board (FASB) and International Accounting Standard Board (IASB) to clarify the principles for Revenue Recognition and to develop common revenue standard for U.S. GAAP and IFRS.

ASC 606 will be applicable across all the industries and aid in recognizing revenue from all the types of transactions, except those transactions which are covered by more specific guidelines (for example – Insurance Contract or Leasing Contract).

INTRODUCTION

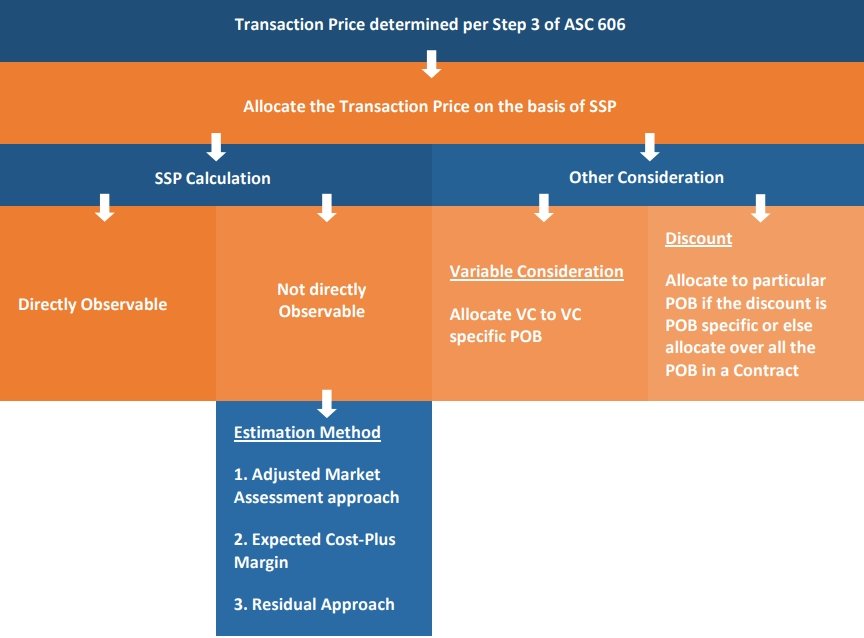

Step 4 of the new five-step revenue recognition standard i.e. ASC 606, requires the allocation of the transaction price to each performance obligation in a contract with a customer.

The transaction price is the basis for measuring revenue. It is not always the price set in the contract. It is the expectation of what the business will receive. It means that a business needs to estimate the transaction price.

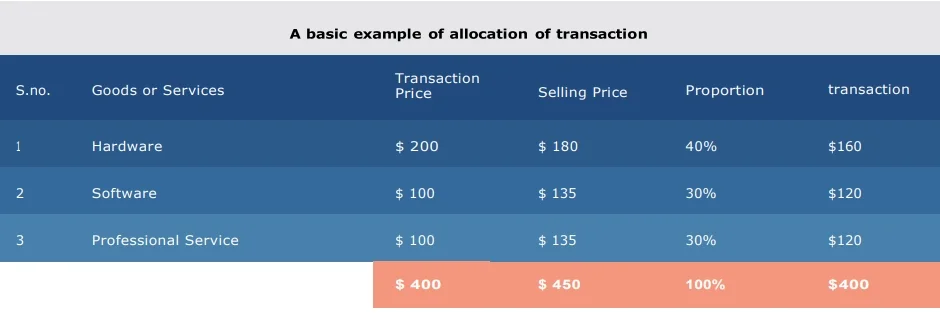

Once the transaction price is determined/estimated the next step as per the ASC 606 is to allocate the transaction price within a contract proportionately based on the Standalone selling price value determined for various Performance obligations. This document will walk through a reader on how the allocation of the transaction price is done what hurdles an entity could face while performing allocation of the transaction price.

BRIEF DESCRIPTION ON TRANSACTION PRICE

The Transaction Price is the amount of consideration an entity expects to receive for the transfer of goods or services to the customer. The amount can be fixed, variable, or a combination of both. Transaction Price is allocated to the identified performance obligations in the contract based on Standalone Selling Price. These allocated amounts are recognized as revenue when the performance obligation is fulfilled.

Consider for example a case where a person enters a shop to purchase a mobile phone and pays consideration of $500, this is a straightforward case where the transaction price can easily be identified as $500, and revenue of $500 can be recognized. But, in certain commercial transactions, identifying the transaction price can be complex if there is an involvement of the amount of ‘Variable Consideration’. Say, in this example, we add mobile return policy with a full refund, then identifying the transaction price and recognition of revenue becomes complicated.

