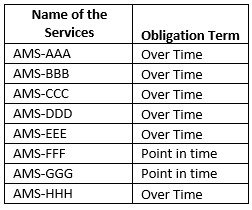

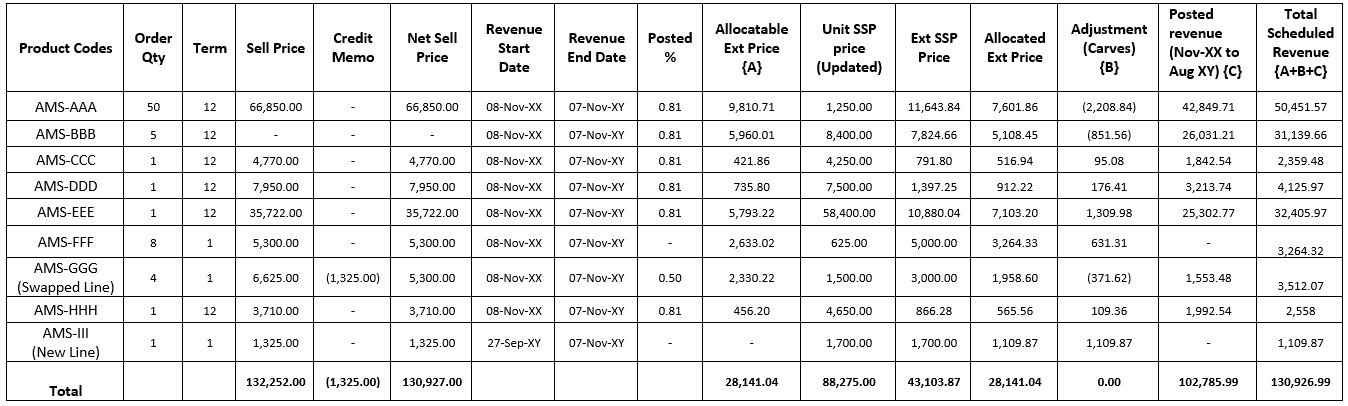

ALLOCATION OF TRANSACTION PRICE TO OBLIGATION

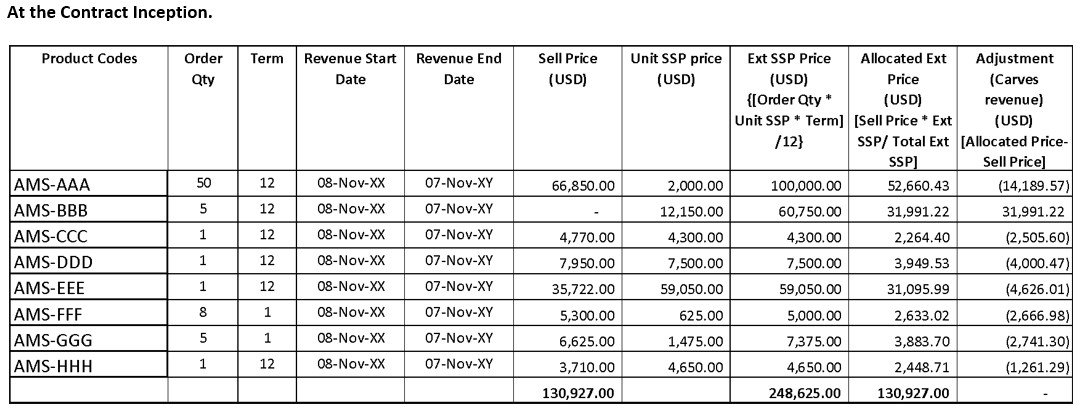

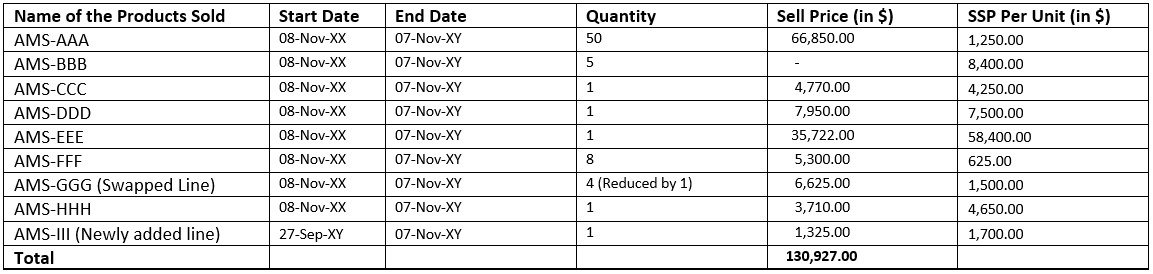

There would be a change in the transaction price since there is a change in the contract. Also, ABC Inc reassesses its SSP every 6 months. Thus, Unit SSPs are also updated.

A Credit Memo of $ 1325.00 is uploaded to cancel one quantity of the Line Item being swapped (AMS-GGG), at the same time, a new line of $ 1325.00 is being added to the contract. Hence, we can see that the Total Net Sell Price (Sell Price- Credit Memo) equals the Total Sell Price prior to contract modification.

