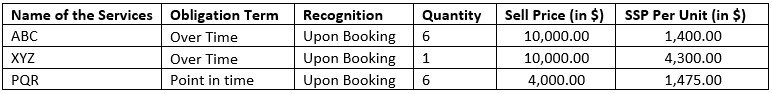

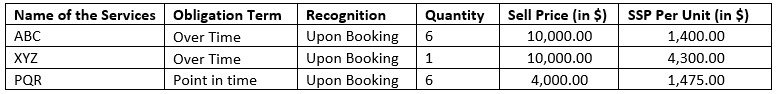

OBLIGATION IDENTIFICATION

A performance obligation is a promise in a contract with a customer to transfer a good or service to the customer. If an entity promises in a contract to transfer more than one good or service to the customer, the entity should account for each promised good or service as a performance obligation only if it is (1) distinct or (2) a series of distinct goods or services that are substantially the same and have the same pattern of transfer.

PRICE FOR TRANSACTION

The transaction price is the amount of consideration to which the Company expects to be entitled in exchange for transferring goods or services to a customer, excluding amounts collected on behalf of third parties such as sales taxes.

In the case of ABC Inc, the determination of transaction price is straightforward based on what is being charged to the customer i.e. only Fixed consideration.

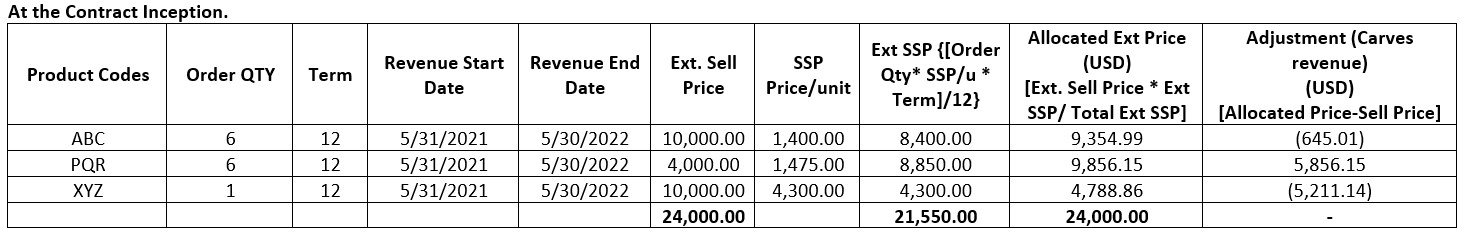

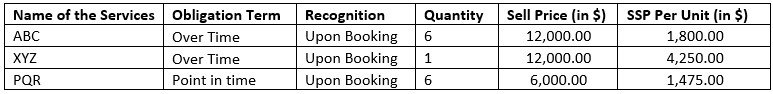

ALLOCATION OF TRANSACTION PRICE TO OBLIGATION

For a contract that has more than one performance obligation, an entity should allocate the transaction price to an amount that depicts the amount of consideration to which the entity expects to be entitled in exchange for satisfying each performance obligation. The performance obligation for allocation will be considered as each distinct separate performance obligation, i.e. let us say there are two separate support services provided within the same contract, even though the performance obligation is the same i.e. “Support”, but for allocation purposes, it will be considered as two separate performance obligation and both the support services will participate in the allocation representing the amount of consideration.

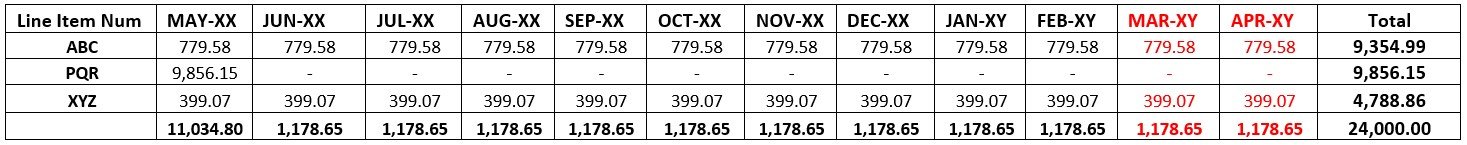

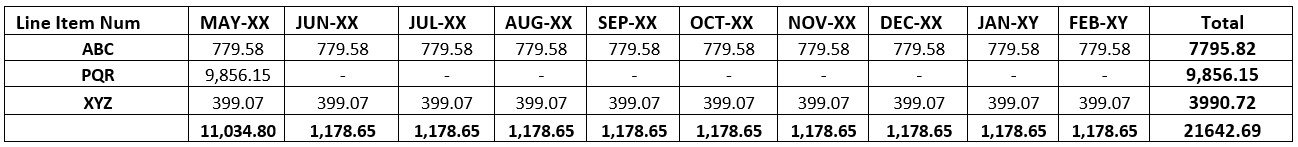

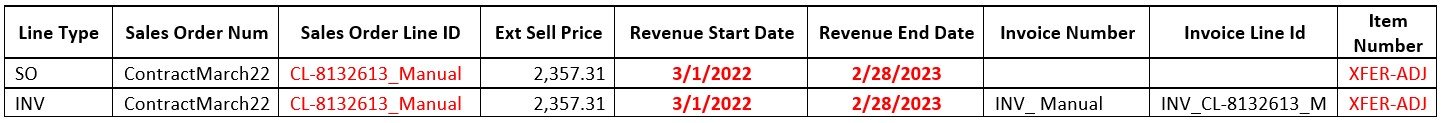

As per the ASC 606 Model, the table below shows the Transaction Price and the Allocations based on the Standalone Selling Price for this contract.