Before performing allocation a business must first identify the transaction price, Step 3 – Allocation of the transaction price

ALLOCATION OF TRANSACTION PRICE

The objective behind the allocation of transaction price to each performance obligation is to establish a fair allocation of the amount to the performance obligation that depicts the amount of consideration to which the entity expects to be entitled in exchange for transferring the promised goods or service to the customer.

In simple terms allocation of transaction price must be done proportionately based on the standalone selling price determined for each performance obligations within a Contract. Determination of standalone selling price and allocation of the transaction price is done at the inception of the contract.

However, no allocation of the transaction price is required, if there is only one Performance Obligation within a contract. An exception to this would be if the entity promises to transfer a series of distinct goods or services as a single performance obligation and the promised consideration includes Variable Consideration i.e. Allocation will be done even though there is only one performance obligation in a contract.

STANDALONE SELLING PRICE

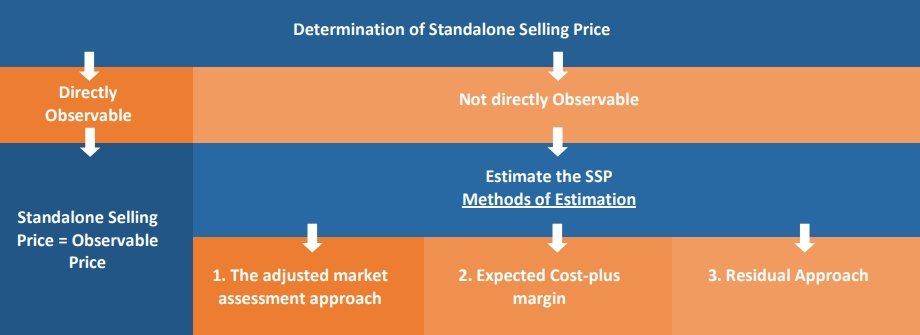

An entity needs to determine/estimate the standalone selling for each performance obligation at the inception of a contract before allocating the transaction price.

Per ASC 606-10-32-32, The standalone selling price is the price at which an entity would sell a promised good or service separately to a customer. The best evidence of a standalone selling price is the observable price of a good or service when the entity sells that good or service separately in similar circumstances and to similar customers. A contractually stated price or a list price for a good or service may be (but shall not be presumed to be) the standalone selling price of that good or service.

Per ASC 606-10-32-33, If a standalone selling price is not directly observable, an entity shall estimate the standalone selling price at an amount that would result in the allocation of the transaction price meeting the allocation objective. When estimating a standalone selling price, an entity shall consider all information (including market conditions, entity-specific factors, and information about the customer or class of customer) that is reasonably available to the entity. In doing so, an entity shall maximize the use of observable inputs and apply estimation methods consistently in similar circumstances.

METHODS FOR ESTIMATING STANDALONE SELLING PRICE

Assessment approach Adjusted market

An entity can estimate the price of goods or service based on the market, what customers are willing to pay in the market for those goods or services. The entity can also refer to the prices charged by the competitors for similar goods or services. This method is suitable in situations where multiple competitors Offer similar goods or services.

Expected cost plus a margin approach

Considers the forecasted costs of fulfilling the performance obligation and add a reasonable profit margin as per market. This method may be most suitable in situations where.

- Demand for the good or service is unknown and information on the demand for similar goods or services from competitors is not available.

- Direct fulfillment costs are clearly identifiable.

Cost plus margin is used where each order is different. The cost-plus margin is easy to apply, and, in some situations, it is the only method to determine a price when the market price is not available, for example in case of government contracts.

Residual approach

Allows an entity that has observable standalone selling prices for one or more of the performance obligations to allocate the remaining transaction price to the goods or services that do not have observable standalone selling prices. Observable selling price is the price that the entity charges for the good or service in a separate transaction when sold to similar customers and under similar conditions.

The sum of the observable standalone selling prices is deducted from the total transaction price to find the residual estimated standalone selling price for the goods or services that do not have observable standalone selling prices. Per ASC 606-10-32-35, A combination of methods may need to be used to estimate the standalone selling prices of the goods or services promised in the contract if two or more of those goods or services have highly variable or uncertain standalone selling prices. Like using residual method for estimating aggregate Standalone Selling Price for highly variable and uncertain Standalone Selling Price.