Calculations: (Ref product code – ‘AMS-GGG’)

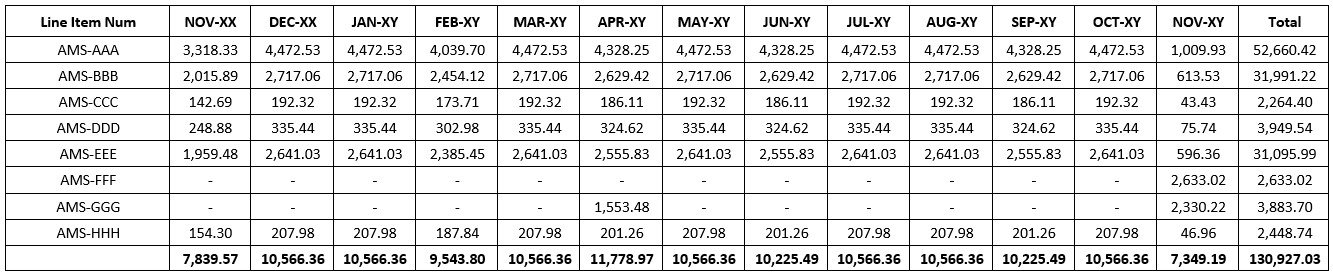

Posted Revenue – Since the Contract modification is triggered in Sep-XY, the posted revenue is the revenue posted from Nov-XX to Aug-XY. Posted Revenue from Nov-XX to Aug-XY for this product code is $1,553.48 (Released in the month of Apr-XY since it is a Point-In-Time line)

Posted Percent – Posted Revenue as a percent of Net Sell Price. For the given product, Gross Revenue already recognized is $2,650.00. Net Sell Price would be the Sell Price as reduced by the Credit Memo value. Hence Net Sell Price = $6,625.00-$1,325.00 = $5,300.00 Thus, posted percent is $2,650.00/$5,300.00 = 0.5.

Allocatable Ext Price = Allocated Ext Price – Posted Revenue. For the given product, Allocatable Ext Price = $ 3,883.70 – $1,553.48 = $2,330.22.

As there is a change in the allocatable price, the consequently allocated price would change too.

Ext SSP = [(Unit SSP * Order Qty * Term)/12]* Unposted percent. For the given product, there is a reduction of quantity hence the updated quantity (4) would be considered. Thus, Ext SSP = (1,500.00 * 4 * 1) * 50% = $ 3,000. 00

Allocated price = [Sell Price * Ext SSP/ Total Ext SSP]. For this product, $ 28,141.04/$ 43,103.87 * 3,000.00 = $ 1,958.60

Adjustment Revenue (Carves) = Allocated Ext Price – Allocatable Ext Price. $ 1,958.60 – $ 2,330.22 = $ (371.62)

Note: This calculation also applies to the other lines of the contract.

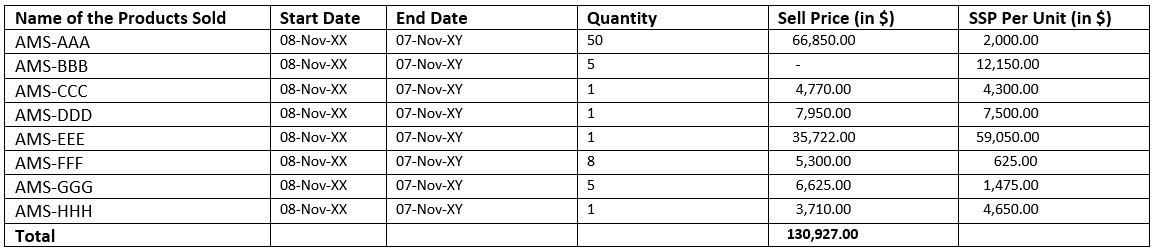

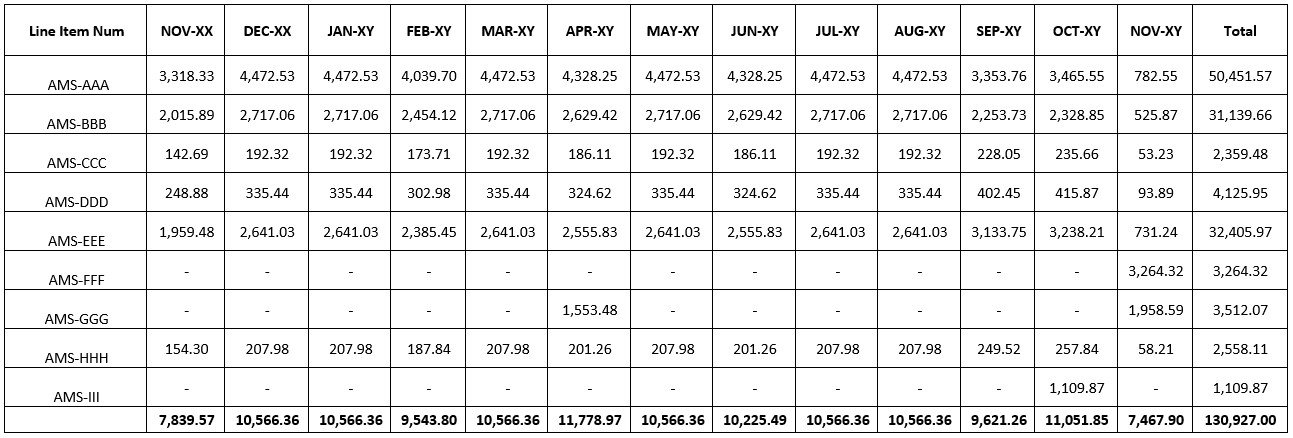

The below table shows the new Transaction Price as per the modification.