20 Mar Summary of changes under ASC 842 – Lease

A lease is a contract wherein the lessee (user) has to pay consideration to the lessor (owner) for use of an asset for a specified period of time.

The new leasing standard is one of the most significant changes in accounting to come about recently. ASC 842 strives to fundamentally record all leases on the balance sheet. The new standard defines how entities should account for leases. The new standard replaces the previous US GAAP standard 840. The aim of ASC 842 is to overcome a major loophole in ASC 840 – off-balance sheet operating leases. The reason for implementing changes in the standard is to allow increased visibility into leasing obligations of the entity to the users of financial statements.

This document covers:

This document is prepared for RevGurus. The document is intended to cover the following areas:

- Need for a new standard.

- Introduction to ASC 842.

- Summary of changes under ASC 842.

WHY WAS 842 INTRODUCED – BACKGROUND

Accounting Standard codification 842 is the new lease accounting standard which replaces the previous leasing standard 840.

The new standard aims to overcome the major loophole in ASC 840 – “Off-Balance Sheet operating Leases”.

Up until the new standard was introduced, accounting for leases required lessees to classify leases as either a capital lease or an operating lease.

Capital leases were recorded on the balance sheet, whereas operating leases were disclosed as a footnote in the financial statements as “Off – Balance Sheet” operating expenses, and thus were excluded from important financial ratios that allowed stakeholders to judge a company’s performance.

This difference in accounting treatments made it difficult for investors to accurately judge the company’s indebtedness, hence, the requirement of ASC 842 came up for the proper presentation of the lease in the balance sheet.

INTRODUCTION TO ASC 842

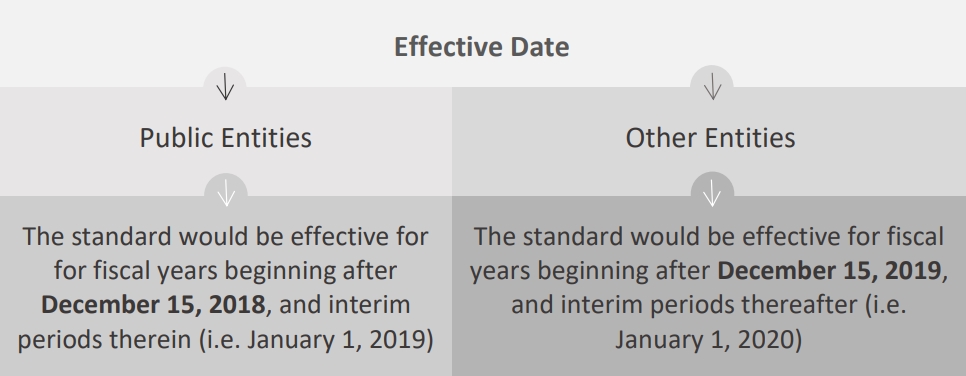

The new codification was added by ASU 2016-02 on February 25, 2016.

Early adoption of the standard is permitted for all organizations.

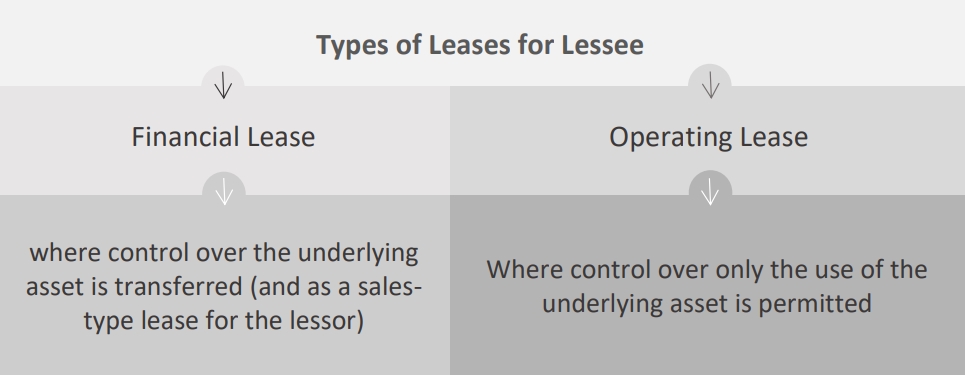

The new lease standard now requires lessees to classify all leases either as a finance lease or an operating lease, and all lessors to classify leases either as a sales-type, direct financing, or operating lease.

A lessee is required to classify a lease on the basis of whether an underlying asset is purchased.