ALLOCATION OF A DISCOUNT

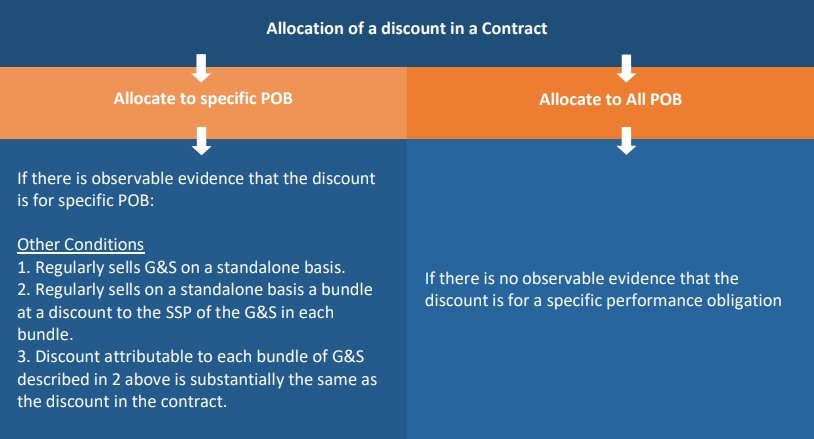

As per ASC 606 discount must be allocated proportionately to all Performance Obligation, unless there is observable evidence showing that the discount is specifically for a particular performance obligation, in the later case the discount will be allocated to the specific performance obligation and not among all the performance obligation.

If a discount is allocated entirely to one or more performance obligations in the contract, an entity shall allocate the discount before using the residual approach to estimate the standalone selling price of a good or service in accordance with paragraph 606-10-32-34(c).

As per ASC 606-10-32-37, an entity shall allocate a discount entirely to one or more, but not all, performance obligations in the contract if all of the following criteria are met:

1. The entity regularly sells each distinct good or service (or each bundle of distinct goods or services) in the contract on a standalone basis.

2. The entity also regularly sells on a standalone basis a bundle (or bundles) of some of those distinct goods or services at a discount to the standalone selling prices of the goods or services in each bundle.

3. The discount attributable to each bundle of goods or services described in (2) is substantially the same as the discount in the contract, and an analysis of the goods or services in each bundle provides observable evidence of the performance obligation (or performance obligations) to which the entire discount in the contract belongs.

Please see below flow chart for allocation treatment of discount.

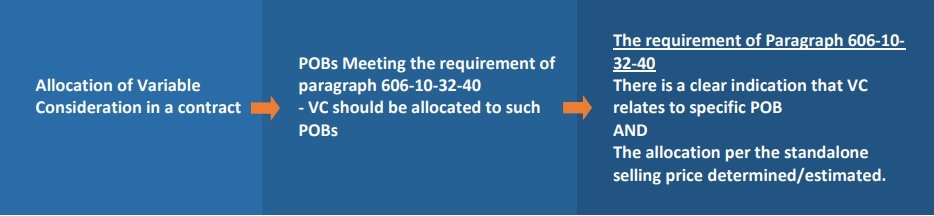

ALLOCATION OF VARIABLE CONSIDERATION

Per ASC 606-10-32-39 Variable consideration that is promised in a contract may be attributable to the entire contract or to a specific part of the contract, such as either of the following:

a) One or more, but not all, performance obligations in the contract (for example, a rebate may be contingent on an entity transferring a promised good or service within a specified period of time)

b) One or more, but not all, distinct goods or services promised in a series of distinct goods or services that forms part of a single performance obligation (for example, the consideration promised for the second year of a two-year cleaning service contract will increase on the basis of movements in a specified inflation index).

ASC 606-10-32-40, an entity shall allocate a variable amount (and subsequent changes to that amount) entirely to the performance obligation or to distinct goods and services that form part of a single performance obligation, if both the criteria are met:

a) The terms of variable payment relate specifically to the entity’s e”orts to satisfy the performance obligation or transfer the distinct good or service (or to a specific outcome from satisfying the performance obligation or transferring the distinct good or service).

b) Allocating the variable amount of consideration entirely to the performance obligation or the distinct good or service is consistent with the allocation objective i.e. Allocation should be done based on the Standalone selling price determined/ estimated for the performance obligation.

Flow Chart showing allocation treatment for Variable Consideration

FLOW CHART ON ALLOCATION OF TRANSACTION PRICE

Legends Used

POB – Performance Obligation SSP – Standalone Selling Price VC – Variable Consideration

Did you find this article on the allocation of transaction price helpful? Would you like more situational examples on how to determine the transaction price in a contract?

We will be happy to answer any questions/queries regarding this and any other topics regarding Revenue Recognition and ASC 606.