The new standard will have a significant impact on how companies account for and report all leases, including equipment and real estate.

SUMMARY OF CHANGES

DEFINITION:

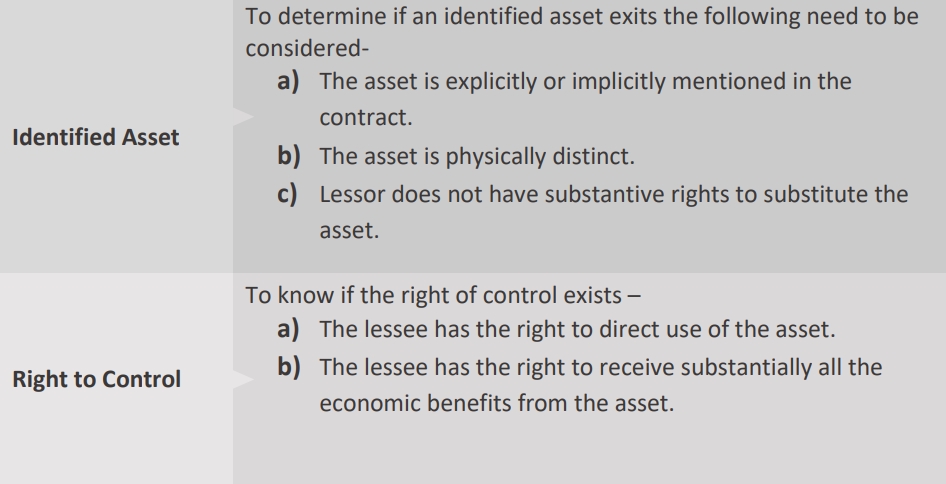

Under ASC 842, “a contract is, or contains a lease if the contract conveys the right to control the use of identified property, plant, or equipment (an identified asset) for a period of time, in exchange for a consideration.”

Thus, to qualify as right-of-use, the contract must meet 2 conditions –

TRANSITION METHOD

Modified retrospective transition method of adoption is required to be adopted by lessors and lessees for all existing leases.

LEASE ACCOUNTING

The term, right-of-use helps to determine whether or not the lessee has the right to use the asset over the term of the lease. If the lessee does not have the legal right to use the asset, then the contract does not actually contain a lease.

For an operating lease to be capitalized on the balance sheet, right-of-use asset, and lease liability has to be determined by the lessee.

a) Right-of-use asset – The right-of-use asset is valued as the initial amount of the lease liability plus any initial direct costs and payments made prior to the commencement date, minus lease incentives.

b) Lease liability – The lease liability is calculated as the present value of the lease payments, using the discount rate specified in the lease, or if that is not available, the company’s incremental borrowing rate (IBR).

Note: No change in the lease accounting for Financial Lease

LEASE ACCOUNTING MODEL

Lessees are required to recognize a right-of-use asset and lease liability on the balance sheet for all leases having a term of more than 12 months.

a) Initial measurement –

Lease obligation: Present Value of lease payments not yet paid.

Right-of-use Asset: lease obligation + Initial direct costs + prepaid lease payments – lease incentives.

b) Subsequent measurement –

Lease obligation: Amortized using effective interest method.

Right-of-use Asset: Would depend on lease classification.

c) Recognition of expenses –

Finance Lease: Under finance leases, expenses will be front-loaded and, therefore impact on income statement will be front-loaded.

PRACTICAL EXPEDIENTS

- Transition Practical Expedients –

The following are some practical expedients available that provide relief when transitioning to the new standard –

a) An entity is not required to re-assess whether any expired or existing contracts are leases or contain leases, the lease classification for any expired or existing leases, and the initial direct costs for any existing leases.

b) An entity is permitted to use hindsight while evaluating the lease term, and the impairment of the underlying right-of-use asset.

Each practical expedient must consistently be applied to all leases.

CONTRACTS CONTAINING MULTIPLE COMPONENTS

a) A contract may contain a lease and non-lease component.

b) Under the new guidance, only lease components are to be accounted for.

c) A non-lease component includes items that relate to another good or service in a contract.

d) Components are those items or activities that represent a transfer of a good or service to the lessee.

e) A lessee may opt to not separate non-lease components from their lease components, If this has opted for all cash flows associated with the non-lease component would be allocated to the related lease component.

Did you find this article on Lease helpful?

We will be happy to answer any questions/queries regarding this and any other topics regarding Lease, Revenue Recognition and ASC 606.